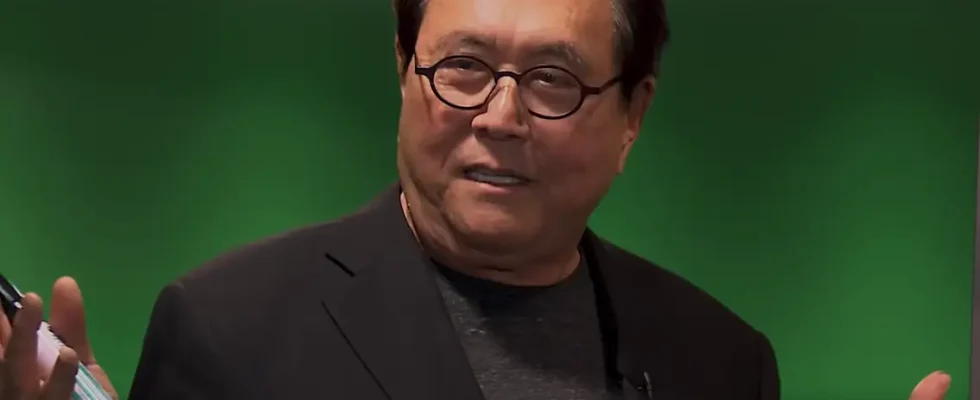

Economist Robert Kiyosaki, famous for his Bitcoin Recommendations, gives advice to his followers on the X social platform today. The economist who emphasizes hyperinflation explains what this means. It also tells what investors should buy.

Deciphering hyperinflation

Bitcoin proponent Kiyosaki points out hyperinflation, which is often misunderstood. Accordingly, he says, this does not mean rising prices as is commonly thought. It actually means the opposite: a rapid decline in the purchasing power of your money. This financial phenomenon affects savings, investments and livelihoods by eroding the real value of your money.

According to Bitcoin pro Kiyosaki, Hyperinflation occurs when a country’s central bank prints excessive money, leading to an excess money supply. In this scenario, the value of each currency drops rapidly, causing the prices of goods and services to skyrocket. The result? Your money can no longer buy the same amount of needs and your standard of living decreases.

Buy Bitcoin and these to protect your wealth

Bitcoin proponent Kiyosaki notes that amid the threat of hyperinflation, protecting your wealth has become crucial. He says three assets have historically proven effective in preserving value during such crises. These are gold, silver and Bitcoin. For centuries, gold has been revered as a store of value. Its scarcity and enduring appeal make it a hedge against hyperinflation. Moreover, when fiat currencies lose value, gold shines as a reliable asset that maintains its real value. Investing in gold allows you to protect your wealth from the corrosive effects of hyperinflation.

Often referred to as the “poor man’s gold,” silver provides an affordable entry point for investors seeking protection against hyperinflation. It attracts attention with its intrinsic value and industrial applications. Accordingly, silver serves as a tangible asset that can weather the storm of currency devaluation. On the other hand, in the digital age, Bitcoin is emerging as a formidable opponent in the fight against hyperinflation. As a decentralized cryptocurrency, Bitcoin is immune to the policies of central banks and governments. Its limited supply and rising adoption rate position it as a modern store of value that can protect your wealth during times of economic turmoil.

Choose to be a winner, not a loser

Bitcoin supporter Kiyosaki points out that the choice is clear in the face of hyperinflation threats. Accordingly, he recommends “diversify your portfolio with assets such as gold, silver and Bitcoin.” These investments, in his opinion, stand the test of time. It also offers a lifeline when the value of traditional currencies declines.

When we look at Kriptokoin.com, Bitcoin supporter Kiyosaki recommends not to fall victim to the devastating effects of hyperinflation. Also, “take proactive steps to secure your future. “On the other hand, by embracing these valuable assets, you can position yourself as a resilient winner in the face of financial challenges rather than a helpless loser.” says.

To be informed about the latest developments, follow us Twitter’in, Facebookin and InstagramFollow on . Telegram And YouTube Join our channel.