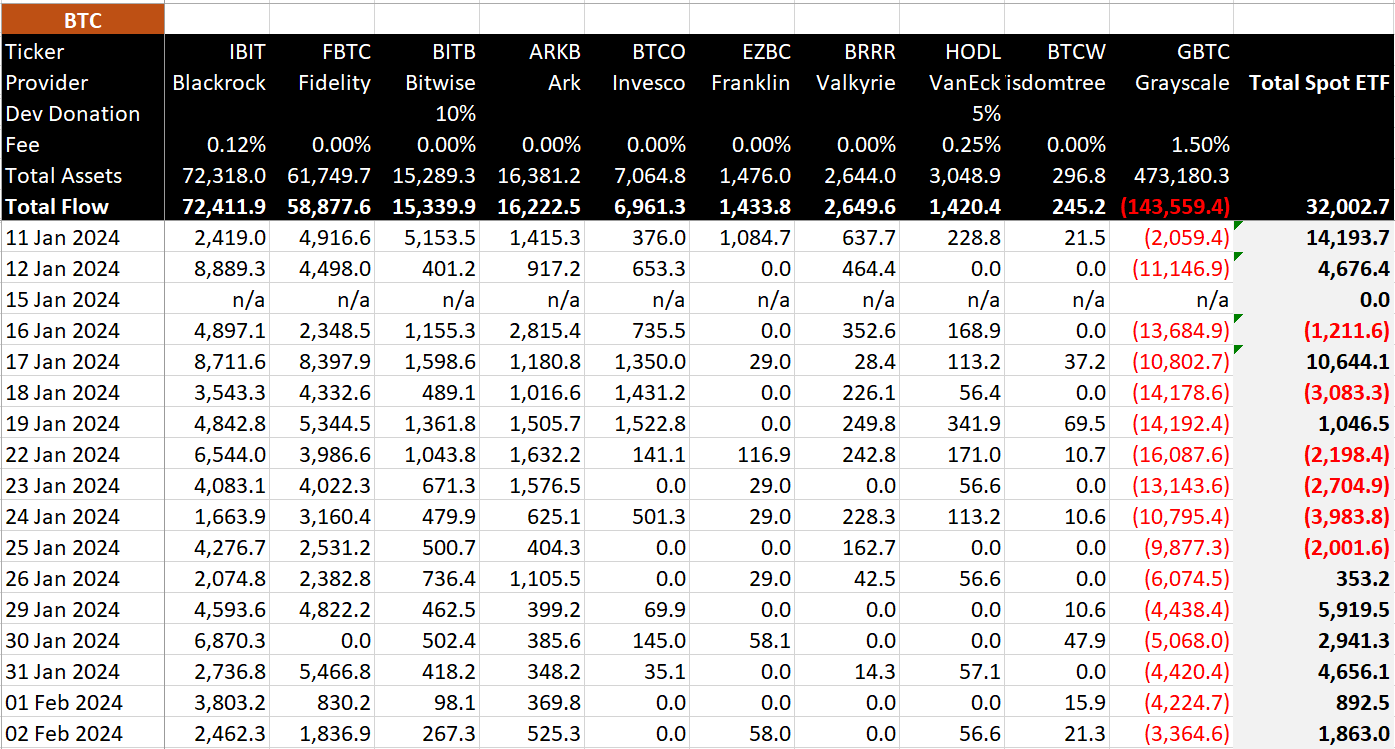

In a report published by BitMEX Research, US Spot Bitcoin Analyzed flow data of ETFs since their launch. According to the report, a significant net inflow of over 32,000 BTC was recorded in just 17 trading days. This increase, valued at approximately US$1.459 billion, led to a dynamic shift in market dynamics, especially as whale wallets showed significant movement.

As we reported as Koinfinans.com, Grayscale GBTC experienced a net outflow of 143,559.4 BTC, equivalent to approximately US$5.967 billion, while the other nine ETFs witnessed a net inflow of 175,562.2 BTC, offsetting Grayscale’s outflow.

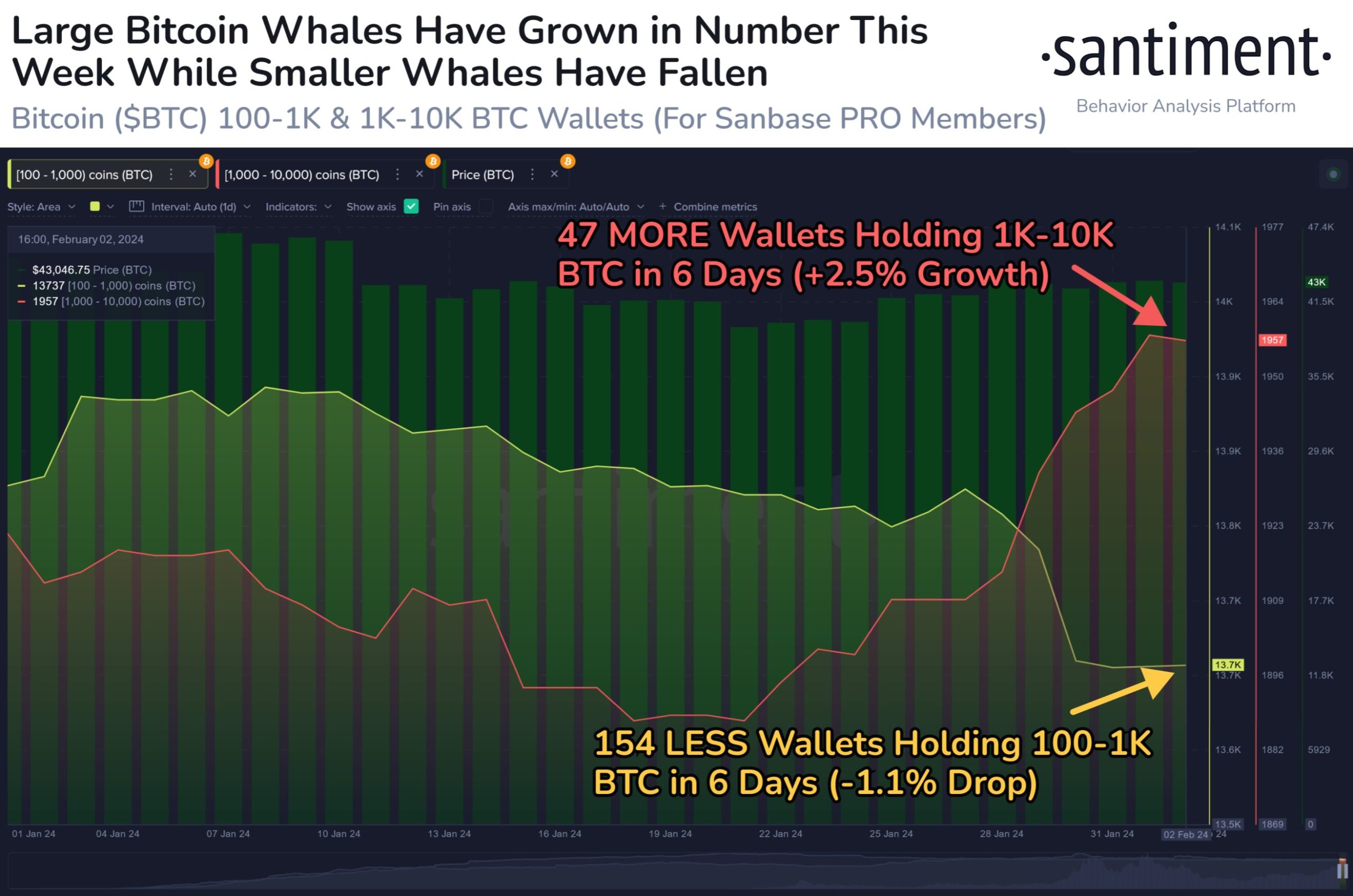

Santiment noted that despite Bitcoin’s price ranging between $41,000 and $44,000, there is significant activity among whale wallets. According to the analysis, the number of 1K-10K BTC wallets increased to 1,958 on February 1, the highest since November 2022, while wallets containing 100-1K BTC reached 13,735, the lowest since the same period.

Will Bitcoin Overtake Gold and Real Estate Markets?

Analyst PlanB shared a bold prediction for Bitcoin’s future supply shortage, comparing it to gold and real estate. PlanB claims that following the halving in April, BTC’s scarcity will surpass that of gold and real estate, potentially leading to a market cap exceeding $10 trillion.

While the current market cap is even below $1 trillion, a possible market cap of 10 trillion would mean a price of more than $500,000 per BTC.