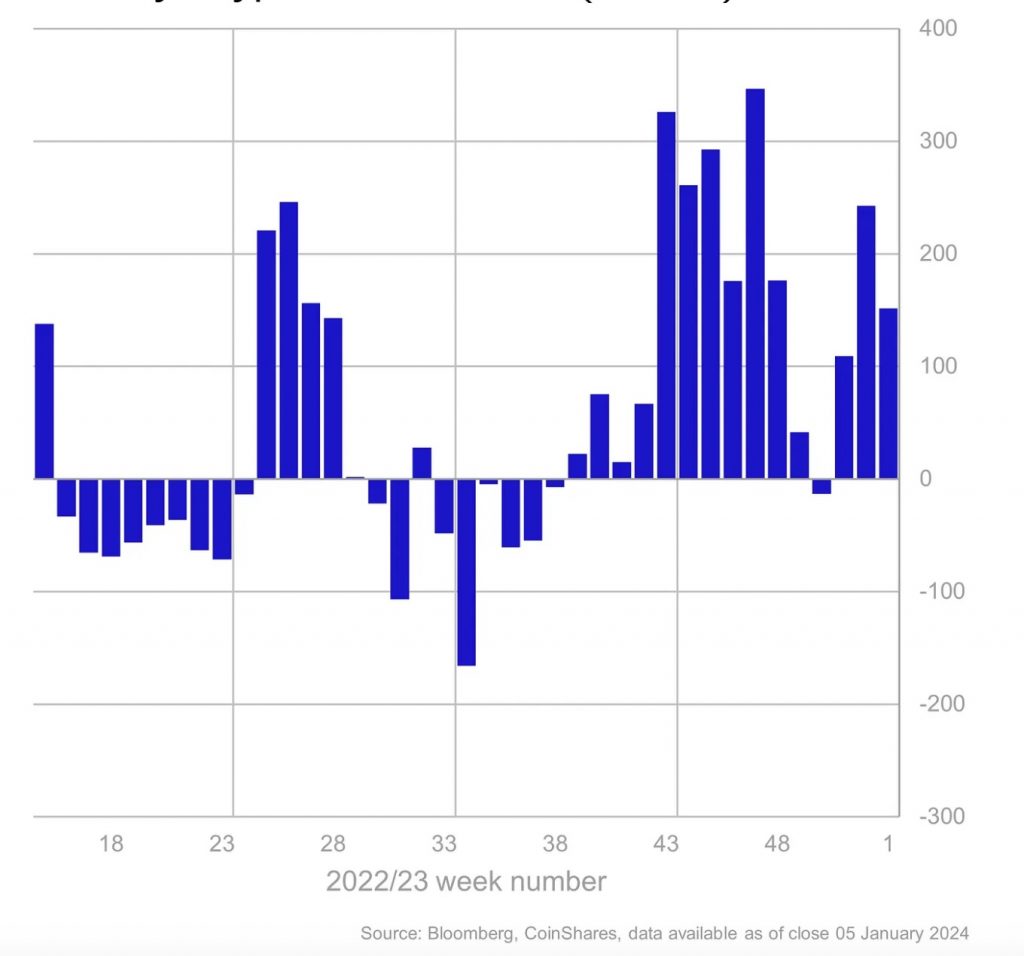

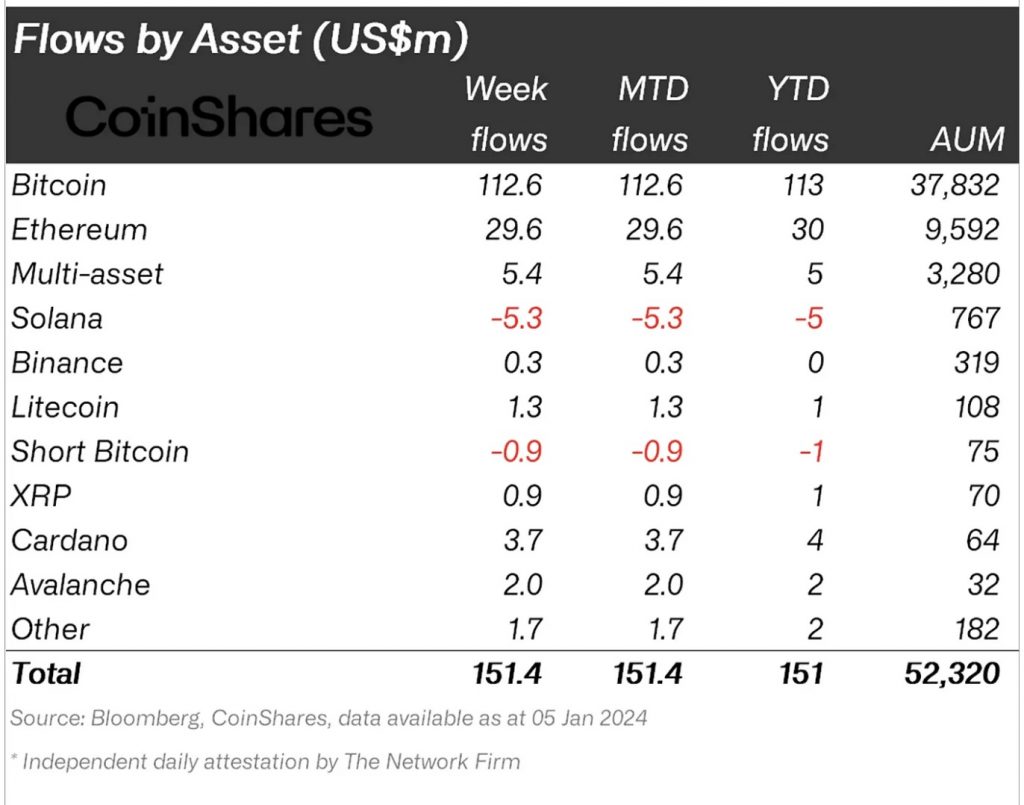

According to the “Digital Asset Fund Weekly Flow Report” printed by CoinShares, the first week of 2024 started quite optimistically for digital asset investments. The report stated that there was a significant inflow of $151 million into digital asset investment products and Grayscale vs. It was stated that the cumulative total since the SEC case has reached 2.3 billion dollars. This increase in investments represents 4.4% of total Assets Under Management (AuM).

Bitcoin took the largest share, accounting for 3.2% of AuM, with inflows of $113 million over the past nine weeks. Short Bitcoin products, on the other hand, saw an outflow of $1 million in the first week of the year, contrary to expectations regarding the ETF’s launch in the US. Notably, the expected “buy the rumor, sell the news” trend has not materialized among institutional investors, recording a total outflow of $7 million in the last nine weeks for shorting Bitcoin ETPs.

Ethereum managed to make an optimistic start with an inflow of $29 million. This marks a significant reversal, indicating renewed interest in cryptocurrency. However, Solana had a less positive start to the year, posting a total outflow of $5.3 million.

Other altcoins also saw notable inflows, with Cardano, Avalanche, and Litecoin pulling in $3.7 million, $2 million, and $1.4 million respectively.

In terms of geographical distribution, 55% of inflows came from US exchanges. Germany and Switzerland also stand out as two significant contributors, representing 21% and 17% of total inflows respectively.

Beyond cryptocurrencies, blockchain stocks have also had a positive start to the year, with a total of $24 million in inflows last week. This broader interest in the blockchain ecosystem beyond digital currencies demonstrates growing investor confidence in related technologies and sectors.