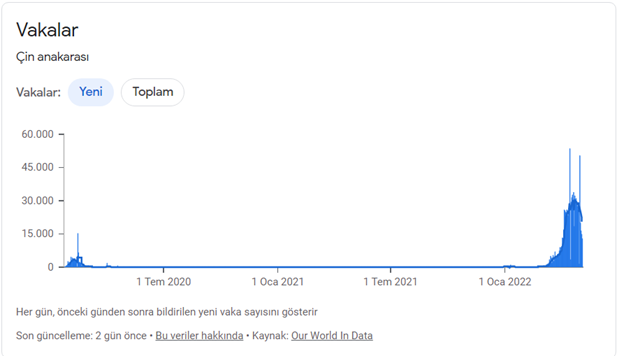

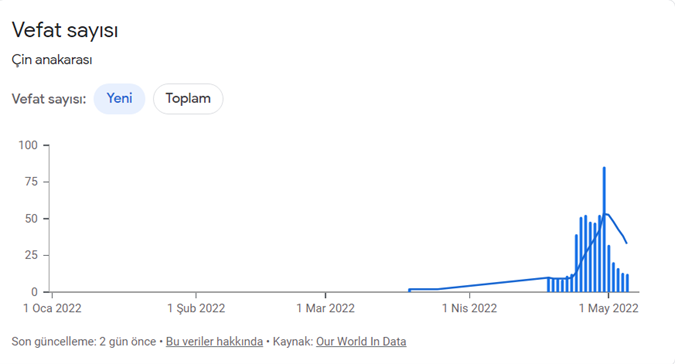

The covid-19 outbreak in mainland China has reached its highest official number of cases since it began. In China, which has reached 53,000 new cases per day, the epidemic is being tried to be brought under control. The Chinese government’s zero-case policy is making financial markets nervous.

The Omicron variant has ceased to pose an active danger to many countries. High vaccination rates make it easier to circumvent and keep the epidemic under control. However, the Omicron variant continues to spread rapidly in China. And strict Covid measures implemented by the government are paving the way for supply chain disruptions.

The Chinese administration, which wants to control the increasing number of cases, is putting into effect the importance of tight closure. Considering China’s position in the supply chain, it is obvious how much of a risk this poses for global economies. At the beginning of the epidemic, we witnessed the closure of huge ports as a result of strict Covid measures. As a result of the closure of these ports, many supply-side problems occurred on the US side.

Considering that the inflation in the US is largely due to supply-side problems, we expect to see a warming again in the US inflation dynamics.

Consecutive Negative Developments Are Putting The Markets In A Difficult Situation.

On the one hand, the ongoing Russia-Ukraine war is making the markets nervous, on the other hand, the hawkish policy of the FED is not giving the markets a breather. Having decided to increase interest rates by 50 basis points at the last meeting, the FED made the highest increase since 2000. Markets, on the other hand, continue to react negatively to this policy.

In particular, given the supply chain problems that will arise as a result of the shutdowns in China, US inflation may continue to trend upwards. The last announced 8.5% inflation pushed the FED to a tough stance. Possible supply problems seem to continue to be a problem for the FED.

The USA, which has not made any concessions from strong growth yet, may have to slow down as a result of persistent inflation. Here, this possibility will continue to unsettle the markets and put investors under selling pressure. On the other hand, it is a development that could have a negative impact on Bitcoin, given its recently increasing correlation with US indices.

Deeper Sales in Chinese Indices Shake Crypto.

The recent sales in Chinese indices are remarkable. The threat of sanctions imposed on Chinese companies by the USA and the increasing number of Covid cases are creating a serious downtrend in the index. This negative divergence in Chinese stocks could spread to global markets and indirectly affect the crypto market.

As a result of the sales in Chinese indices, investors continue to exit the shares of Chinese companies. If this selling epidemic grows and spreads to other markets, we can see movements below $ 30,000 on the Bitcoin side.

$BTC The red channel, i.e. a trend has been broken. Sales will continue for a while. We’ll see how it reacts to a significant $35,000 level. #BTC pic.twitter.com/Zme4YQaRQ0

— Furkan Bozkurt (@BzkrtFrkn) May 6, 2022

You can check the price movements here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.