The recent rally that Bitcoin has experienced has shown that its relationship with the stock markets has become even more distant. In the statement made by the USA, after the news that Russian oil will be banned, the stock markets fell even more, Bitcoin (BTC) It is trading above $41,000 while rallying 6%.

Bitcoin Outperformed Stocks in the Past Month

BTC has managed to hold its ground in recent weeks, despite falling in line with stocks in the early stages of the Russia-Ukraine conflict. Compared to the 9% drop in the S&P 500 index, Bitcoin has lost about 6%.

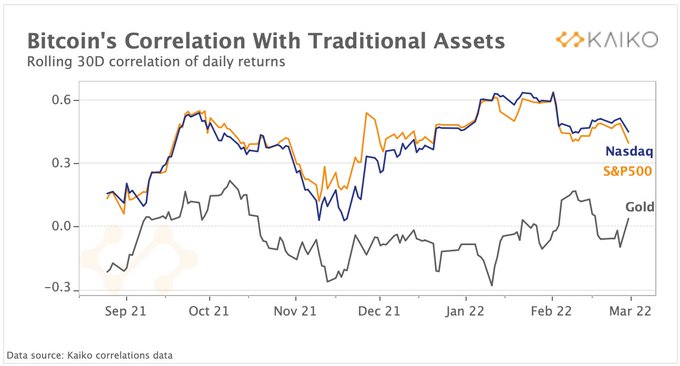

Data from crypto researcher Kaiko showed that Bitcoin’s correlation with stocks and traditional assets hit a two-month low in the past 30 days.

A major factor in this potential divergence is speculated to be the heightened regulatory attention after Russia launched military operations against Ukraine, and Ukraine being the first country to officially seek help in crypto. Fears that Russia could use crypto to circumvent US sanctions also showed that several developed countries were in a hurry to pass comprehensive crypto regulation.

The European Union will vote on a key crypto law next week, while US President Joe Biden signs an executive order that is expected to benefit crypto adoption later in the day.

This, cryptocurrency It could increase adoption and help crypto markets move away from stocks and other risk-focused assets.

Bitcoin’s relationship with equities has been a trend observed since 2021, when a large amount of institutional interest entered the market. While this interest has taken BTC to new highs, it has also started to trade more in line with traditional risk assets.

Specifically, traders now see Bitcoin as similar to US tech stocks, which are also benefiting from increased liquidity in the market.

Buying bitcoin now is akin to buying tech stocks (as they move together) with a call option on decoupling – within 6-12 months sounds realistic to me given what’s happening in the geopolitics & FX spaces.

— Alex Krüger (@krugermacro) March 8, 2022

Gold prices have managed to increase by about 8% in the last 30 days, in contrast to the volatile fluctuations seen in Bitcoin. This has reduced its potential as a safe haven. The token’s divergence from gold may not necessarily be a positive trend. Given that the price has failed to keep up with the sharp rise in US inflation this year, the divergence from gold has also questioned Bitcoin’s viability as an inflation hedge.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.