What the cryptocurrency market is eagerly awaiting Bitcoin Since the approval of the ETFs, the BTC price has reacted contrary to expectations, losing 20% of its value. In BTC, where the “buy the rumor, sell the news” phenomenon took place, the selling pressure resulted in the price falling below $ 39,000. While the pressure on the price continued, the whales’ “bottom buying” move attracted attention as an interesting detail. Here are the details of that exciting development.

Bitcoin Whales Take Advantage of Bearish Opportunity

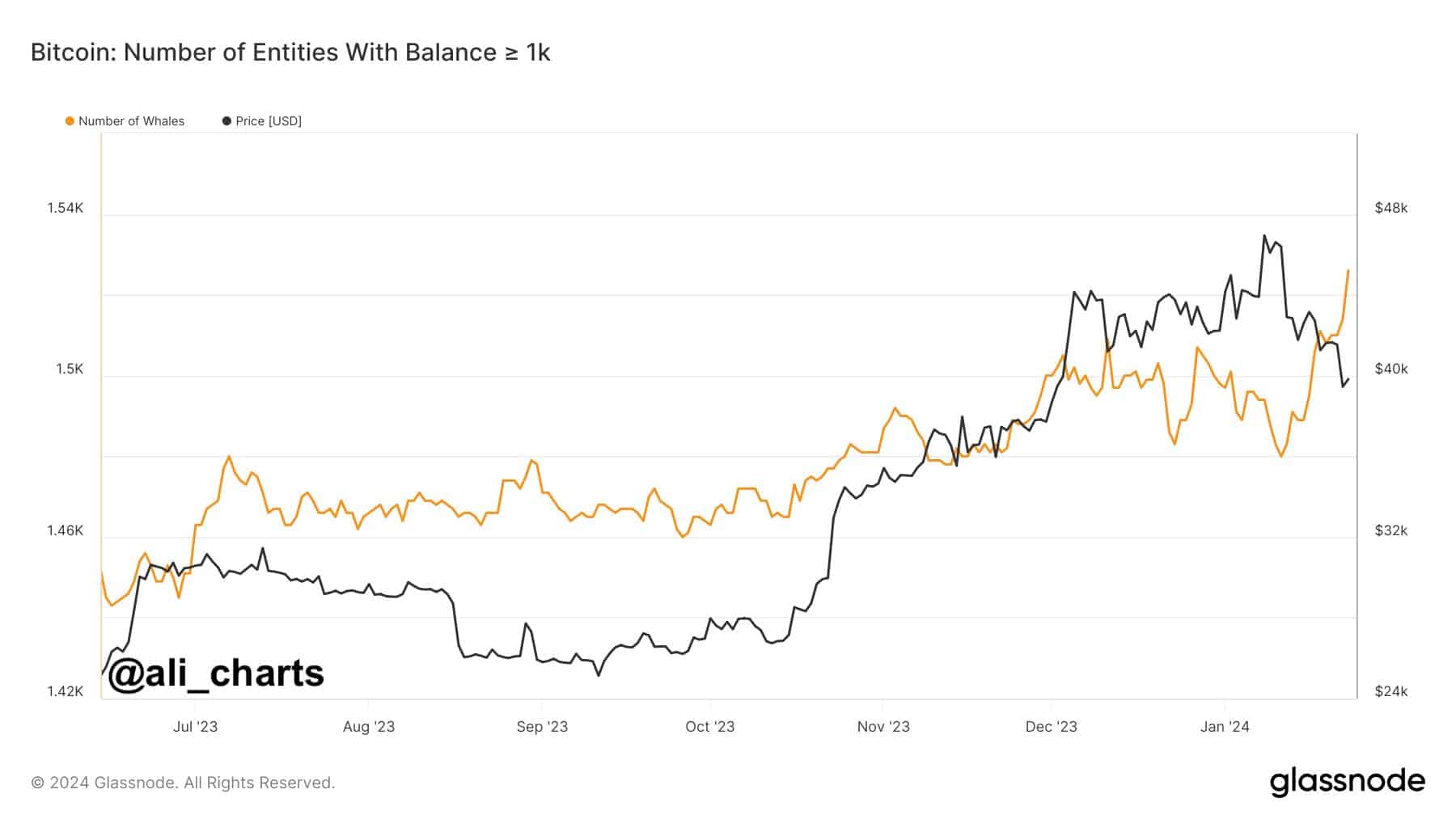

Commenting on the current correction, Ali Martinez stated that Bitcoin whales continue to buy at low prices without even showing any slowdown.

While the analyst stated that the number of whales purchasing is increasing steadily, he emphasized that the number of wallets holding assets of 1000 BTC and more has increased to at least 46 addresses.

Following the approval of Bitcoin ETFs, markets recorded a strong entry. With the launch of the BlackRock iShares spot ETF, an inflow of $42 billion attracted attention. In the first two weeks of ETFs, IBIT ETF broke a record by reaching a value of $ 3 billion.

In his prediction about when the price will rise, Ali Martinez drew attention to the bull runs between 2015-2018 and 2018-2022. Martinez thinks that if the current price movement follows previous price movements, it could record a peak around October 2025.