Santiment found that whales continue to accumulate despite ‘weak’ movements in Bitcoin price. According to the data, since April 9, when around $28,000 was traded, whales have been buying $26 million worth of BTC per day (an average of 1000 tokens per day). This indicates a potential price increase. doing.

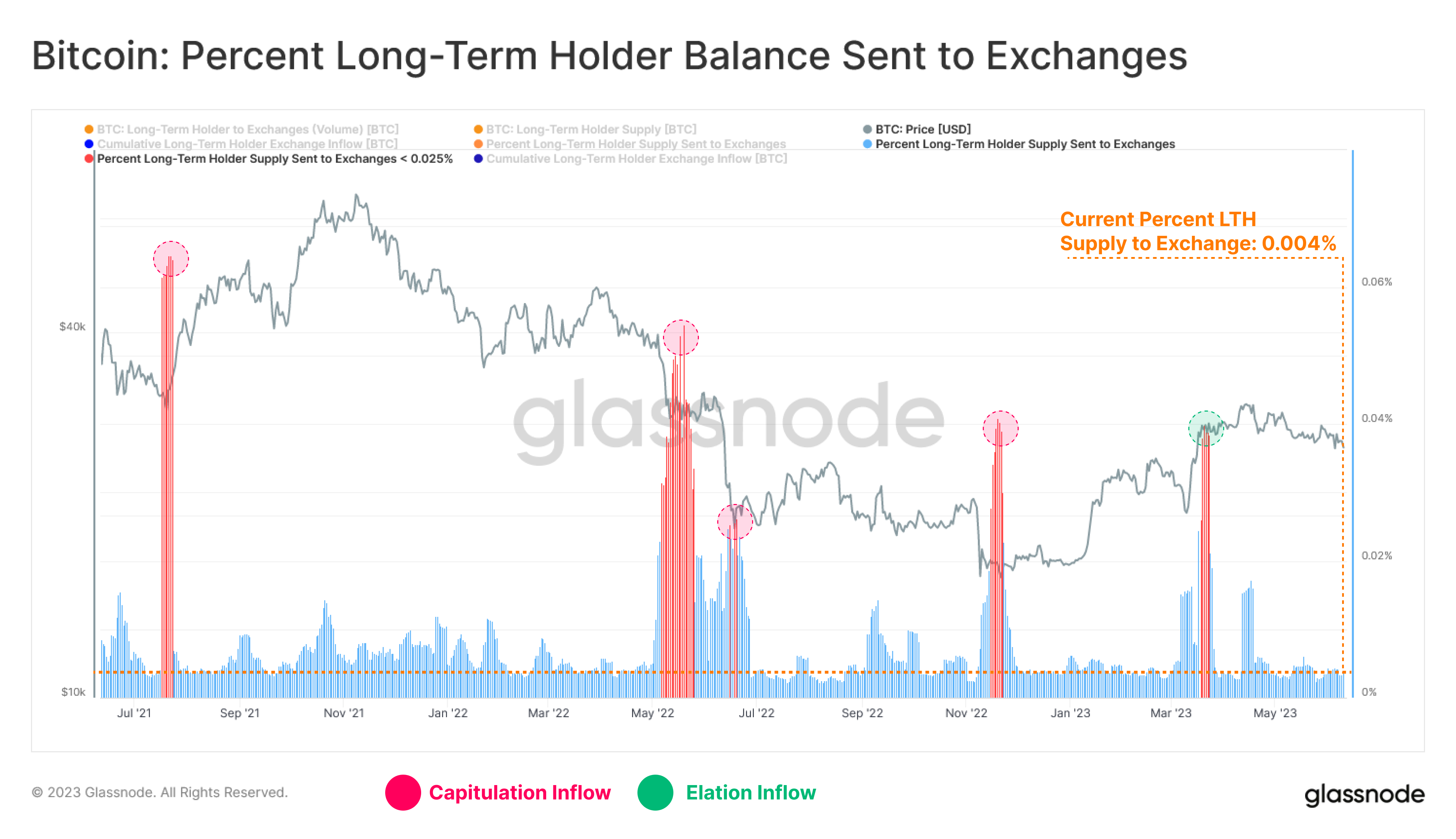

Glassnode closely monitors the activities of long-term Bitcoin holders. According to Glassnode, long-term BTC holders are not much affected by the current market downturn.

The percentage of Bitcoin long-term owner supply sent to exchanges remains extremely quiet at 0.004%. This highlights the deep inactivity of this group amid growing market distress, indifferent to regulatory accusations from Binance and Coinbase.

NEWS CONTINUES BELOW

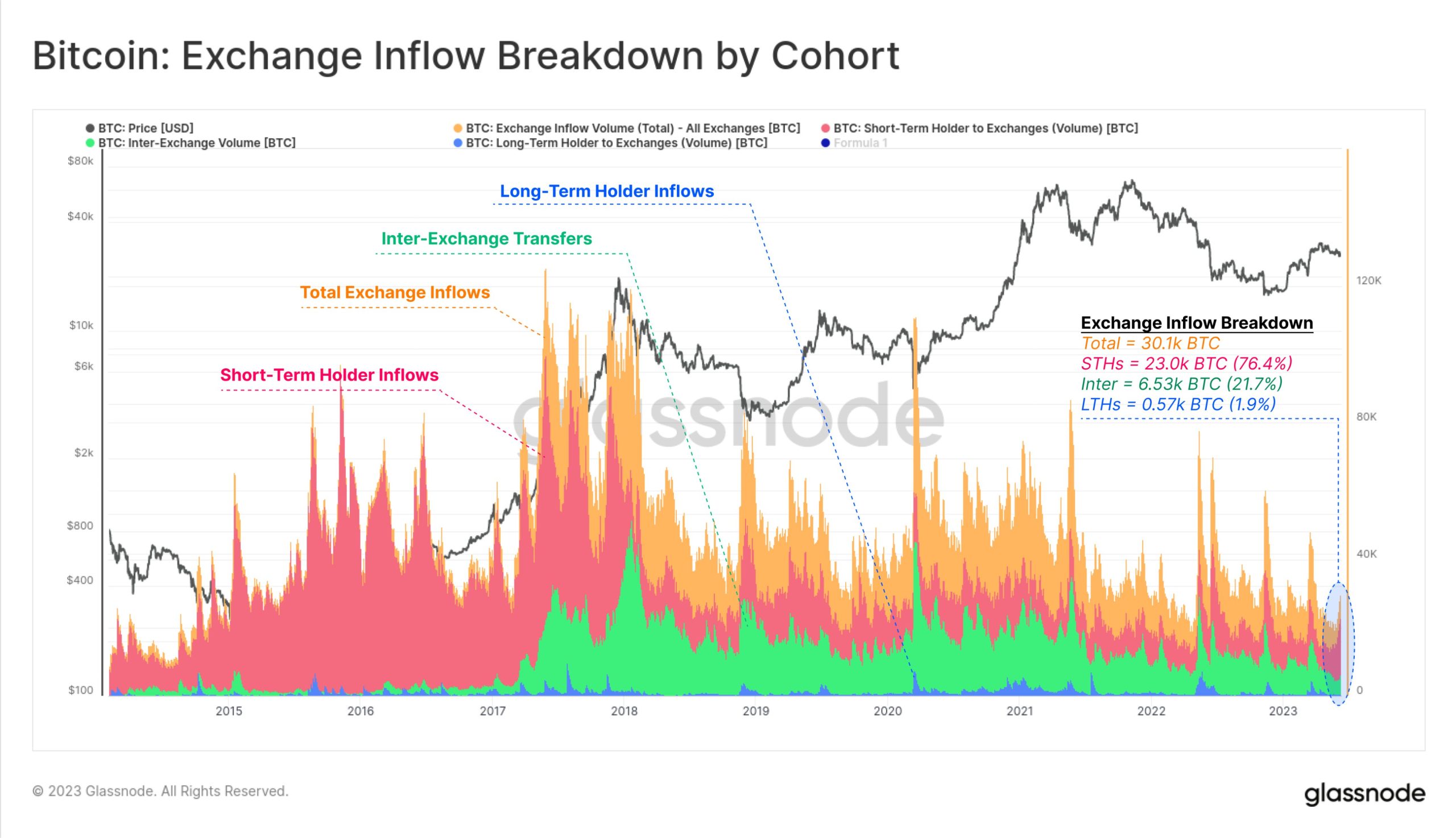

According to the analytics firm, the overwhelming majority of BTC transfers to crypto exchanges are short-term investors.

By focusing on total Bitcoin exchange deposit volumes, we can create a breakdown by cohort type. Thus, we can identify which investor groups have had the most significant reaction to the latest regulatory news:

- Short-term investors account for 76.4% of the deposit volume (23,000 BTC).

- Long-term holders account for only 1.9% of deposit volume (570 BTC).

- Inter-exchange transfers account for 21.7% (6,530 BTC) of deposit volume.