A closely-followed crypto analyst says Bitcoin (BTC) may have reached its bottom, while a popular Ethereum (ETH) rival is predicting an uptick.

An analyst known by the pseudonym Cantering Clark said that smart contract platform Solana (SOL) is poised for a move that could trigger a strong rise from current prices. told.

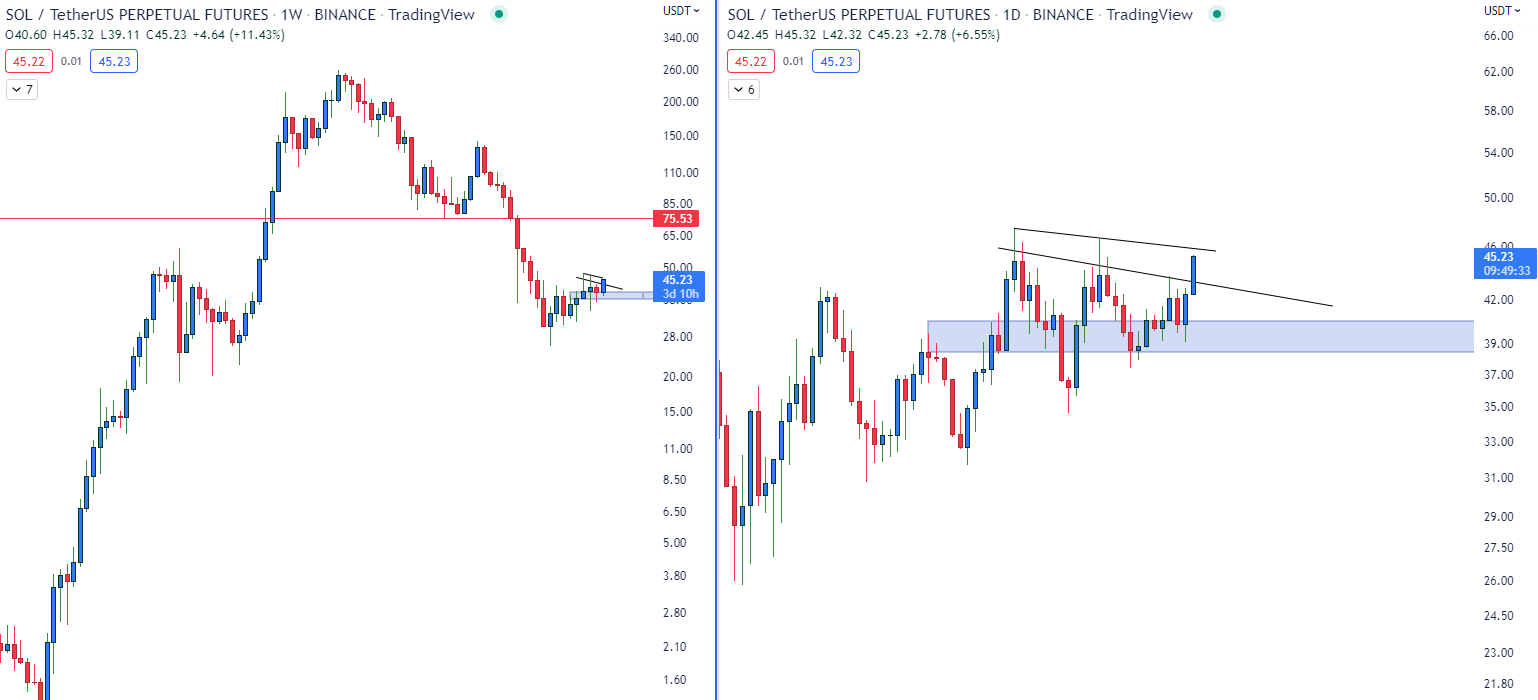

“Just look at the chart.

SOL seems to be strengthening against resistance and getting stuck to fly… This daily chart looks good and we haven’t seen a reversal to the average as I expected. LEFT.”

Looking at the analyst’s charts, the next major resistance for Solana appears to be around $75.

According to Cantering Clark, at the time of writing, SOL is trading at $47.48, indicating about 60% upside potential for its Ethereum rival.

As for Bitcoin, the trader thinks that BTC retesting the 2017 bull market around $20,000 and maintaining it as support on the weekly timeframe could be a suitable bottom signal.

“Is it possible for Bitcoin to really be that simple? Everyone talks about a dip that should match previous dips, but ignores the fact that the last bull market was less intense than the previous ones.

Regardless, we’re back to a good historical tool.”

Cantering Clark also noted that during the 2017 bull market, Bitcoin recovered over 11,000% from the bottom. pulling. Meanwhile, during the 2021 bull market Bitcoin had gained less than 2,000%.

“Is there a problem with your eyes?”

The crypto analyst is also warning traders planning to open a short position in Bitcoin due to its relatively poor performance in the past weeks.

“Bitcoin is very boring and gives the impression of weakness.

“Never short in a boring market.”

This reminds me of the 2020 build in March lows.”

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.