Bitcoin (BTC)Consolidated below $40,000 on May 5 after rising to one-week highs amid economic developments from the United States.

FED Pokes Crypto Markets

Data from Cointelegraph Markets Pro and TradingView revealed that an overnight top of 40,050 was formed on Bitstamp following comments from the Federal Reserve and Chairman Jerome Powell.

The US central bank had aligned with market expectations with a key 0.5% rate hike and also suggested that similar repeat increases would follow.

However, the minor market rally has left Bitcoin eerily volatile in what contrasts strongly with previous Fed statements on issues like inflation.

The main threat, according to economist Lyn Alden, could be the long-term sideways course of risky assets.

Ben Lilly, who works as a token economist at Jarvin Labs, drew attention to the low funding rates in the BTC derivatives markets.

“Markets eased a bit after Powell’s comments. But will this situation continue for crypto assets? Funding rates have been negative for a long time. This is usually seen when there are bottom prices.”

According to Lilly, a good structure to start here for ascension will start right here.

But Lilly added that at current price levels, the lack of accumulation in whales is “not what we expected to see.”

The Worst-Scenario for Bitcoin Hasn’t Happened Yet

Focusing on lower timeframes, popular trader Crypto Ed resisted for a fresh move above $40,000 on May 5.

BTC/USD was on track to reach $40,800 and although there were “many reasons” to curb a more significant climb, it was still listed as an option, according to the trader.

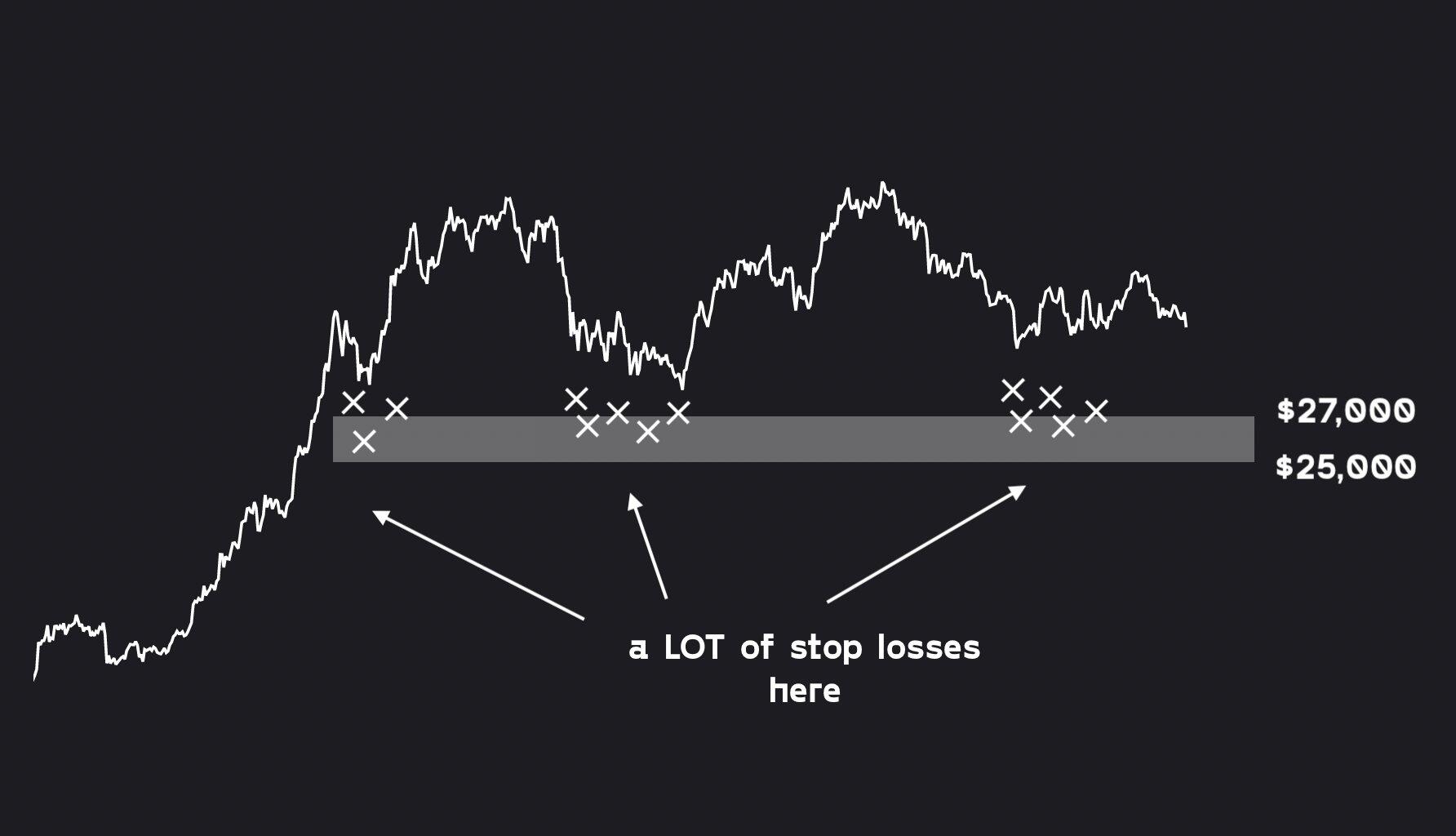

Meanwhile, in terms of BTC price capitulation scenarios, on-chain tracking resource Whalemap reiterated its previous claim that the $25,000 to $27,000 area would create “maximum pain” for Bitcoin holders. According to Whalemap, these levels can see much more liquidity and stop loss.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.