Bitcoin is headed for a liquidity crisis on the sell side, according to the co-founder and CEO of analytics platform CryptoQuant. Meanwhile, according to analyst Willy Woo, price models show that Bitcoin’s bull run is just beginning.

At this rate, we will see a liquidity crisis!

cryptokoin.comAs you follow from , spot Bitcoin ETFs are witnessing record inflows. In addition, BTC is also recording new records. Ki Young Ju, co-founder and CEO of CryptoQuant, says Bitcoin bears “cannot win this game” until spot Bitcoin exchange-traded fund (ETF) inflows stop. In this context, Young Ju makes the following statement:

Last week, spot ETFs saw net flows of +30,000 BTC. Well-known entities such as exchanges and miners hold approximately 3 million BTC, of which 1.5 million are held by US entities. At this rate, we will see a liquidity crisis on the sell side within 6 months.

Bitcoin is in the price discovery phase!

According to the analyst, Bitcoin is currently in the price discovery phase. “When there is a liquidity crisis on the sell side, the next cyclical peak could exceed our expectations due to limited sell side liquidity and a thin order book,” the analyst said. This will likely happen when the accumulation addresses reach approximately 3 million BTC in total.” says.

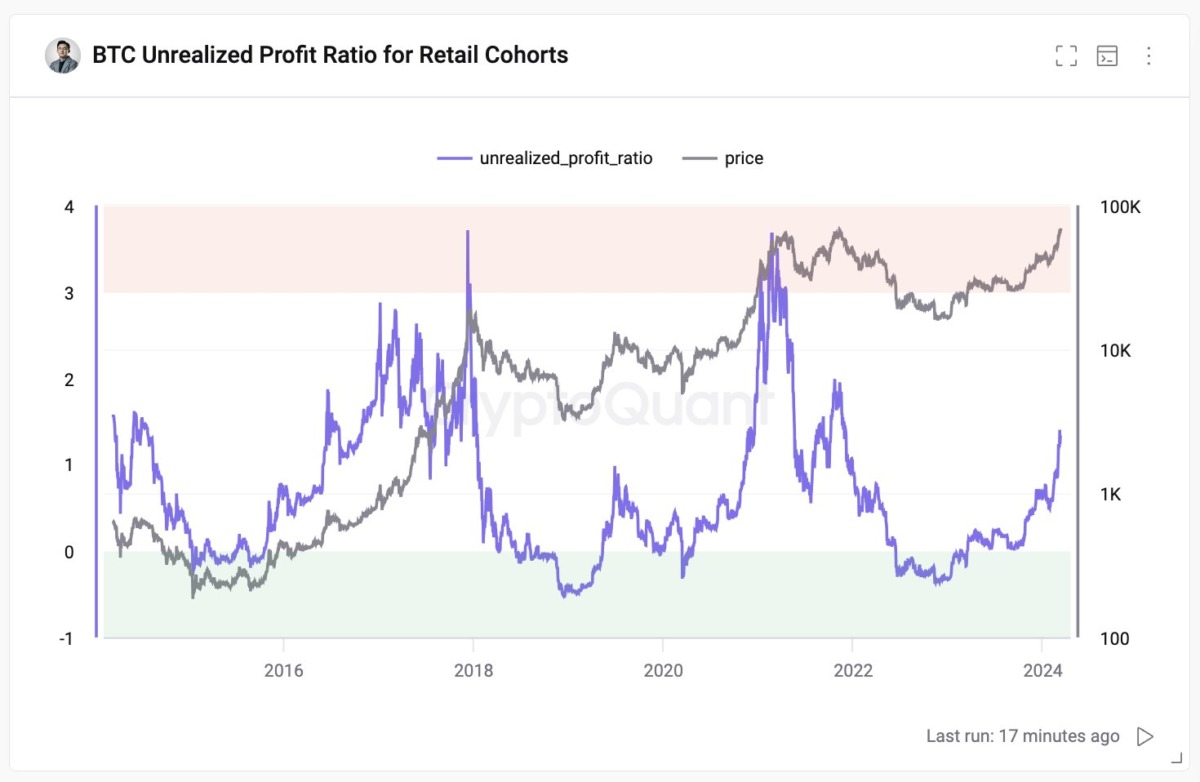

Young Ju also says that the current market is “halfway to Bitcoin euphoria.” The analyst expresses his views on this subject as follows:

On-chain individual activities are definitely active. But it does not indicate a cyclical peak. BTC is in the price discovery phase, so it is important to determine whether we are at a cyclical top.

Willy Woo: It’s still early for the bull market!

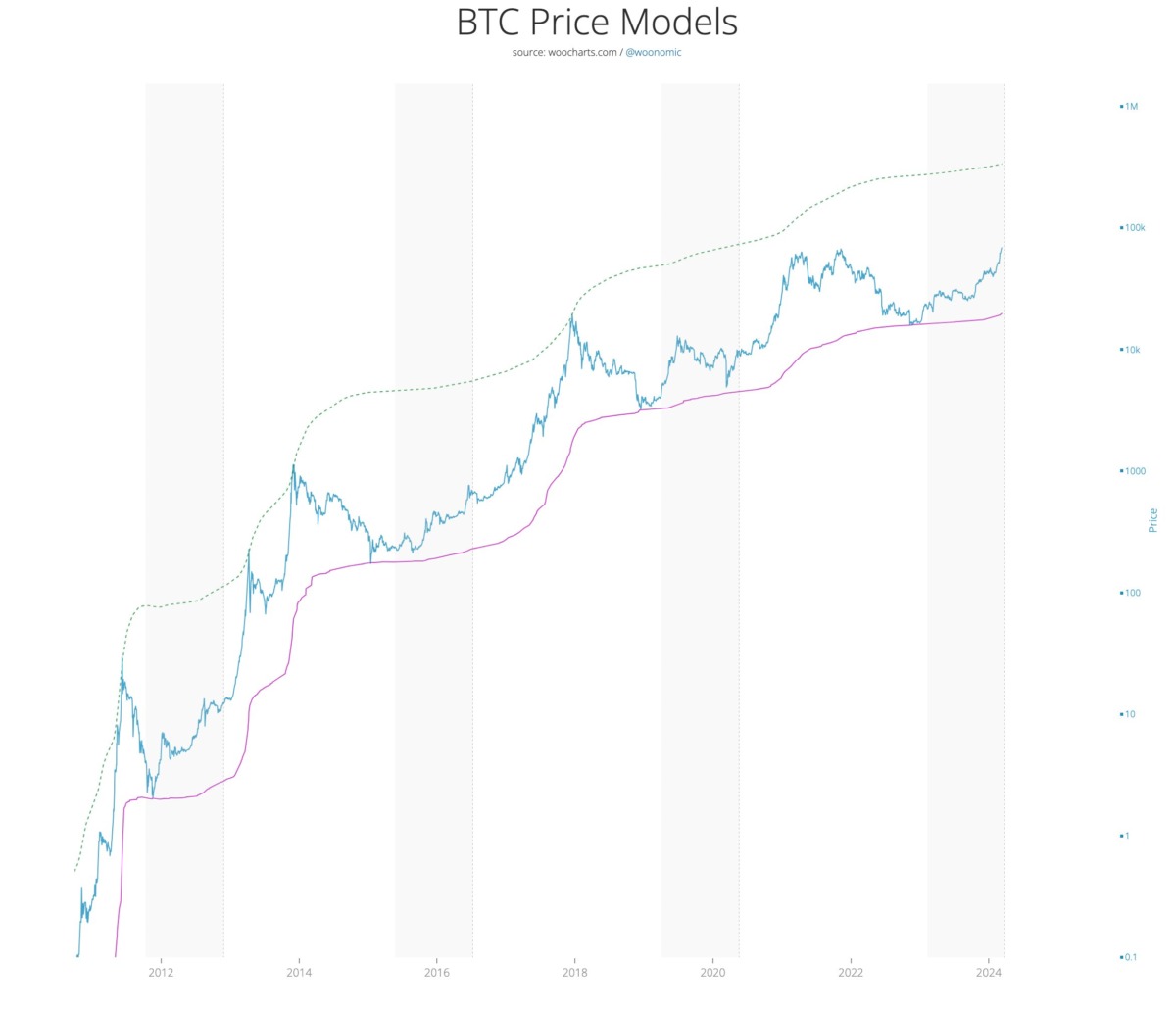

According to on-chain analyst Willy Woo, price models show that Bitcoin (BTC)’s bull run is just beginning. Woo says Bitcoin’s upper limit is currently $337,000. In this regard, the analyst makes the following statement:

So this bull market is still early, equivalent to last cycle’s $20,000. Last cycle the cap was not reached due to the paper BTC flood, this cycle it is less dominant.

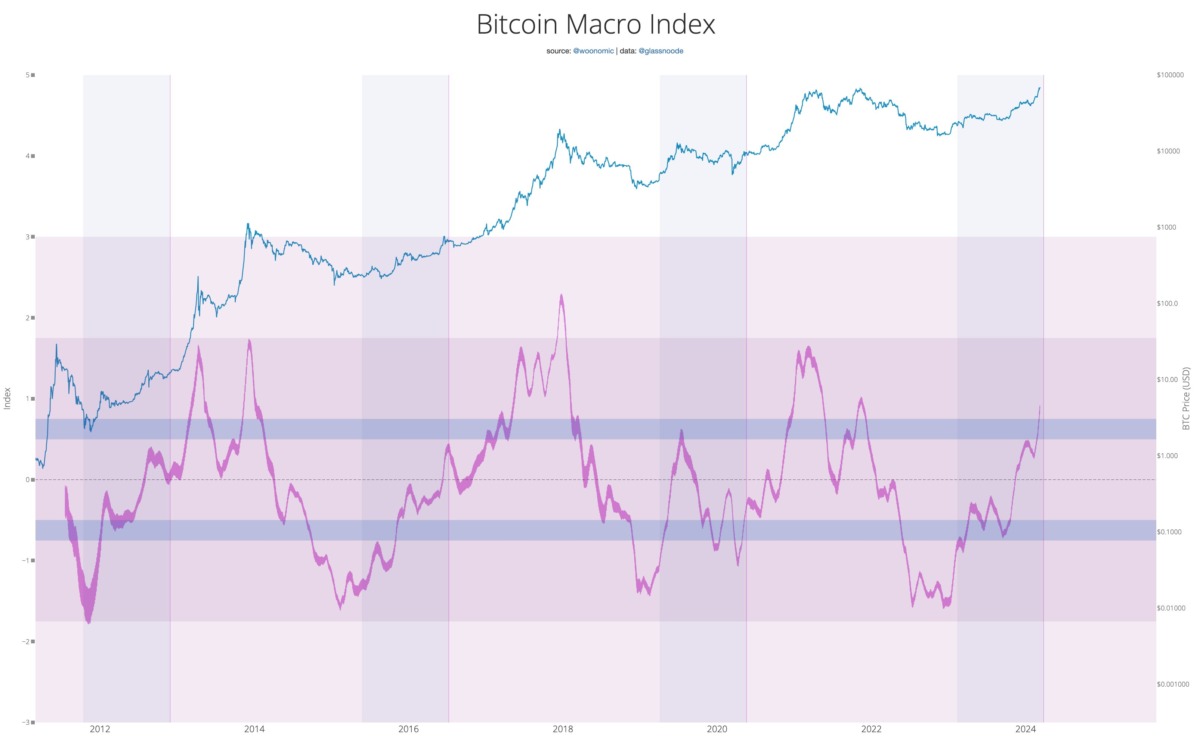

Paper BTC refers to derivatives that represent Bitcoin but do not include actual ownership of the asset. Woo also looks at the Bitcoin Macro Index (BMI), a composite of 17 fundamental and technical macro signals that tracks the behavior of BTC investors and miners. The analyst said, “We broke the upper blue band this week. “This is a sign that we are in a complete bull market based on fundamentals.” says.

Bitcoin was trading at $72,473 at the time of writing this article. The leading cryptocurrency recorded an all-time high of $72,733 on Tuesday morning. During this period, it increased by more than 8% last week.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!