Bitcoinreached a significant milestone in on-chain analytics. According to Glassnode’s report, on February 14, 2024, the Realized Price of BTC increased by 1.5% to $23,230. This shows that the average price paid for each BTC in circulation has reached a record high.

The Realized Price is calculated by multiplying the price at which a cryptocurrency was last traded on the blockchain by the transaction size and dividing by the total supply. This, unlike the market price, reflects the total cost of Bitcoin investors and their confidence in the asset.

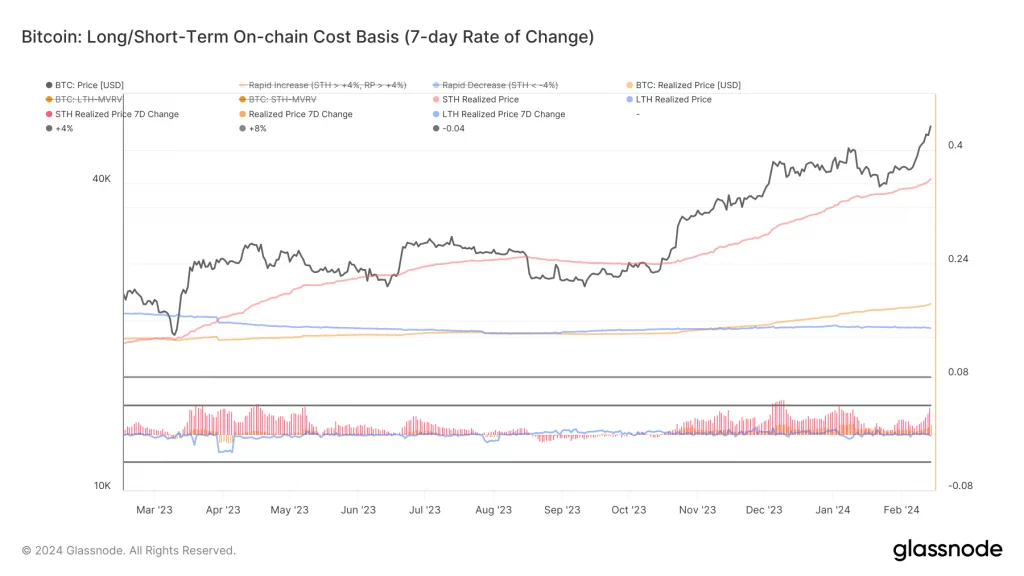

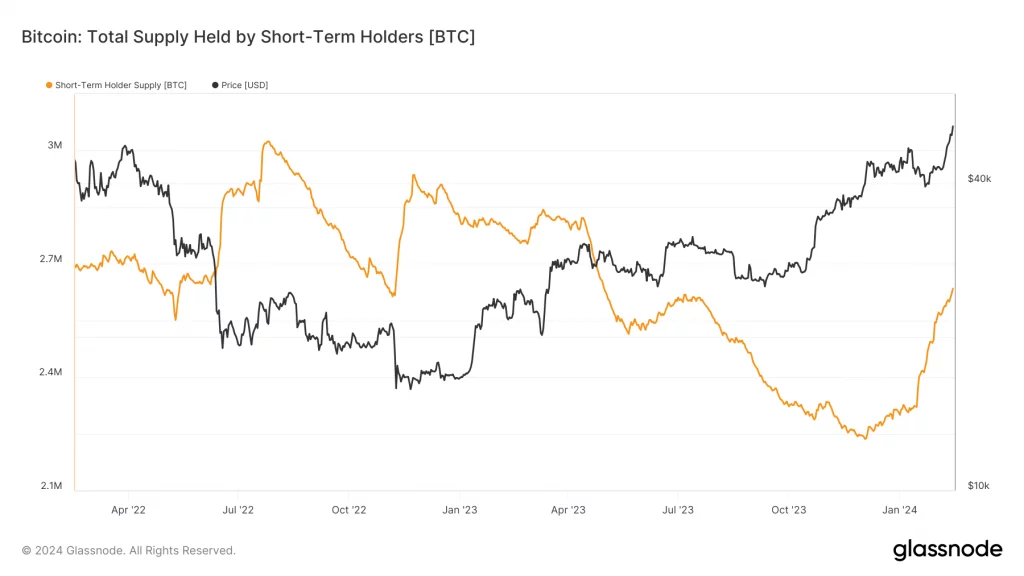

The Real Price increase was inevitable as short-term investors who moved their Bitcoins over the last 155 days saw their average purchase price increase by 12.5% to $52,800. This coincided with the market value of BTC exceeding $1 trillion for the first time. glassnodestates that short-term investors may have made a profit by adding 400,000 coins during this period.

The difference in the behavior of long-term and short-term investors can be seen in the “Realized Cap HODL” Waves chart. This chart shows that long-term investors’ holdings decreased from 86% to 82%, while short-term investors’ holdings increased from 14% to 18%. This could be a sign that at higher prices, long-term investors are selling to short-term investors.

However, this does not mean that long-term investors have lost faith in Bitcoin. Long-term investors can reorganize their portfolios or realize their profits by evaluating market conditions. Short-term investors, on the other hand, may be optimistic about the future of Bitcoin and be willing to increase their investments. The Net Unrealized Profit/Loss (NUPL) metric shows that the market is generally profitable.

In conclusion, the increase in Bitcoin’s Realized Price and these differences in investor behavior indicate that the market is healthy and dynamic. Bitcoin’s evolution reflects the complexity and diversity of on-chain metrics, with the diverse strategies and expectations of participants.