Today marks the first monthly settlement following the approval of the spot Bitcoin ETF, which took place in early January. Bitcoin options will expire. Following the approval, the Bitcoin price showed a largely volatile performance, contrary to the expected rise. In this context, it faced strong selling pressure and crashed below the $40,000 resistance. At the time of writing, Bitcoin is trading at $39,925 with a market cap of $782 billion.

Bitcoin Options Expiry Sees Significant Volumes

Greeks.Live is a platform specializing in options data. In this context, he announced significant figures for Bitcoin (BTC) by providing information on January 26 option data.

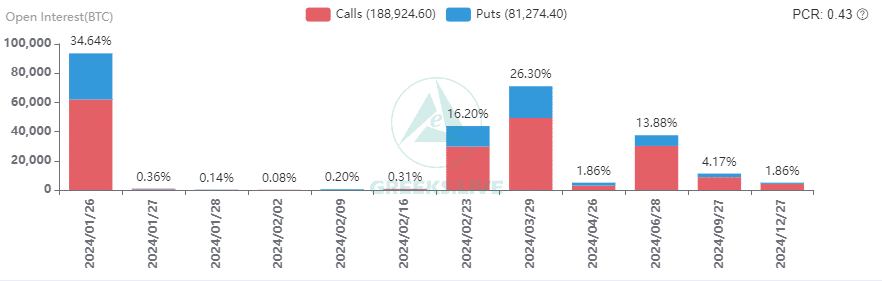

Approximately 94,000 Bitcoin options will expire and have a Put Call Ratio of 0.51, a Maxpain point of $41,000, and a face value of $3.75 billion. On ETH, 932,000 options are approaching expiration, exhibiting a Put Call Ratio of 0.31, a Maxpain point of $2,300, and a total notional value of $2.07 billion.

Koinfinans.com As we reported, the crypto market has entered a downward trend, contrary to the expected rise following the launch of Bitcoin ETFs.

The ongoing volatility decline was evident as large-term Implied Volatilities (IVs) decreased and some short-term IVs fell below the 40% threshold.

The Call to Put Ratio (PCR) has dropped sharply, indicating reduced bearish activity, primarily characterized by more investors selling put calls and fewer participating in active calls.

With more than 30% of options approaching maturity today, there is an expectation that the margin released during this period may once again impact IV and contribute to the reversal of Bitcoin’s option maturity structure.

BTC price has started to follow a downward path with recent developments. Analysts are of the view that Bitcoin will drop to $35,000 and below before resuming its next bull run. Currently, the community is eagerly awaiting the Bitcoin halving and thinks that this development will trigger the expected rally. In addition, analysts predict that a new bull run will begin from now on.

On the other hand, some market analysts also stated that caution should be exercised. Bloomberg senior commodity strategist Mike McGlone predicts that Bitcoin will underperform the stock market on a risk-adjusted basis in 2024, while gold may outperform.

Macroeconomic factors according to analyst cryptocurrency It could prevent the unit from reaching all-time highs in 2024. McGlone said market expectations about a possible interest rate cut by the US Federal Reserve, which supports risky assets such as Bitcoin, may be misplaced. emphasizes.

#gold set to beat #Bitcoin in 2024 unless the stock market can keep going up. https://t.co/ApRZ8K8Ptz

— Mike McGlone (@mikemcglone11) January 25, 2024