Bitcoin (BTC), the world’s largest cryptocurrency, is struggling to maintain its upward momentum. In this context, it is currently facing the concerns of investors. Despite rising above $31,000, Bitcoin now faces significant risk. Miners have an important move of 128 million dollars in our news. Let’s look at the details.

Bitcoin bulls face uncertainty

Yan Allemann, co-founder of Glassnode, states that the transfer of miners can create significant selling pressure on the market. Accordingly, he warns that this could potentially disrupt the ongoing bull run. Bitcoin BTC is currently struggling to hold steady at the key $30,000 support level. On the other hand, it adds to the uncertainty surrounding its future performance.

Tight Bollinger Bands and market complications

Bollinger Bands, a popular technical analysis tool used to measure volatility, make the point. It remains tight despite low volatility, further complicating things. Historical data shows that such situations often precede sudden market movements. Accordingly, this may create additional difficulties for Bitcoin bulls.

The $30,000 support level, which plays a vital role in the resurgence of the uptrend, becomes a focal point for investors observing the market’s reaction to the miner’s move. Bitcoin has faced and overcome similar challenges in the past. However, the current situation raises concerns among market watchers.

Downtrend indicators and chart patterns

Bitcoin’s Average Directional Index (ADX) on the daily chart reflects the current price recession. On the other hand, this situation is in a downward trend. This indicates a potential downtrend for the next 10 days. On the other hand, there are possibilities ranging from consolidation to revisit the $29,600 support line and even dropping to the $28,300 level if the downside continues.

Bitcoin often goes through phases of correction or consolidation before entering another uptrend, a pattern that recurs throughout the year. During this period, late long positions are absorbed. It also contributes to the natural tides of market cycles. What is Bitcoin doing after the correction or consolidation phase has passed and liquidity has stabilized? Beginning another uptrend that will potentially result in a 6,000-point increase as seen in previous cycles

Bitcoin faces potential drop

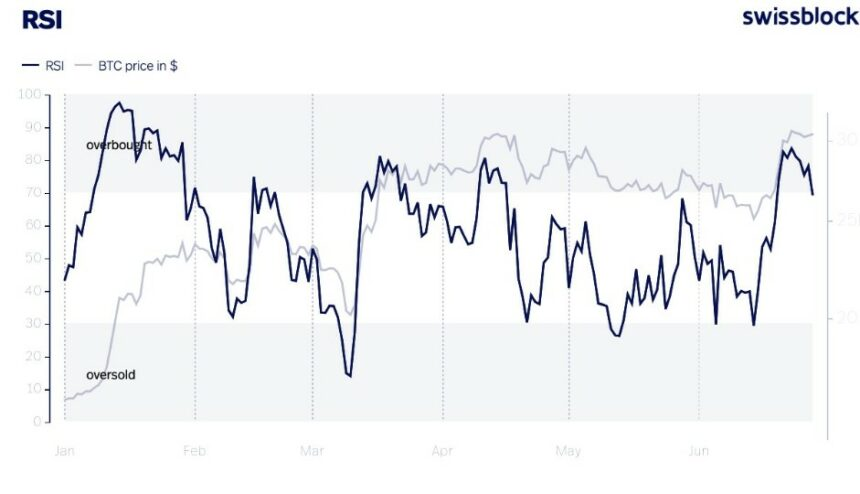

Yan Allemann highlights technical indicators that point to a short-term reversal in Bitcoin’s price. The Relative Strength Index (RSI) reached overbought territory at 72.92 over the weekend. Also, the double top pattern and the Moving Average Convergence Divergence (MACD) also point to a possible short-term reversal. These factors point to a potential reduction in buying pressure, with the RSI holding the upper and lower levels.

Despite the potential challenges, there are also positive indicators for Bitcoin’s price. Accordingly, there are continued positive funding rates reflecting the bullish sentiment among investors. Moreover cryptocoin.com As we mentioned, there is also an upward movement in Bitcoin mining stocks. This indicates a potential catalyst for the next big price move.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and Instagramfollow on. Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your own research and due diligence before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.