The movements of Bitcoin miners always attract attention. Just as the movements of the whales draw attention to. So what does this mean? Is a sales wave on the horizon? Let’s see for details.

Bitcoin miners transfers

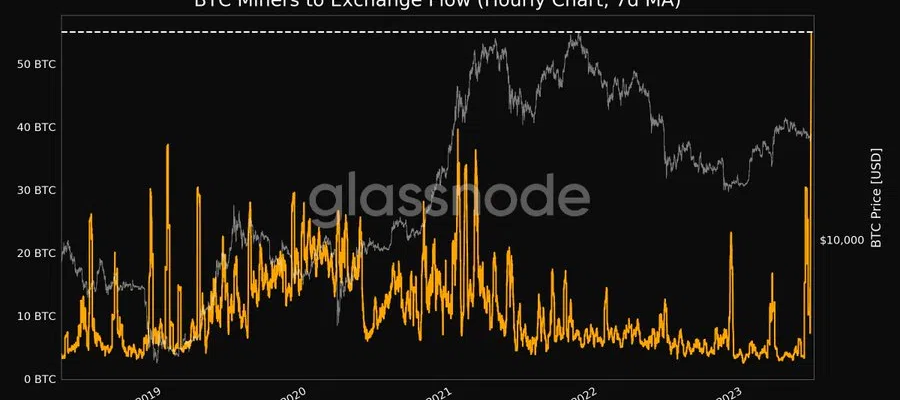

According to data from Glassnode, Bitcoin miners transferred more BTC to exchanges in the past week than at any point in the past five years. Blockchain analytics firm reported that the hourly chart of the 7-day moving average for BTC miners shows exchange flows reaching a 5-year high of 55,068 BTC. According to Glassnode’s data, despite the rate of flow of funds from miners to exchanges, miners still hold 1,829,000 BTC (about $49 billion).

Miners’ reserves increased in the first days of June. It increased from 1 million 836 thousand recorded on 31 May to 1 million 845 thousand as of 2 June. However, it fell slightly during the same period after news broke of the U.S. Securities and Exchange’s (SEC) lawsuit against Coinbase and Binance. On June 11, Glassnode stated that miners are sending a significant amount of coins to exchanges. He reported that the largest entry was equal to $70.8 million. Despite the increased flow of miners to exchanges, BTC’s balance on exchanges reached a 3-month low of 2 million 280 thousand Bitcoin BTC due to outflows exceeding inflows. According to Glassnode data, Bitcoin’s stock market outflow has surpassed $56.3 million in entries in the last 24 hours.

What does it mean for BTC price?

There are mixed reactions as to what this could mean for Bitcoin. Generally, the flow of funds to exchanges indicates that a business plans to sell. This could mean that miners want to cash out their BTC due to the negative regulatory environment. Meanwhile, some market analysts believe that miners’ transactions show their confidence in Bitcoin’s future prices. Because their profitability largely depends on how well the asset performs.

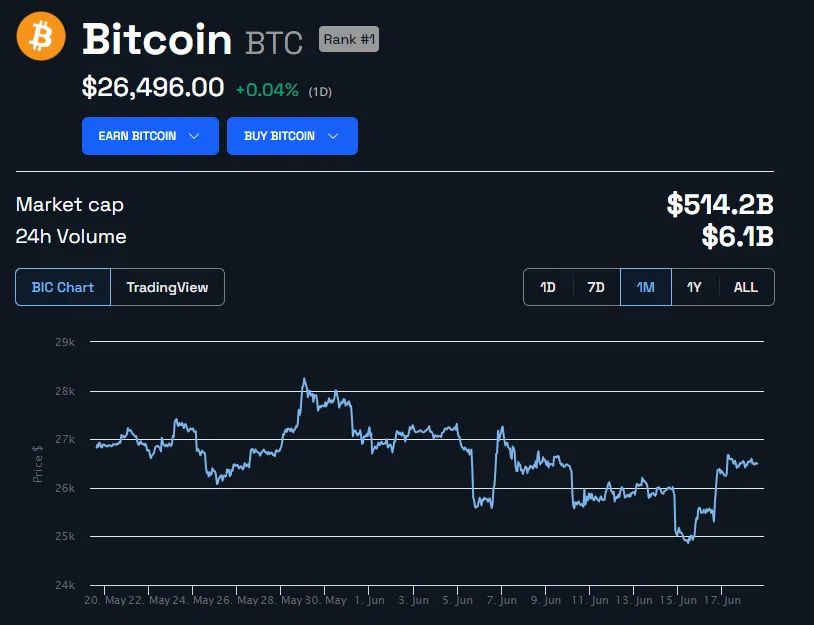

Whatever the view, Bitcoin has dropped significantly over the past two weeks. In addition, many negative news impacted its performance. However, sentiment surrounding the flagship digital asset seems to have changed after BlackRock filed for the Bitcoin Spot ETF. Bitcoin is up 0.04% in the last 24 hours. At the time of writing, it is trading at $26,496. As a result, the activity of Bitcoin mines did not present a negative situation for Bitcoin. However, developments in the markets during the week will reveal a clear picture.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your own research and due diligence before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. Therefore, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.