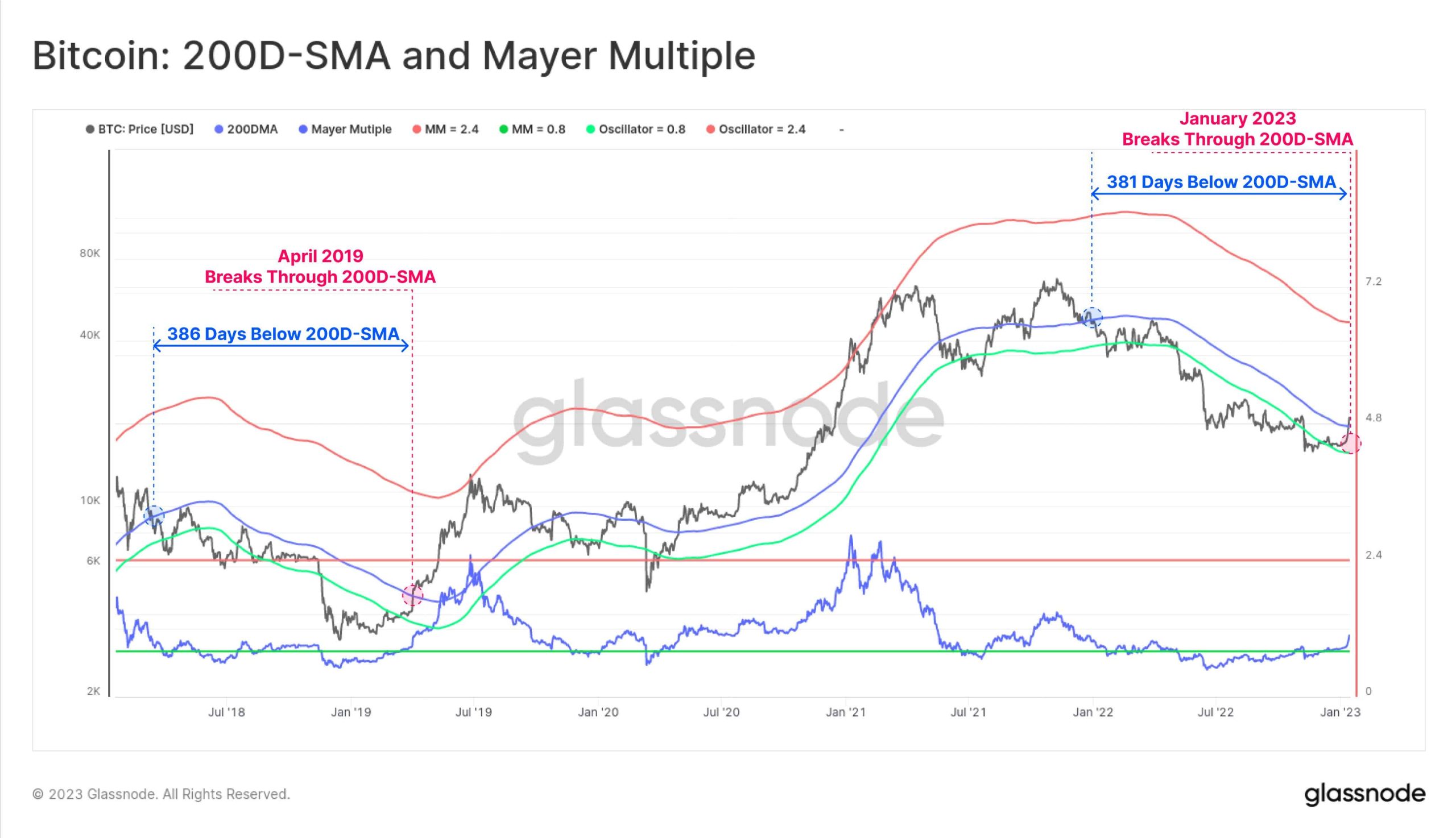

bitcoin (BTC) caught a big break last week and started the activity in the markets. BTC managed to surpass its 200-day moving average (DMA, $19,500) with the rally it triggered.

According to on-chain data, Bitcoin is moving in line with its previous cycles. During the 2019-19 bear market, BTC traded below the 200 DMA for 386 days. According to the current data, the similar trend lasted for 381 days and was able to be broken right after.

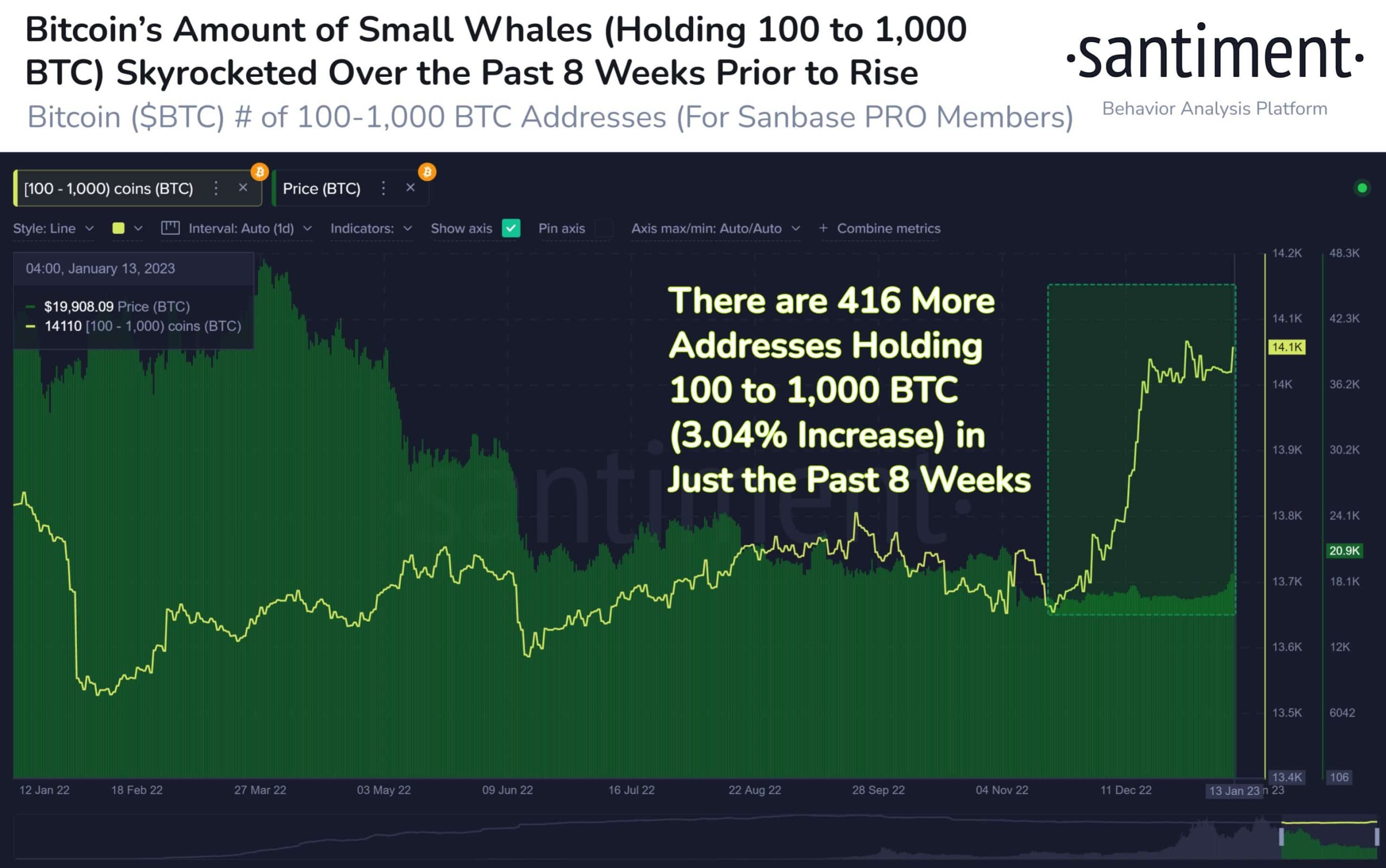

Bitcoin has recorded a strong price increase for 12 consecutive days since the beginning of 2023. However, its formation has been due to the accumulation of small whale addresses over the past eight weeks. Santiment made the following comment on the subject.

“One of the many factors that heralded this break in 2023 was the rapid increase in addresses holding 100 to 1000 BTC. Price increases are usually caused by whales accumulating Bitcoin. BTC is up 26% in a week.”

BTC Makes Short-Term Investors Smile

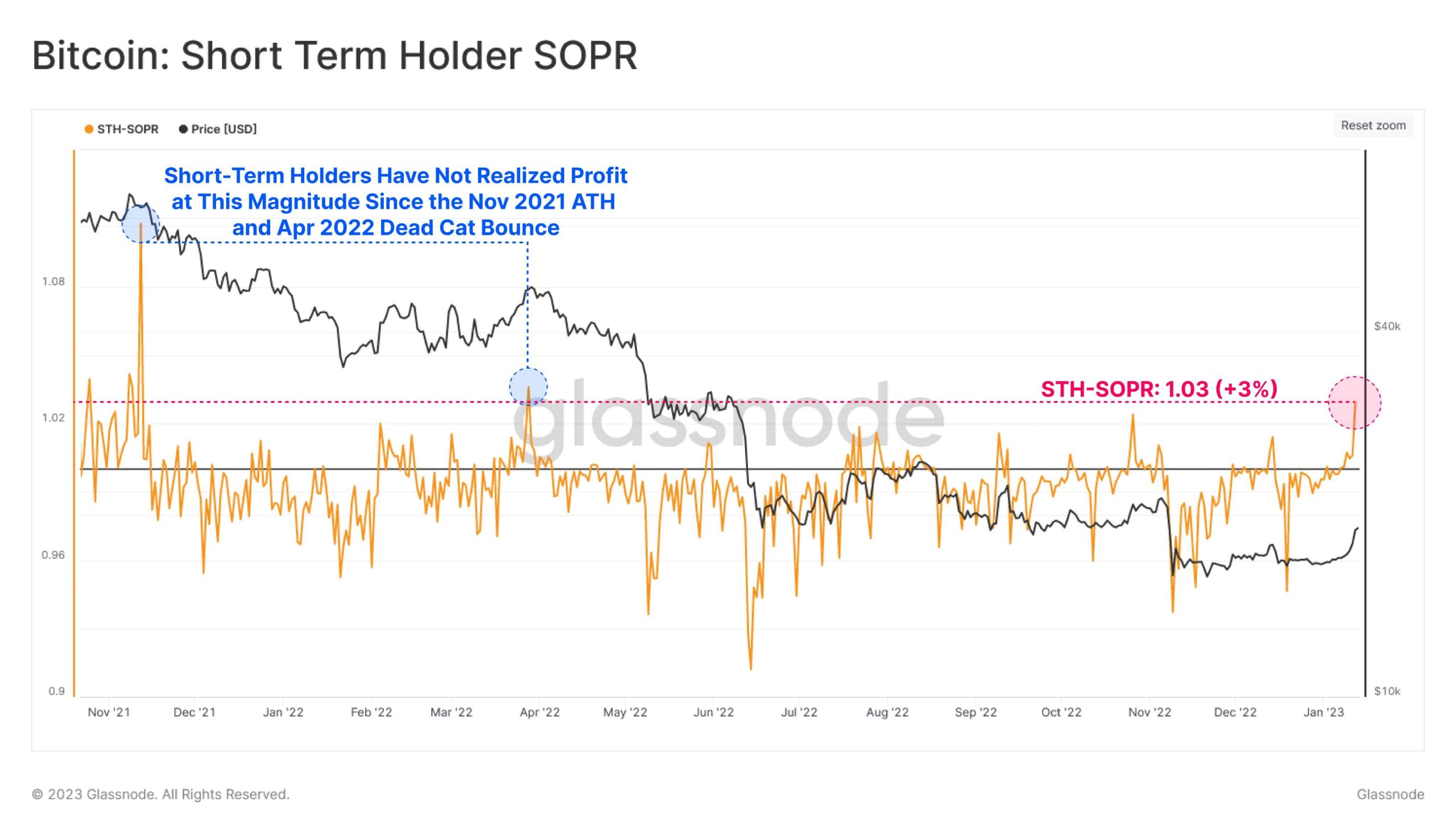

On-chain data provider Glassnode has found that Bitcoin short-term investors made the most profit on January 14 after April 2022. A profitable STH-SOPR data indicates that there is sufficient demand to absorb the profits made. A retest of the SOPR to ~1.0 will separate this rally from previous attempts to break out in 2022.

Glassnode commented on the subject:

“In all three previous breakouts, STH supply in profits has reached over 50% of assets. In response to the current price rally, over 70.5% of all recently acquired $BTC has profited. This is a harbinger of large volumes of coins changing hands in recent months.”

This heralds Bitcoin’s gains if supported by global macros. It is very important how Wall Street indices will perform this week. As a result, this could also hint at the next price direction.