cryptocoin.com As we have reported, metrics for the leading cryptocurrency Bitcoin have been announced. According to the metrics, Bitcoin (BTC) will see these critical levels! Here are the details…

Will Bitcoin make a big break to $ 50 thousand?

As the 2023 Bitcoin (BTC) rally continues, the cryptocurrency recently hit a 10-month high, surpassing $30,000, benefiting from generally positive market sentiment. Investors are now eagerly awaiting the next price target for Bitcoin, especially with the ongoing economic uncertainties.

Accordingly, in a tweet on April 15, Stockmoney Lizards, a cryptocurrency analyst, said that current gains are part of a pre-halving rally that reflects an increase of about 320 percent after bottoming out in 2020. In both periods, Bitcoin reached a 38.2 percent Fibonacci retracement. Looking ahead, the analyst noted that Bitcoin reaching $49,000 remains “a possible target for the coming months,” based on historical price movements.

It is worth noting that the next Bitcoin halving is expected to occur in April or May 2024, when the block reward will drop to 3,125. Halving events are considered a bullish sentiment for Bitcoin. However, Bitcoin’s recent rise has come in part as the world economy has witnessed a drop in inflation, leading to expectations that central banks may soon shift their policies towards quantitative easing. As such, crypto analyst Michael van de Poppe suggested in a tweet on April 14 that Bitcoin overall looks strong, but warned investors to expect “shallow corrections in an uptrend.”

I marked $31.7-32k as the key resistance point for BTC. However, $25,000 was the level everyone wanted to buy. That will probably slide to $28.5k and then no one will buy it. I prefer to focus on $29.7k.

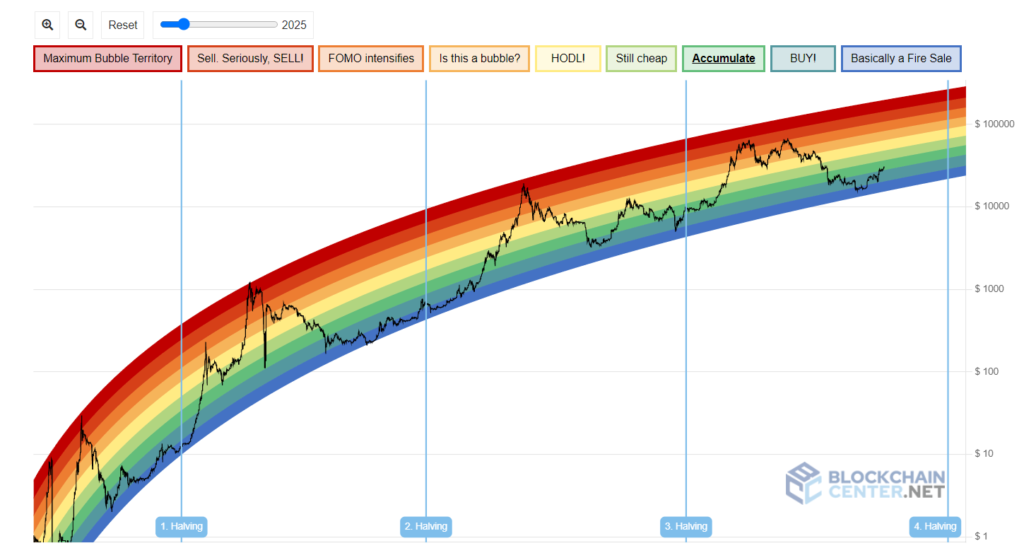

Elsewhere, the Bitcoin rainbow chart shows that BTC may have started a new rally ahead of the halving event. According to the chart, as of April 15, BTC is currently in the ‘Save Up’ zone after a period of consolidation in the ‘Basically a Fire Sale’ area.

Interestingly, this pattern is similar to the previous trend in March 2020, days before the halving event. In March 2020, Bitcoin broke out of the ‘Basically a Fire Selling’ zone as it was trading below $6,000. This event marked a major turning point for the cryptocurrency, triggering a price bottom that eventually led to a surge in value towards the 2021 bull run. Ultimately, this bullish trend resulted in BTC reaching its all-time high of around $69,000.

This tool serves as a valuable resource for investors to follow Bitcoin’s future price fluctuations. Using color bands, which follows logarithmic regression and evaluates Bitcoin’s historical price performance, the tool provides insight into the long-term movements of the asset.

The recent Bitcoin gains came after the asset reacted positively to the banking crisis and the Federal Reserve’s rate hike, leading to consolidation. At the same time, after the release of the non-farm payroll report, which fell in March, the market started to rise again. Inflation data also pointed to a decline in consumer prices in China, which helped Bitcoin once again rise above $30,000.

BTC price analysis

The leading cryptocurrency BTC has gained 0.3 percent in the last 24 hours. It is momentarily trading at $30,369. Bitcoin (BTC), which has experienced a great price change since the beginning of 2023, is facing the expectations of its investors. It is not clear where the price will go yet, but many experts are predicting a rise. The leading crypto has gained 8.7 percent in the last week.

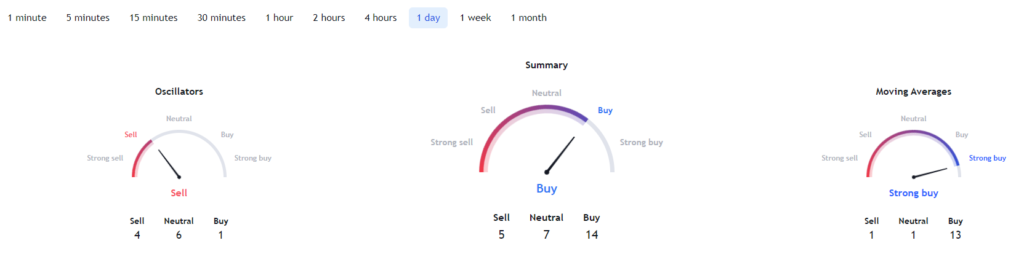

Meanwhile, an uptrend dominates the one-day technical analysis of Bitcoin from TradingView. The summary of the indicators is ‘buy’ at 14, while the ‘moving averages’ suggest ‘buy strong’ at 13.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.