Technical analyst DonAlt predicts that the Bitcoin price will rise to the $50,000 level. Another analyst assumes that Ethereum price will continue to form lower highs. And finally, technical experts say that the dYdX price is out of the downtrend.

Expert predicts a massive increase in Bitcoin price!

Evaluating the Bitcoin price chart, technical analyst DonAlt predicts that the BTC price will rise to the $ 50,000 level. The analyst’s thesis points to four key phases: bear market, “whatever”, indecision and bull market. According to DonAlt’s thesis, Bitcoin is currently in volatility. This stage is followed by a bull run in BTC price.

Therefore, DonAlt predicts a pullback in BTC price after Bitcoin crosses the key $33,000 resistance. DonAlt awaits a correction in Bitcoin price on its way to the upward target of $50,000. The analyst’s explanation is the “indecision” phase of the Bitcoin price cycle.

The expert expects the asset to pull back and trigger before the explosive move to $50,000 in the next few months of 2023. The analyst points to resistance at $19,500, $32,290 and $62,500 as the three key levels on the Bitcoin price chart.

Bitcoin miners are under pressure, what does this mean for BTC?

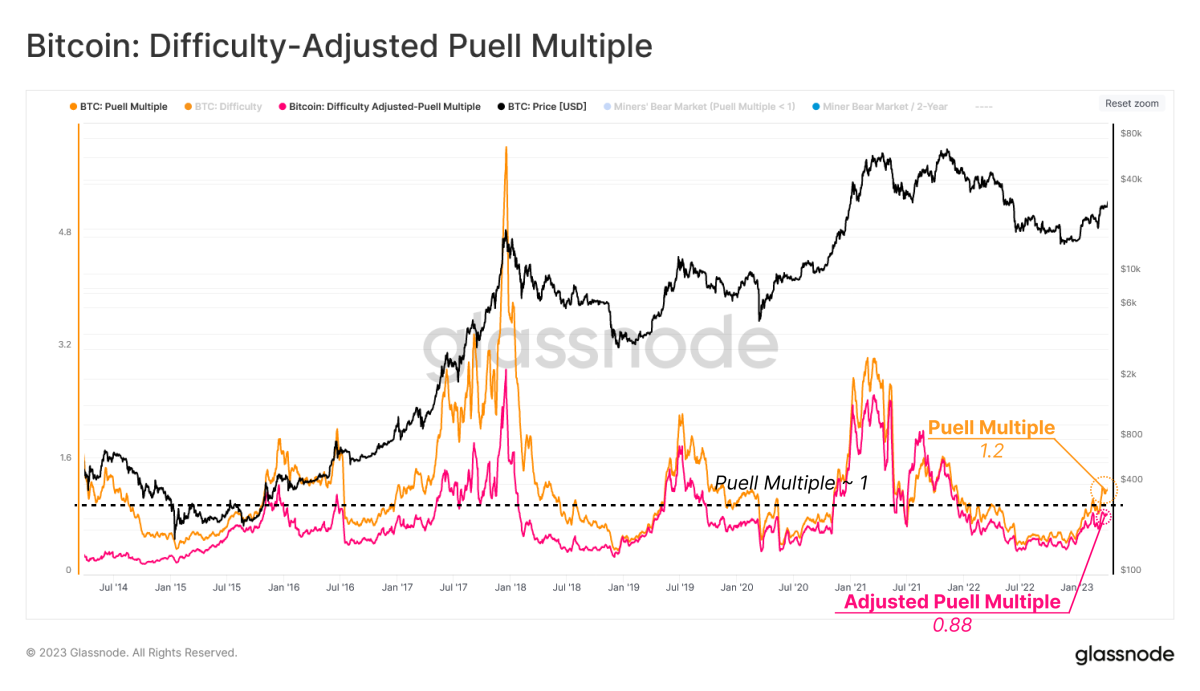

It is important to note that miners are still under pressure when the Bitcoin price is above $30,000. The “Difficulty Corrected Puell Multi” metric is used to detect difficulties on miners. While Puell Multiple measures the ratio between daily Bitcoin miner revenue (in USD) and the 365-day moving average (MA), it does not take into account the difficulty of asset mining as measured by hashrate. The difficulty-adjusted Puell coefficient measures the profitability of miners, taking into account the difficulty of mining Bitcoin.

Miners often sell their Bitcoin rewards to cover their operating costs. This is one of the main reasons why the profitability of miners and the status of miners in the network have an impact on the price of the asset.

According to the difficulty adjusted Puell coefficient, miners are currently under pressure as the Bitcoin price is above $30,000 as the hashrate has risen significantly. At the metric 0.88, a value below 1 indicates that miners are not yet profitable. When comparing the current Bitcoin price rally to bull markets in previous cycles, experts note that the “crazy” surrounding BTC price action is missing.

Market participants are losing risk appetite for ETH

Santiment analysts have identified divergences in the crypto market that could cause a temporary pause in Ethereum’s growth. cryptocoin.comFollowing the successful completion of Ethereum’s Shapella upgrade, the altcoin surged to $2,100 before its final pullback.

Experts argue that the risk appetite of market participants is relatively low and traders expect a drop in Ethereum price. Analysts reach this conclusion based on the behavior of large wallet investors. One of the key differences noted by experts is between Ethereum’s trading volume and price, as seen in the chart below.

These differences are indicative of the declining risk appetite among traders.

What to expect from Ethereum?

Ethereum price started a pullback after crossing the $2,100 resistance. CrymeaCOIN, an expert analyst and trader, assumes that Ethereum price will continue to form lower highs.

Commenting on the ETH/BTC price chart, the analyst thinks this is an ideal spot for redistribution. Breaking above the previous low of 0.072 could invalidate the bearish thesis for the altcoin.

On-chain measurements, Support the ascension thesis for dYdXhe is drinking

Whale wallet holdings and exchange reserves of dYdX are two on-chain metrics that support the bullish thesis for the token. Major wallet investors holding between 100,000 and 1 million dYdX tokens have steadily amassed the asset since March. This whale segment currently has a supply of around 5.6%, according to data from crypto intelligence tracker Santiment.

Whale accumulation is a typical bullish sign for an asset and coupled with declining stock market reserves support the thesis of a sustained price rally in dYdX. Decreased stock market reserves reduce selling pressure on an asset in the long run.

dYdX stock market supply fell as low as 10 million between February and April 2023, easing selling pressure on the asset. Of that, about 7.86 million tokens have been withdrawn in the past three weeks.

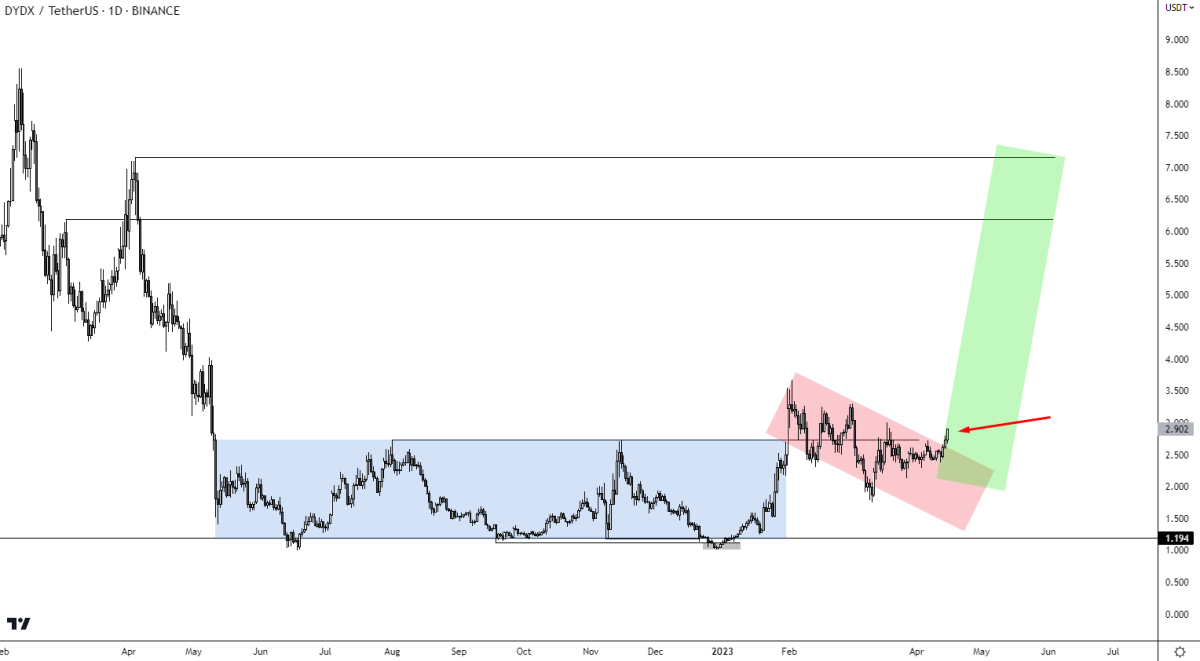

Technical experts point out that dYdX price has recently broken out of the downtrend represented by the red band in the chart below. The token consolidated in a band for months between May 2022 and February 2023 before breaking out. dYdX price action in the green band is a bullish sign for the asset. Jackis, a technical expert and trader, sets a target of over $6 for dYdX.

Falling support below $2.5 could invalidate the bullish argument for the token and result in a consolidation within the blue band between $1.19 and $2.5.

Contact us to be instantly informed about the last minute developments.twitter‘in,Facebookin andInstagramFollow andTelegramAndYouTubejoin our channel!

For the rest of the article Bitcoin, ETH and dYdX: These Levels Are Expected Next Week!