Bitcoin (BTC) price and altcoins have been trading sideways for the past two days. Bitcoin, the largest crypto asset by market value, has continued to trade at the same levels on average for the past two days.

Bitcoin and Altcoins Follow Sideways

According to the views of some closely followed analysts, after the TerraUSD (UST) event, which resulted in a major collapse for two weeks, these levels should continue for a while (average $28,500 to $30,500) as investors do not have any clear vision in light of high inflation and uncertainties in the economy. quite possible.

Federal Reserve officials indicated they would have to raise interest rates by 0.5% at each of the next two meetings, according to the minutes of their last meeting Wednesday. The US Federal Reserve provided the same increase on May 4, but the hawkish stance is expected to get tougher to rein in the rising prices, and many people think that this stance is too late.

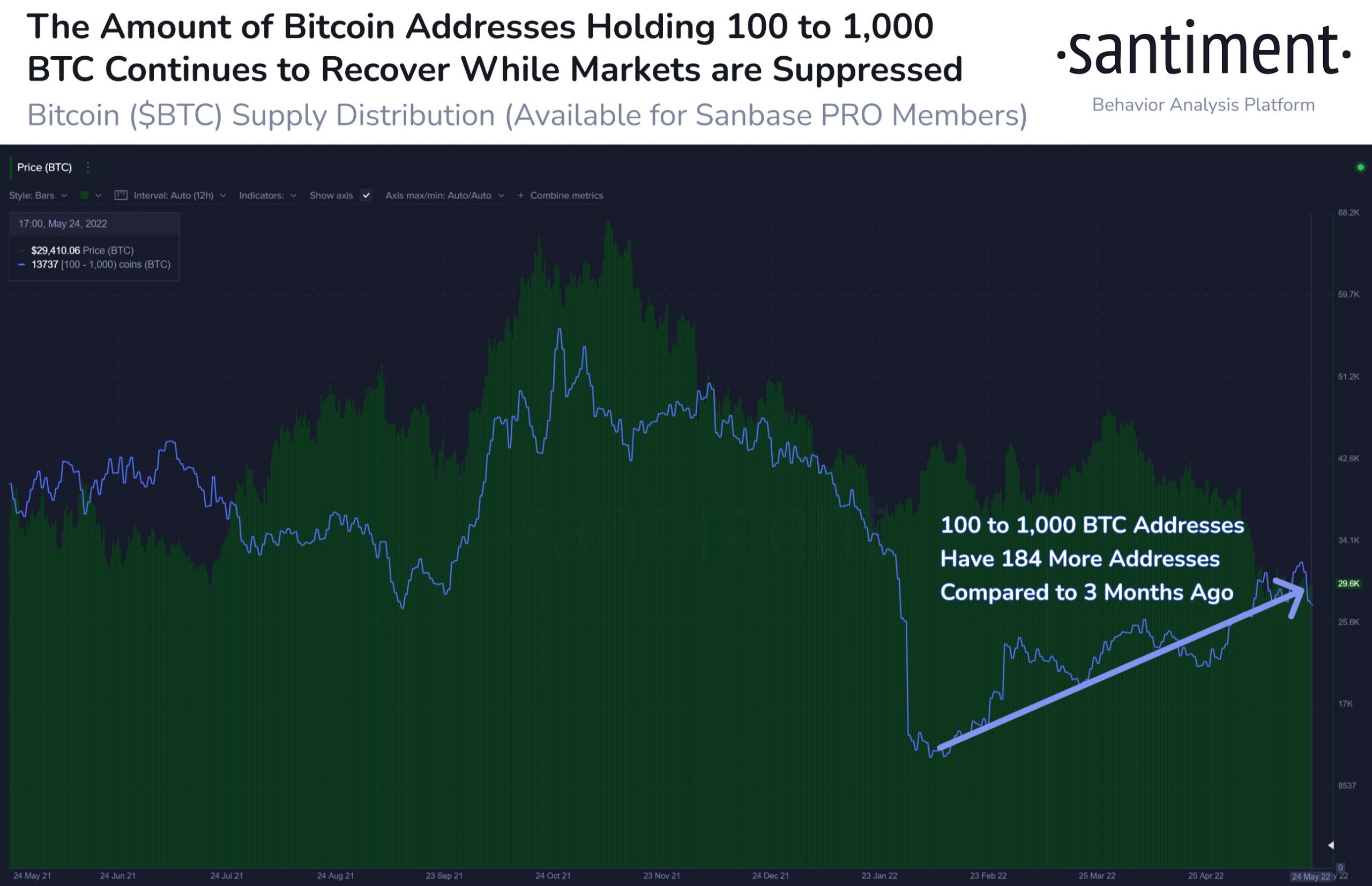

“Bitcoin continues to trade around $29,600, while the amount held by key whale addresses (addresses holding 100 to 1k BTC) has been increasing since late January. Historically, we’ve seen a correlation between price and the amount of addresses for this layer.” – Centiment

bitcoinappears to be in a consolidation phase defined by a narrow price range with low trading volume. So far, Bitcoin has struggled to make a decisive move above $30,000, which is near the top of its last range. It shows that buyers can stay active above the $27,500 support level.

The sharp drop to $25,300 on May 12, albeit less significant than the previous selloff, was driven by high volume that could be a sign of capitulation. Still, while there is room for price bounce, the upside seems limited due to negative momentum readings on the weekly and monthly charts.

many other altcoin It also traded higher and managed to outperform last week’s losses. Ethereum (ETH), the second-largest cryptocurrency by market cap, is down close to 1% and is trading just below the $2,000 level it has held for most of this week.

The remaining crypto assets, on the other hand, are quite mixed. For example, Decentraland (MANA) is up 3% in the last 24 hours and has been more or less flat last week. Meanwhile, The Sandbox’s (SAND) value increased by 7%. MANA and SAND are also known as metaverse tokens used to exchange value in a virtual gaming environment. TRX is also among those that have managed to rise more than 5% recently.

The overall cryptocurrency market cap is at $1,267 trillion and Bitcoin’s dominance rate is 44.7%.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.