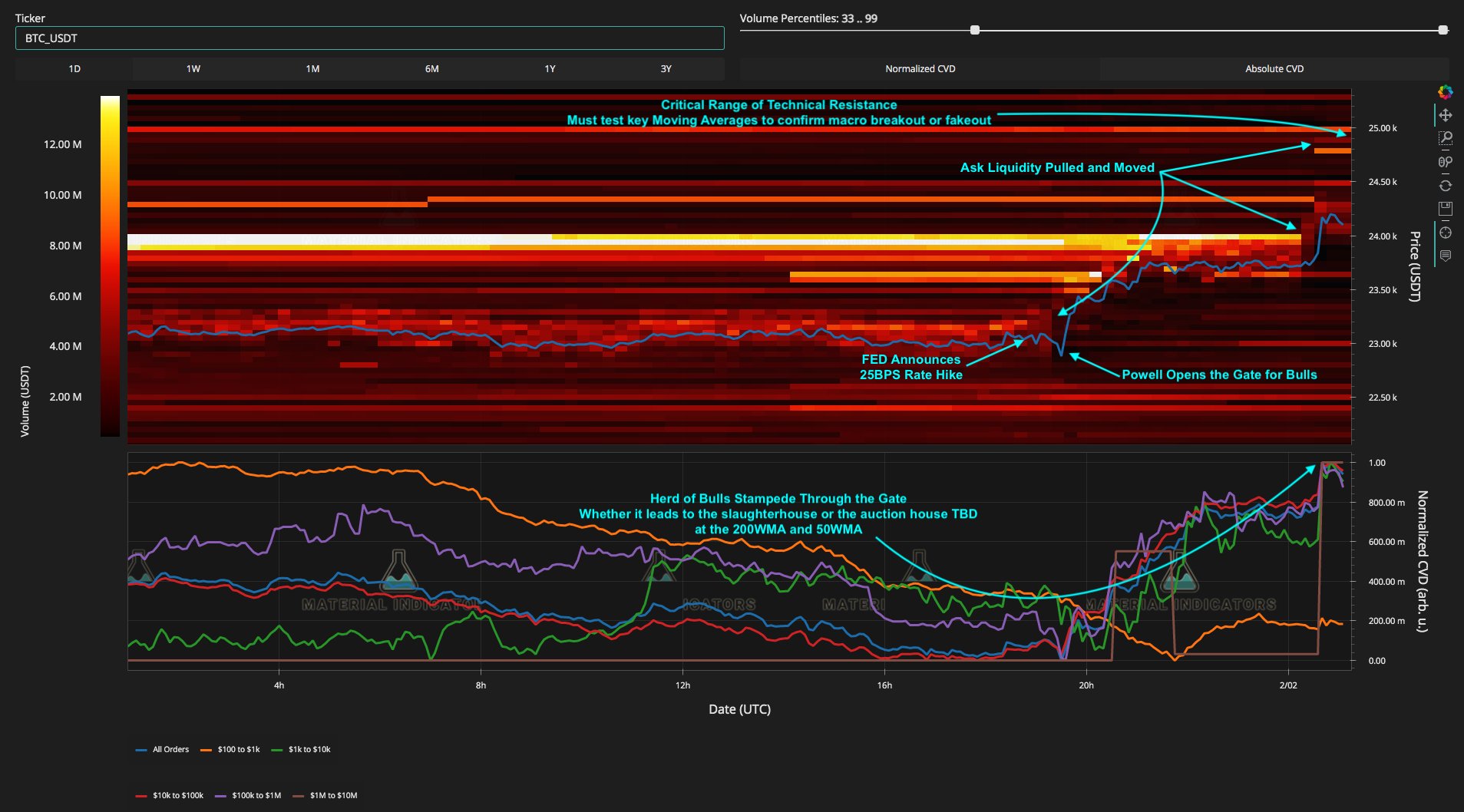

A newly published Bitcoin technical analysisAccording to BTC, it is facing an “okay or continue” resistance test to confirm its “macro breakout”.

Material Indicators marked key levels for support after BTC/USD rallied above $24,000 in a tweet on Feb.

Preparing for Bitcoin Trendline Showdown!

The Fed’s interest rate announcement was in favor of the bulls and was increased by 25 basis points. With President Jerome Powell’s use of the word “disinflation”, hopes immediately focused on the earlier end of rate hikes and the return of easier monetary conditions.

These feelings cryptocurrency can be seen in the market. Bitcoin price managed to win the dip and recorded a local top at $24,250. The ensuing correction resulted in a $500 drop. it happened.

However, Material Indicators believes that for the good days to continue, BTC/USD must now contend with two trendlines that are creating resistance for much of 2022.

These are the 50-week and 200-week moving averages (WMAs), and so far the bulls have failed to retest, let alone turn, to support them.

According to the data, 50WMA is at $25,345 and 200WMA is at $24,837.

One section of the comment included the sentence “Should test key Moving Averages to confirm Macro breakout or fake breakout.”

The chart included the status of the Binance order book. According to this chart, resistance has slipped higher to allow the spot price to rise with it. This was a detail related to the Fed’s interest rate decision.

In addition to the absence of resistance pressure, Material Indicators described the BTC price increase as a “Bull Herd Through the Door”.

BTC is at Great Risk!

BTC/USD has now spent longer than usual below the 200WMA, a key aspect of the 2022 bear market. Also, the two WMAs in focus continue to form what is known as the “death intersection”, where the falling 50WMA crosses below the 200WMA.

According to analysts, if this happens, sentiment will take a rather negative view.

“There is no doubt that risk assets are correlated, but Bitcoin rallied 40% in January, outpacing TradFi,” Material Indicators co-founder Keith Alan said in a statement ahead of the Fed.