Arcane Research, which works on cryptocurrencies, suggested that the negative correlation between the US Dollar Index (DXY) and Bitcoin (BTC) and financial assets continues to be high, and that DXY is in the dominant position.

Arcane Research’s report on October 18 states that the negative correlation between Bitcoin and DXY has been on the rise since the March 2020 Covid-19 crisis. unseen to levels pointed to it. DXY in the report dominant direction giving found to be in position.

In the report, last week’s CPI data unexpected inflation resistance, FOMC forecasts for November 2 again of pricing It was suggested that it caused a new joint movement in various asset classes.

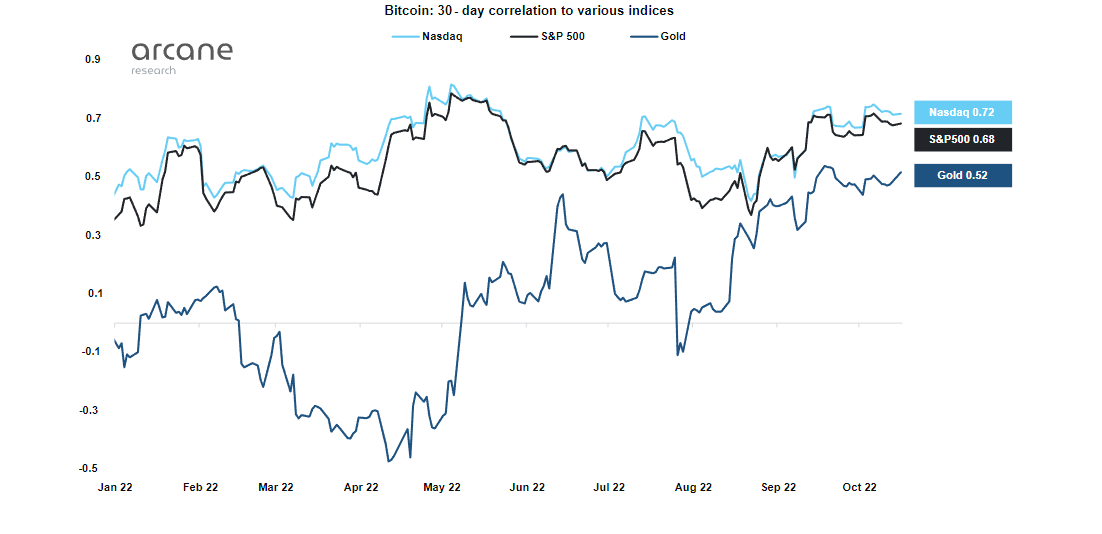

The 30-day correlation between Bitcoin and US stocks has been in the last five weeks. 0.7 Stating that it is fixed at the levels of April and May Until the liquidity crisis occurs in the crypto money markets in 6 week along similar levels He noticed that he was watching.

On the other hand, the report shows that the correlation between Bitcoin and gold has been increasing since May. quickly The increase was considered as an indication that DXY is in a position to guide the markets.

Finally, the correlations in both directions unusual Stating that it is approaching the levels, the company said that the 30-day correlation of Bitcoin and DXY has been around since 2017. 9 once again below the level of 0.64, all of these 9 cases after the pandemic period stated to have happened. In addition, the company stated that DXY seems to be clearly directing financial assets in the current period.