According to data from Coinglass, $741 million futures positions have been liquidated in the past 24 hours. The majority of the liquidations are positions on the FTX exchange.

Bitcoin price on July 18 is about 10%exhibited an upward performance. Seeing the highest price of Bitcoin, which is the most voluminous cryptocurrency, in the last 1 month, caused activity in the market. Bitcoin price, monthly with this rise MA50 moving average overcame his support. Ethereum price your $1500 on and bitcoin price your $22,800 There were major liquidations in the market.

coinglass According to the data, at the time of writing the article, within a 24-hour period, a total of $741 million position was liquidated. 132,777 different users The largest position that was liquidated at once in this short period of time when it was liquidated $2.83 million with FTX on the stock market BTC/USDT occurred on par.

Positions in liquidation 436 million dollars from Ethereum, $135 million from bitcoin, 19 million dollars and Ethereum Classic (ETC).

When the data on all cryptocurrencies are examined 360 million dollars in 24 hours While the long (long) position is liquidated, the total value of the positions liquidated on the short (short) side 380 million dollars corresponds. Total liquidation volume of $741 million $356.17 million It took place on the FTX exchange. Popular cryptocurrency exchange ranked 3rd in 24-hour liquidation volume Binance if on $112.31 million There appears to be a total liquidation.

In addition, according to the funding data on Coinglass, the top 3 coins with the most bullish positions are as follows:

KAVA/USDT (-0.0335%)

TRX/USDT (-0.0200%)

ETC/USDT (-0.0166%)

It is observed that on these parities with positive funding fees, the general audience mainly opens long positions and pays funding fees for short positions.

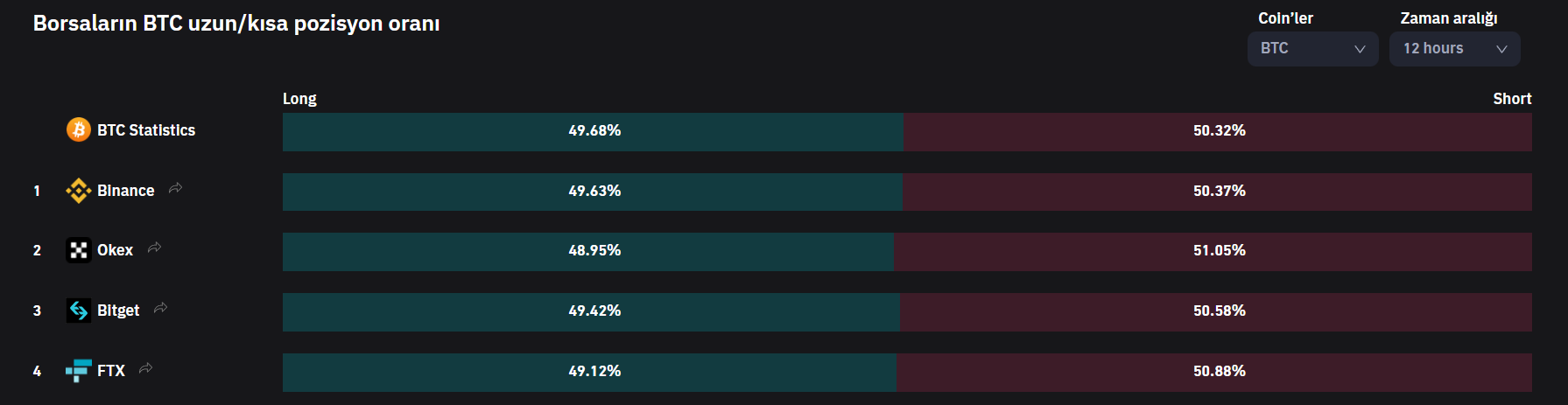

Bitcoin-focused past Short/long position covering 12 hours When we look at the data, users 49.64%at the rate of long, 50.38%at the rate of short It turns out that he took a directional position.