After a busy November, the crypto money market started the last weeks of the year relatively calmly. new on-chain According to the indicators, the bottom is approaching in the leading cryptocurrency Bitcoin.

Experts at crypto research firm Carole Investments argued that a bottom is near for BTC, based on some on-chain data.

Bitcoin Price Dropped Below Cost

Calculated over electricity, equipment costs and mining difficulty of Bitcoin miners BTC The cost fell below market value for the fourth historical time in November. This means that miners are working at a loss for a while.

For this reason, experts pointed out that the third largest miner sales pressure in BTC history has taken place recently. Although these data seem to be negative, the last time a similar situation occurred, the BTC price was at $ 2 and $ 290. In short, although miners create a selling pressure, the future of cryptocurrencies is not affected.

Although Price Drops, HODLers Increase

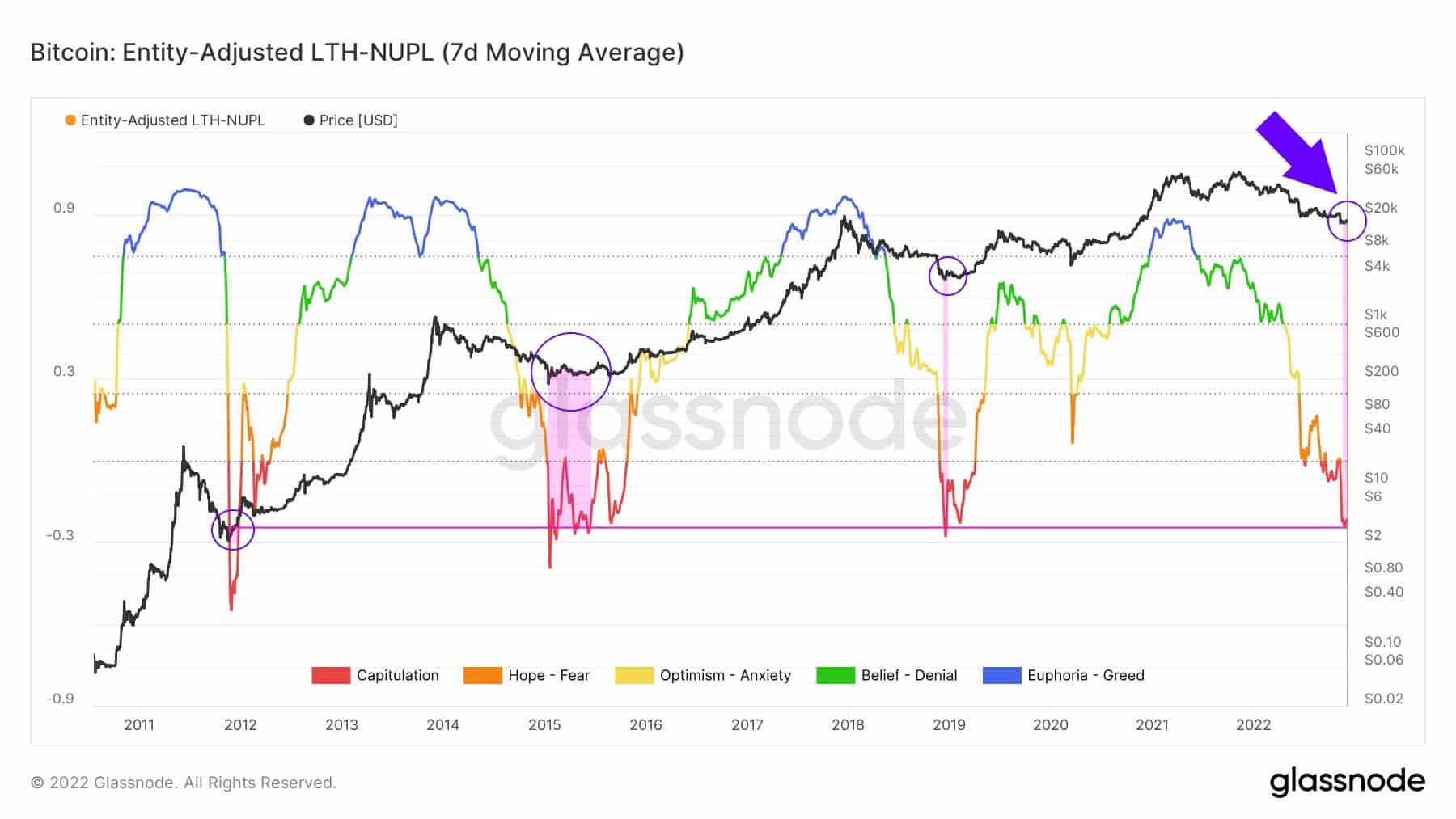

Interestingly, in this year’s bear market bitcoin Although it lost value, investors continued to HODL. Long-term Bitcoin investors are currently sitting at a loss, according to Glassnode data. NUPL data fell to the red level, experiencing the fourth-largest decline in history.

Experts draw attention to the fact that a big rally has come after the loss period experienced by long-term investors in the past.

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android and iOS Start live price tracking right now by downloading our apps!