The co-founders of leading analytics firm Glassnode warned Bitcoin investors of possible selling pressure. Here are the details.

In a recent Glassnode news release, Jan Happel and Yann Allemann suggested that Bitcoin remains highly correlated with risky assets, and that a correction in the US stock market would push BTC down as well.

“Our analysis shows that this renewed sensitivity to market risks and the possibility of stronger bearish [BTC]It goes on to suggest that it is due to a loaded macroeconomic environment, not a lack of confidence in .

According to the Glassnode co-founders, the macroeconomic landscape looks uncertain after the Federal Reserve announced that it was cutting its balance sheet to $95 billion a month to fight inflation. They also talk about the looming risk of Russia expanding and targeting its military aggression as far as the territory of the European Union.

In response to the risky environment, Glassnode executives stated that over $100 million out of crypto money markets last week, with BTC weighing the weight of the outflows.

“A closer look at the crypto space saw an outflow of $134 million in funds last week, making it the second-highest weekly outflow in 2022. Solana received $3.7 million in inflows and altcoins (multi-assets) registered $5 million in inflows, while Bitcoin recorded a massive $131 million outflow.”

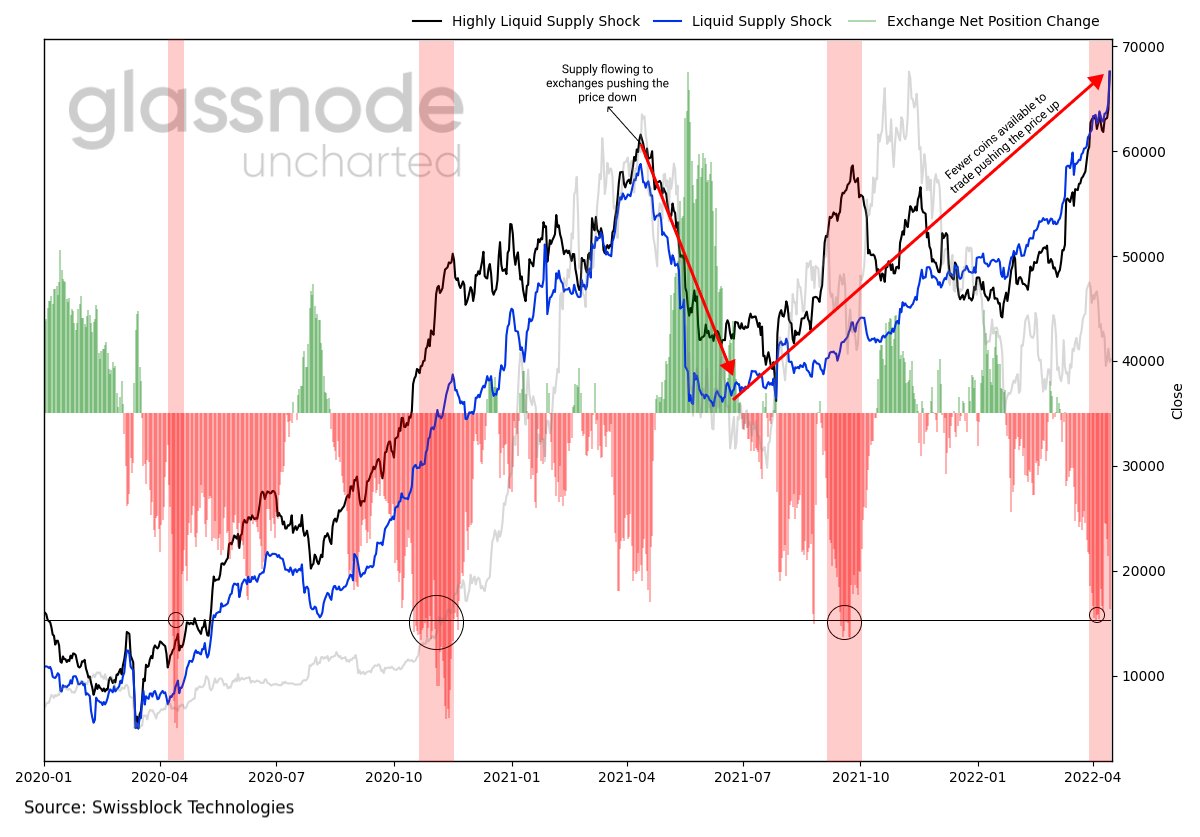

Allemann added that despite the bleak macroeconomic picture, BTC continues to show signs of on-chain strength. According to Allemann, BTC investors are pulling Bitcoin from crypto exchanges at a historic rate, suggesting that a bottom may be in sight.

“Bitcoin exchange net position change points to potential bottom and next upward move. Less supply available on exchanges leads to less selling pressure.”

You can check the price movements here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.