The cryptocurrency market witnessed a significant decline on Saturday, April 13. Leading crypto asset Bitcoin (BTC) took a big hit, dropping over 6 percent to as low as $65,000. This triggered a domino effect in the altcoin space, with many major players suffering double-digit losses.

Bitcoin is feeling the squeeze

Bitcoin price correction sent shockwaves through the industry. At the time of writing, BTC is at $67,582, down 5% from the previous day. However, a more concerning metric is the 56.89% trading volume increase, indicating a potential increase in sales activity. Despite the decline, Bitcoin maintains a market value of over $1.33 trillion. The altcoin arena was not spared either. Ethereum (ETH), the second-largest cryptocurrency, experienced an even steeper decline of 8.35%, falling below $3,300.

This adds to investors’ woes as ETH witnessed its worst intraday decline since November 2022. Other leading altcoins such as Cardano (ADA), Solana (SOL), and XRP suffered similar fates, each suffering losses ranging from 10% to 10%. 15%. The meme coin craze also appears to be waning, with Dogecoin (DOGE) and Shiba Inu (SHIB) reflecting the broader market trend. DOGE price fell a staggering 12.47% to settle at $0.1747, while SHIB fell 11.13% to $0.00002465.

Liquidations are increasing

The sharp correction triggered a wave of liquidations. Coinglass data revealed that long cryptocurrency positions worth $925 million were liquidated in the last 24 hours. This represents a serious loss of confidence among investors, many of whom have fled to traditional safe-haven assets such as bonds and the US dollar. Analysts attribute the market decline to a combination of factors. The recent increase in geopolitical tensions has created uncertainty and pushed investors to seek safer grounds. In addition, concerns about inflation and possible interest rate hikes by the Fed also put pressure on investor confidence.

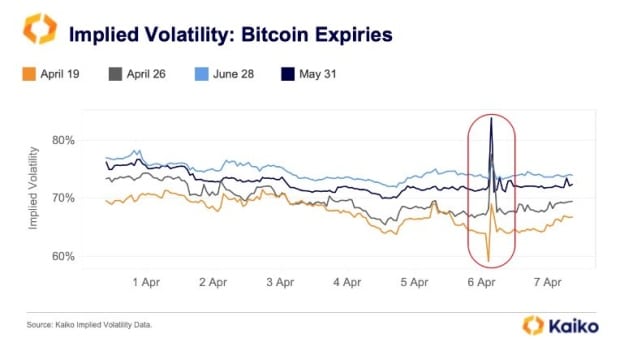

Warning signs are flashing in the options market, an important indicator of investor sentiment. According to Kaiko Research, increased implied volatility for Bitcoin options indicates growing concerns among speculators. This generally indicates reduced confidence in price direction and a willingness to pay a premium to hedge against potential price fluctuations.

The current market correction serves as a stark reminder of the inherent volatility associated with cryptocurrencies. Although the future remains uncertain, the coming weeks will be critical in determining the market’s resilience. It is not yet known whether this is a short-term blow or the beginning of a long-term bear market.

To be informed about the latest developments, follow us Twitter’in, Facebookin and InstagramFollow on . Telegram And YouTube Join our channel.