bitcoin and Ethereum Although the US inflation data announced last week was moved by the FED’s interest rate decision and President Powell’s hawkish statements, it was traded in a narrower range as there was no significant development in the sector and the world economy this week.

In this article, we will examine the current status of Bitcoin and its biggest rival, Ethereum.

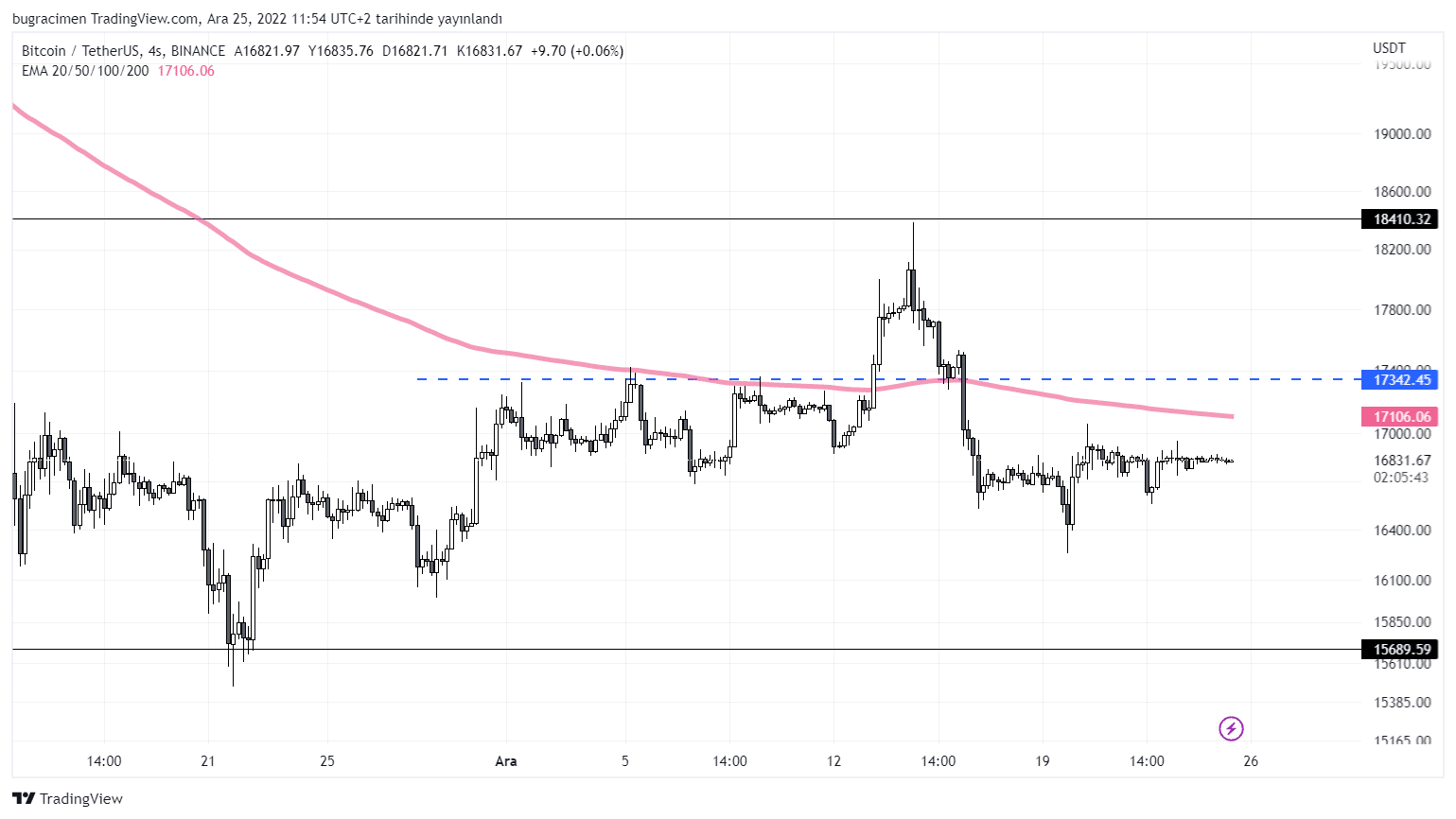

Bitcoin (BTC)

Leader cryptocurrency The unit failed to break the critical resistance level of $18,400 in the previous week. This week, it would not be out of place to say that it behaved like a stablecoin, except for the price action that took place on Tuesday.

Bitcoin traded in a range of just 2% from Wednesday to the weekend. The most important reason for this situation is that investors are moving away from trading as the Christmas holiday is approaching.

According to the 4-hour chart, Bitcoin, which continues to trade below the MA 200, must pass the intermediate resistance of $ 17,350 in order to test the $ 18,400 level again. On the downside, the net support level is located at $15,700.

$BTC As of writing, it is trading at $16,800.

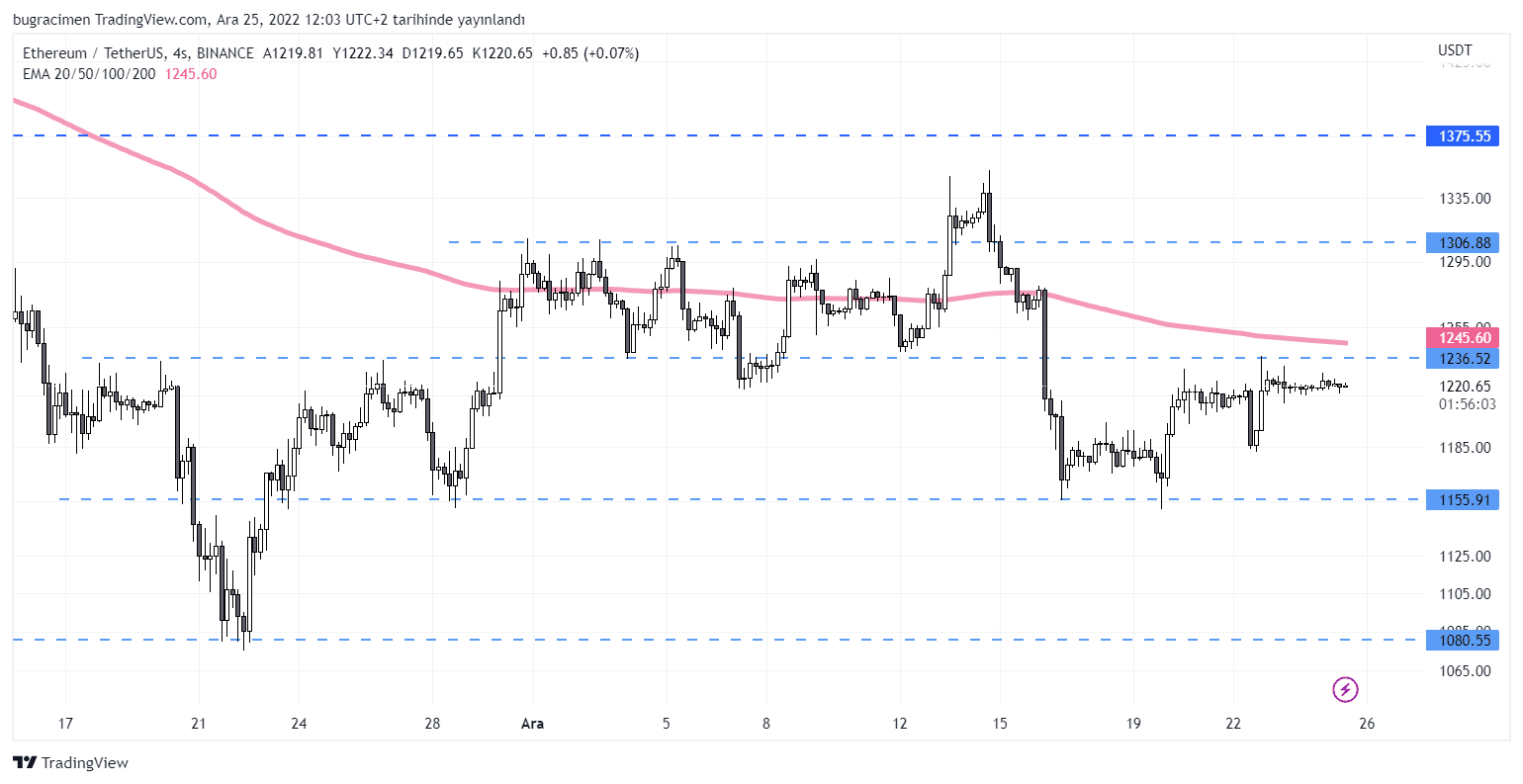

Ethereum (ETH)

The situation is not much different in Ethereum, which holds the title of Bitcoin’s competitor and the largest smart contract platform. Testing $1155 on the first business day of the week, ETH found buyers at the support level, but failed to surpass the $1236 resistance.

Ethereum could retest $1300 if it can break above $1236 and MA 200, respectively, at $1245. Downside supports are found at $1155 and $11080.

Ethereum could retest $1300 if it can break above $1236 and MA 200, respectively, at $1245. Downside supports are found at $1155 and $11080.

$ETH As of the date of writing, it finds buyers at $ 1220.

Bloomberg Analyst: Ethereum Outperformed NASDAQ!

Mike McGlone, one of the experts of Bloomberg Intelligence, the research arm of the economics-finance media organ Bloomberg, said that investors who bought Ethereum were benefited from Bitcoin and stock indices. NASDAQ He pointed out that it is more profitable this year than those who trade on it.

Bitcoin crosses series; Ethereum may be top candidate to continue outperforming the first born crypto –#Ethereum‘s advances vs. #Bitcoin have been unshaken by 2022 deflation in most risk assets and may be gaining underpinnings. pic.twitter.com/mLRMO4vpQr

— Mike McGlone (@mikemcglone11) December 20, 2022

According to McGlone, although Ethereum’s volatility is 1.3 times that of Bitcoin, it may take the throne in the future due to its resistance to decline.

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android and iOS Start live price tracking right now by downloading our apps!