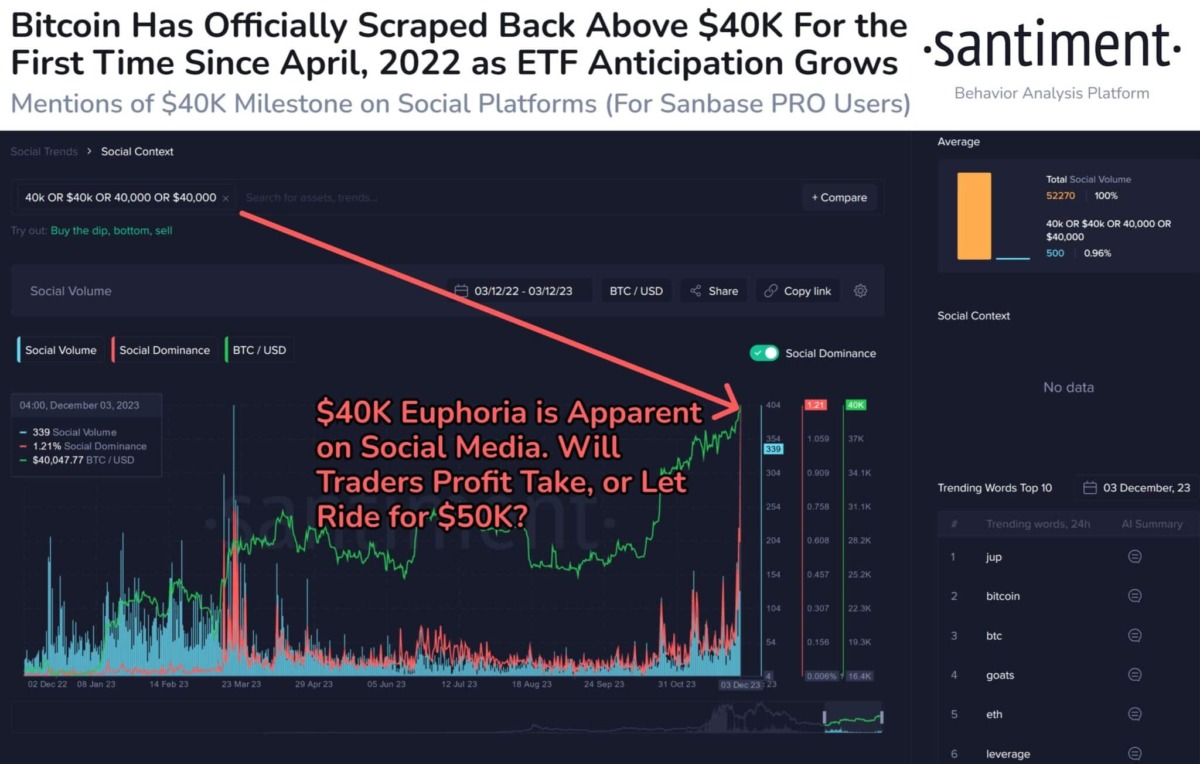

Bitcoin (BTC) has surpassed the long-awaited $40,000 and $41,000 milestones. Because it has risen to this level for the first time since the end of April 2022. Meanwhile, Ethereum has also surpassed $2,200 amid a broader rally in crypto markets. Thus, the leading altcoin also joined the rally. Here are the details…

Bitcoin experienced a resilient surge

The price of Bitcoin showed a strong climb of approximately 5%, reaching $41,725 in 24 hours. Thus, it reached the highest level in 19 months. This BTC surge did not just break the $40,000 barrier. It has also shown a significant gain of 140% since the beginning of the year. Thus, it set a new yearly high. However, it remains approximately 42% below its all-time high of over $69,000 recorded on November 10, 2021.

cryptokoin.com As we reported, Markus Thielen, director of research at Matrixport, predicted that Bitcoin would reach over $60,000 by April 2024 and $125,000 by the end of the same year. Thielen’s analysis is based on historical patterns, specifically the bullish cycles that follow Bitcoin mining reward halvings. Additionally, the next halving is expected to occur in mid-April 2024.

BTC ETF speculation continues

The rise in Bitcoin price is in line with speculation about the approval of a spot Bitcoin exchange-traded fund (ETF) in the United States. Standard Chartered predicts that Bitcoin could reach six figures by the end of next year. It also expects spot ETFs to launch in the US. There are currently 13 bidders for the spot Bitcoin ETF. Moreover, Bloomberg ETF analysts put the probability of simultaneous approval by January 10 at 90%. With the price of Bitcoin surpassing $40,000, all eyes turned to the next resistance level at $42,330.

While technical charts point to a bullish trend, analysts are ruling out major pullbacks once the $40,000 region is reached. Some market experts even predict that Bitcoin will reach $60,000 before the next halving in April 2024. Additionally, in recent weeks, investors have bet that Bitcoin (BTC) will rise to $45,000 by the end of March 2024. So they turned their focus to high-end options plays. This week, US ISM services PMI data and December non-farm employment data will be released. A strong NFP number has the potential to cause Fed rate cut bets for 2024 to unwind. This, according to experts, risks slowing down the rise of BTC.

Ethereum also participated in the rally

Not to be outdone, Ethereum, the world’s second-largest cryptocurrency, surpassed $2,200, extending its weekly gain to over 9%. Analysts are predicting an ongoing rally for Ethereum, with potential targets reaching $2,600 and even $3,500. As a result, the cryptocurrency market is experiencing a revival, led by Bitcoin and Ethereum. Investor optimism is growing as Bitcoin surpasses $40,000 and Ethereum breaks the $2,200 barrier. The upcoming decision on spot Bitcoin ETFs in the US and positive market sentiment sets the stage for further upside in the coming weeks.

To be informed about the latest developments, follow us Twitter’in, Facebookin and InstagramFollow on . Telegram And YouTube Join our channel.