According to Ki Young Ju, CEO of on-chain analytics firm CryptoQuant, bitcoin (BTC) has started to signal a metric that is very similar to previous bear market lows.

Sharing on his Twitter account, Ju stated that the level of accumulation in Bitcoin has reached the highest level in the last seven years:

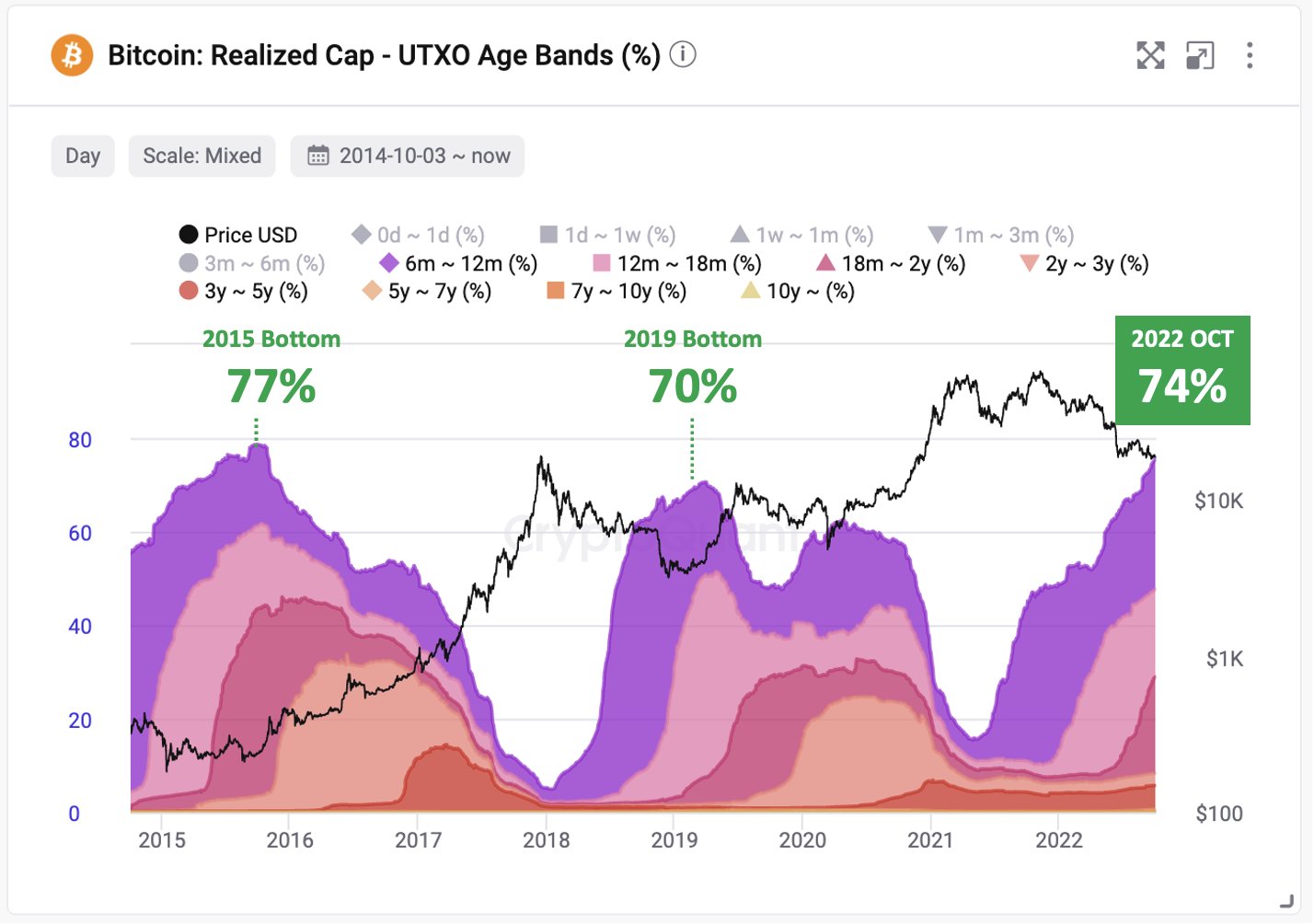

“The BTC rate held for more than six months represents 74% of the realized value. In the lowest levels recorded in 2015 and 2019, this rate was 77% and 70%. Imagine buying Bitcoin and doing nothing with it for six months, you can imagine how hard it is.”

Koinfinans.com As we reported, the CEO also underlined that he did not say that 74% of Bitcoin supply has not moved in the last six months.

“It’s not just about the Bitcoin supply, it’s about the realized use of capitalization. Bitcoins more than six months old represent 74% of realized value, which means Bitcoins that are more than six months inactive take 74% of market value in terms of performing PnL.”

crypto analytics firm glassnode He also shared on Twitter that the Bitcoin supply (based on the one-day moving average), which was active 6-12 months ago, reached a 6-month high of 2,311,039,946 BTC this week.

The firm also says that the number of BTC addresses holding 0.1+ coins hit an all-time high of 3,832,859 on Monday.

Bitcoin was trading at $ 20,217 at the time of reporting. The top-ranked crypto-asset by market cap has gained more than 3.6% in the last 24 hours and more than 6.5% in the past week.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.