Binance Q3 report rates the crypto market as ‘challenging’ due to high interest rates. The world’s largest cryptocurrency exchange paints a bleak picture of the market, although there are occasional bright spots for individual players.

Binance Q3 report: It’s been a challenging period for the market!

Binance, the leading cryptocurrency exchange, published its 3rd quarter market pulse report. The report confirmed that it was a tough quarter for the crypto market. The entry of institutional players such as Deutsche Bank, Sony and PayPal has helped offset some of the pain, according to the report.

However, the market has declined in many sectors. Global crypto market capitalization fell 8.6% quarter-over-quarter (QoQ) “as the ‘higher for longer’ interest rate narrative continues.” Fundraising was the lowest since Q4 2020. Additionally, it decreased by 21.4% compared to the previous quarter. However, infrastructure performed significantly better than other sectors.

These altcoins attract attention in the report

According to the Binance report, activity on blockchains has decreased slightly, with NEAR being a major exception. It witnessed an increase of nearly 120% compared to the previous quarter. NEAR also saw an increase in active addresses starting in August. Meanwhile, BNB, the exchange’s token, experienced a sharp decline. On the other hand, leading altcoin Ethereum rose slightly and Solana fell slightly.

Total value locked (TVL) fell 13.1% across decentralized finance despite the influx of real-world assets. However, liquid staking increased by 10.5%. Ethereum was the leading Blockchain with 55.1% of TVL, despite a decline of 18.6%. Meanwhile, Tron’s TVL increased by 17.9% compared to the previous quarter. Tether accounted for 67.2% of its share in the stablecoin market.

Our latest State of Crypto Report summarises all the key insights, events, and learnings from Q3.

Find everything you need to know about developments in the space, including analysis of:

🔸 Layer 1s & 2s

🔸 DeFi

🔸 NFTs

🔸 GamingStart reading here ⤵️https://t.co/ES5z6g8FMU

— Binance Research (@BinanceResearch) October 19, 2023

Binance report: Things are slow in NFTs and Game Tokens!

On the other hand, Non-Fungible Token (NFT) sales continued their decline. September was the worst month for NFT sales since January 2021, at nearly $300 million. The average selling price that month was $38.17, falling to a high of $791.84 in August 2021. However, despite the sharp decline in September, transactions in NFTs increased overall.

Gaming tokens saw a 44.9% decline compared to the previous quarter. Thus, they also became loss leaders in price. Despite this, they led the way in NFT sales. Less than 28% of Web3 games were released. Meanwhile, Binance says that Google’s decision to allow NFTs in games on the Play Store could give the market new momentum. Sweat Economy and SuperWalk took second and third place, respectively, based on unique active wallets. Thus, it showed that interest in play-to-earn games is increasing.

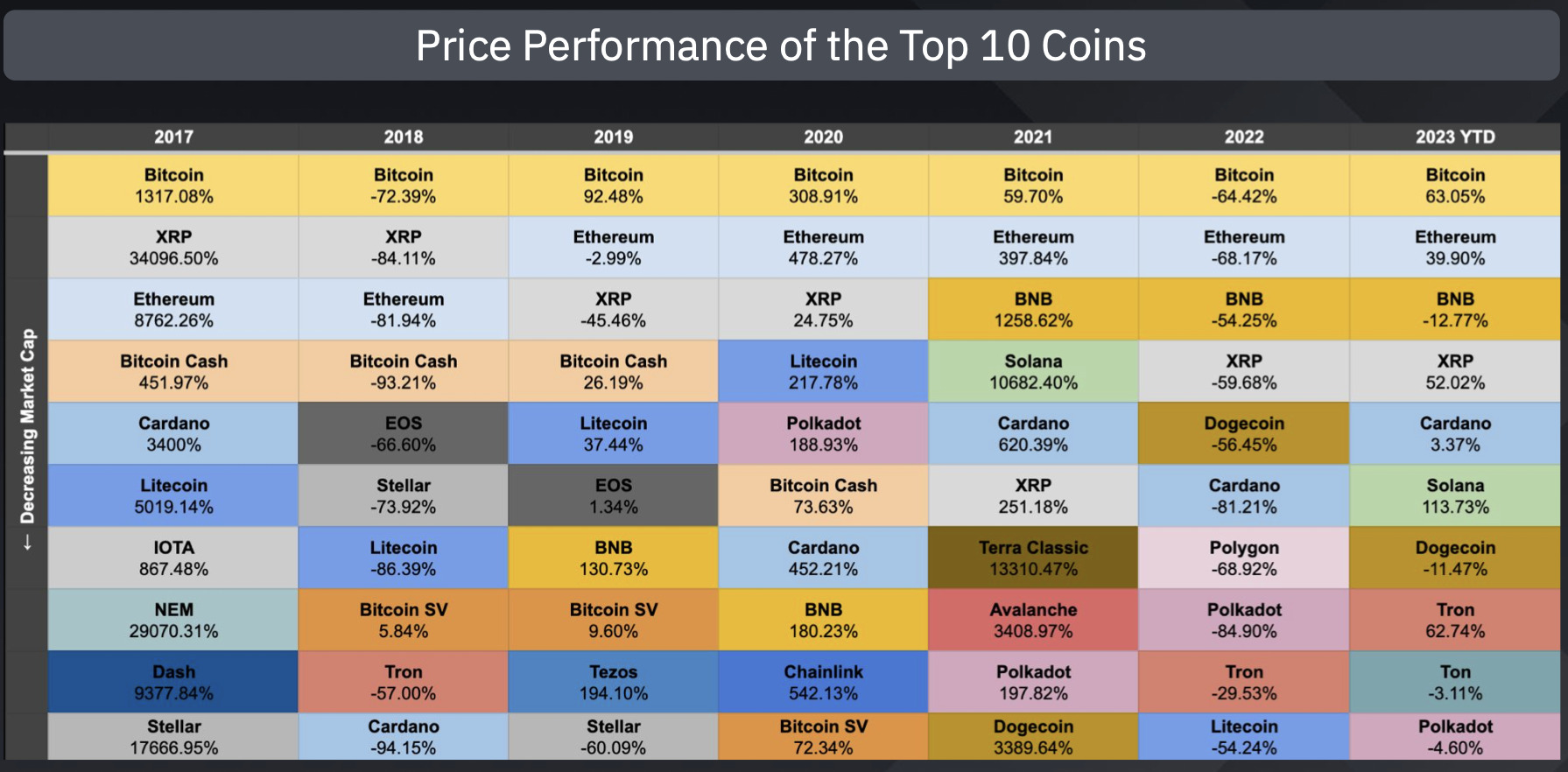

cryptokoin.comAs you follow from , six of the ten largest coins have increased this year. Solana (SOL) had the best showing, up 113.73%. Ton entered the list with a decrease of 3.11%. The leading cryptocurrency Bitcoin has increased by 63.05% so far, and the leading altcoin Ethereum has increased by 39.9%. Binance token BNB lost 12.77% value at the end of the 3rd quarter of 2023.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!