Last week, the cryptocurrency market witnessed a strong rally with a 12% jump, adding more than $180 billion to the total market capitalization. While Bitcoin and altcoins participate in this rally together, BinanceCoin It seems like it failed to capitalize on this trend.

This coincides with a difficult period that Binance is facing due to its ongoing $4.3 billion settlement with US regulators. Over the past week, nearly all of the top ten cryptocurrencies posted double-digit gains, while Binance’s BNB token barely managed a 1% return.

Binance Coin (BNB) is having a tough year, reflecting the exchange’s regulatory struggles. BNB, known for providing benefits such as low transaction fees on the Binance platform, is the only major token to show a significant loss year-to-date, as reported by Bloomberg.

Binance’s regulatory troubles came to a head in the United States after it was filed criminal charges in connection with money laundering and sanctions violations on November 21. This development underscores the increasing regulatory scrutiny facing cryptocurrency exchanges.

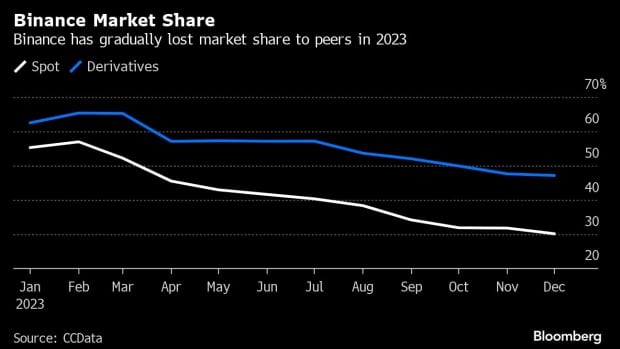

Although Binance remains strong in the cryptocurrency market, it is witnessing a decline in its market share. According to data from CCData, the platform’s share in spot transaction volumes decreased from 55% at the beginning of 2023 to 32% in November. Similarly, its share in the derivatives market fell from over 60% to 48%.

Matthew Sigel, head of digital assets research at VanEck, made a prediction that Binance could lose its top position in centralized exchanges. Rivals such as OKX, Bybit, Coinbase and Bitget are seen as potential rivals to take over the lead amid the exchange’s recent plea deal with US authorities.

Binance founder Changpeng Zhao resigned as CEO after pleading guilty. Richard Teng, who replaced Zhao as head of the company, was tasked with the difficult mission of restructuring the company to overcome legal challenges while also preventing further erosion of market share. In an interview last month, Teng aimed to reassure Binance by stating that its revenues and profits continue to strengthen.

In November, Binance witnessed the second-highest monthly fund outflow, with customers withdrawing a net $1.6 billion, according to DefiLlama data. However, there has been a partial reversal in December, with $398 million in net inflows into the stock market so far. BNB token also experienced a loss of value during this period and could not benefit from the rally in the cryptocurrency market.