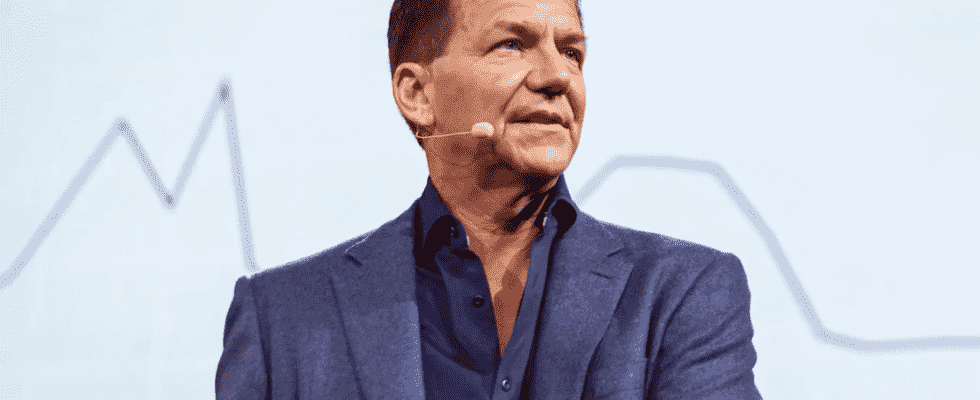

Managing billions of dollar hedge funds Paul Tudor Jones Speaking to CNBC, he talked about inflation, the Fed, and Bitcoin.

The famous investment giant noticed the rise in Bitcoin in 2020 and announced that it allocated 1-2% of its billion-dollar portfolio to Bitcoin.

Within the story of institutional investors entering Bitcoin, Bitcoin was reacting to the statements made by Jones in those days. During the bull season, Jones said, “If the Fed continues monetary easing, we will increase Bitcoin allocations to 5%.” It had come with a nice rise in price with its explanations.

However, as another indicator of the bear market, the Bitcoin price did not react to the famous name’s statements today.

to CNBC bitcoin Making a statement about his portfolio, Jones said, “I still have a small amount of money in Bitcoin” said.

Talking about inflation and the FED, Jones said that although he maintains the bullish expectation in Bitcoin, the current place of money is cash.

“Inflation is a bit like toothpaste. Once out of the tube, it’s hard to get it back in. The Fed is now trying to get that taste out of his mouth. If we go into a recession it will have really negative consequences for various assets.

While I continue to believe that Bitcoin will be valuable, cash is where you need to be as long as you believe it will succeed in the Fed’s commitment to bring inflation back to its 2% target.”

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android and iOS Start live price tracking right now by downloading our apps!