The biggest cryptocurrency With the bankruptcy of one of its stock exchanges, FTX, the crypto market witnessed a panic sale. The total value of cryptocurrencies decreased by 18.75% in 1 week, falling below $ 800 billion.

While the panic environment in the market is calming down for now, new data about which type of asset holders the sales are coming from are slowly emerging.

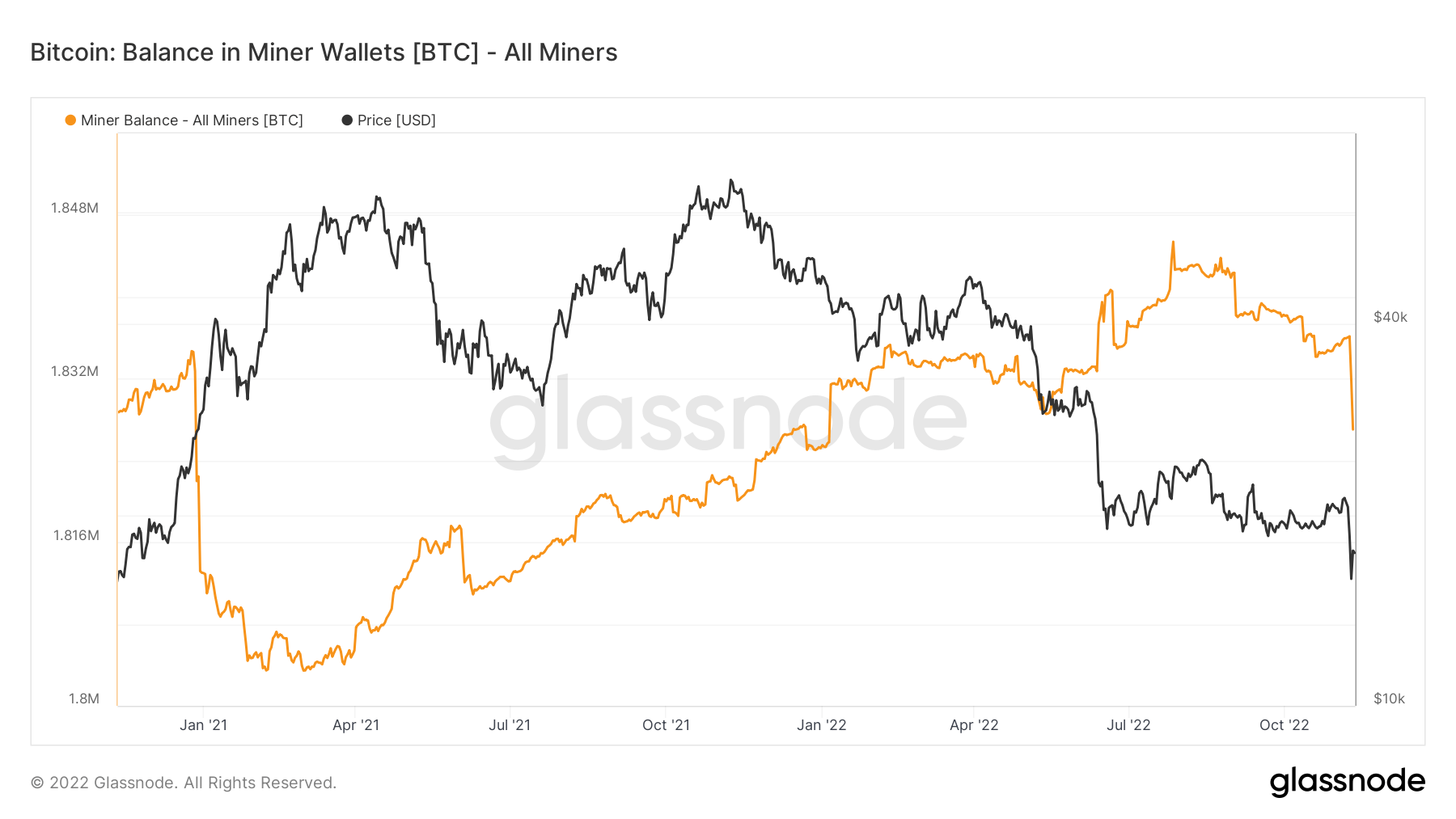

Based on various on-chain market analyzes bitcoin miners were instrumental in the decline this week. Crypto miners have put up the biggest selling pressure on a daily basis since January 2021, according to analysts.

Why Do Miners Sell?

Like any private business cryptocurrency miners He also works to make a profit. Bitcoin mining difficulty (hashrate) has continued to rise in recent months.

The hashrate increase causes the miners to decrease the amount of Bitcoin they receive per transaction they verify. If we add the hashrate, the increase in energy costs and the drop of the leading cryptocurrency up to $ 16,000, the profitability of the giant mining companies is minimized.

Unable to make a profit, miners sell some of their Bitcoins to continue their cash flow.

On-chain follower glassnodeshowed how deep the miner sale was with the chart he shared.

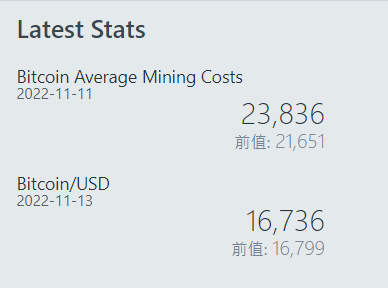

On the other hand, according to data from the Macromicro website, the current average cost to the miner to produce one BTC is around $23,800.

Assuming the data is correct, we can expect miner selling pressure to continue if the leading cryptocurrency continues to trade below cost for an extended period of time.

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android and iOS Start live price tracking right now by downloading our apps!