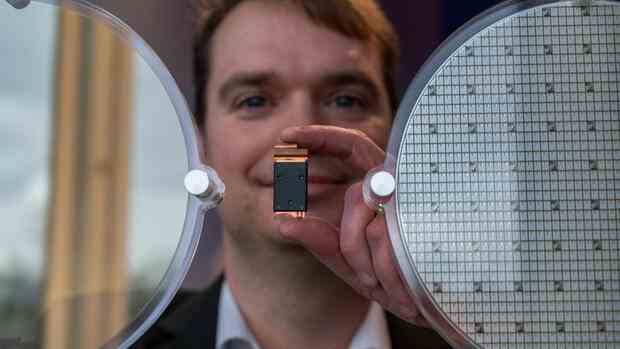

Stefan Hain, Head of Semiconductor Development at ZF, holds one of the intended products up to the camera.

(Photo: dpa)

The importance for Saarland and the companies involved, Wolfspeed and ZF, can hardly be overestimated: the world’s largest factory for silicon carbide chips is to be built on the site of the former Ensdorf coal-fired power plant.

The Saarland thus gets urgently needed promising jobs; the US semiconductor manufacturer Wolfspeed is moving closer to its important European customers and the automotive supplier ZF is entering a business area that is extremely interesting for the entire industry.

And the German automotive industry can also be pleased that in future it will be supplied reliably and from Europe with the power-saving chips that are so important for electromobility.

The fact that Wolfspeed is settling in Saarland is also significant for Germany, indeed for the entire EU. Because the plant makes the region less dependent on deliveries from overseas for the strategically important components. The risk of delivery bottlenecks decreases drastically.

And yet: In relation to the target set by the EU Commission of doubling the share of global semiconductor production to 20 percent by 2030, this is at best a small step. To achieve this, many other chip companies have yet to decide to build in the EU.

The rest of the world has been building for a long time

The new factories announced so far by Wolfspeed, Intel, Infineon and STMicroelectronics should at best be enough to keep the market share at less than ten percent. Because especially in the USA, but also in Taiwan, South Korea and Japan, numerous and much larger plants are currently being built. This is mainly due to the fact that the subsidies are already flowing there while Europe is still discussing which projects should be funded and to what extent.

Little is gained if the chips come from the EU but are flown to Indonesia or Malaysia for testing and packaging.

Europe must therefore pick up the pace. If the EU hesitates further, most chip companies will opt for other regions. Equally important: It must finally be clear into which fields the funds should flow. Europe cannot support all areas of industry, as there would be too little left over for the individual projects. So far, however, a focus has not been identified.

Keep an eye on the entire supply chain

But that’s not all. Europe should not concentrate solely on the core of chip production, the so-called wafer fabs. Such a factory is now being built in Saarland. It is important to keep an eye on the entire value chain. This includes the manufacturers of chip machines, semiconductor materials, but also further processing, the so-called back end. Little is gained if the chips themselves come from the EU in the future but are flown to Indonesia or Malaysia for testing and packaging as has been the case up to now. Or if a critical supplier is based in China.

The EU therefore needs a comprehensive chip strategy as soon as possible. After all, Wolfspeed’s decision in favor of Saarland shows that in individual cases locations in Europe can definitely keep up in the global struggle for the favor of semiconductor manufacturers.

More: Expensive chip offensive – How Europe can keep up in the race for new factories