Closely followed crypto analyst Benjamin Cowenshared their views on how Bitcoin might look for the first quarter of 2022 and how long investors can wait for a rally in altcoins.

Speaking at a new strategy session, Benjamin Cowen told over 712,000 YouTube subscribers, in the short term, Bitcoin (BTC) He stated that although he is not particularly optimistic about the issue, he limited his analysis to the first quarter only and does not expect the rest of the year.

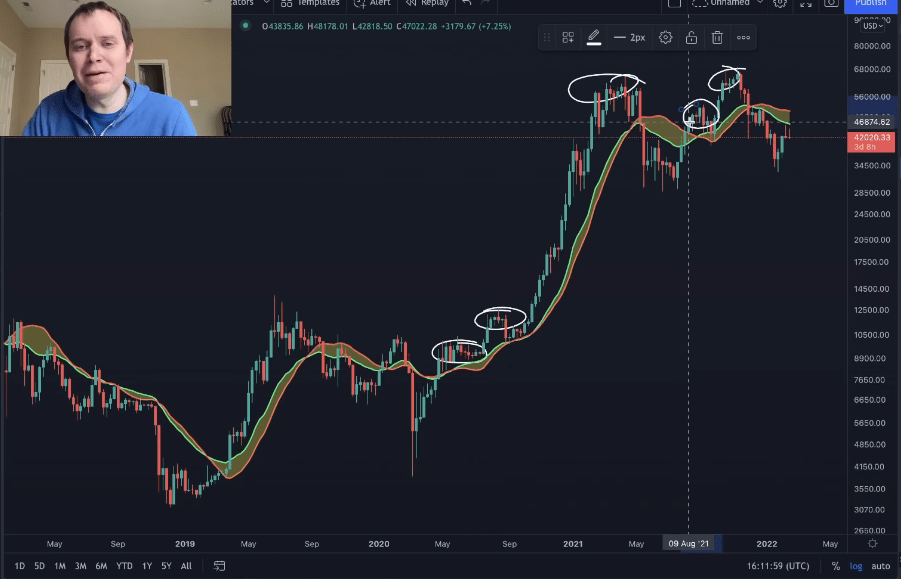

“one. My outlook for the quarter is bearish or neutral at best for Bitcoin. The best scenario I can imagine would be for Bitcoin to close where it opened the first quarter, around $46,000.

I’m not talking about Q3, Q2 or Q4, I’m just talking about Q1.”

Cowen, altcoin markets He shared how he manages risks in an environment where various macroeconomic factors, including

“I see a qualitative tightening, we see a lot of macroeconomic uncertainty, we see the dollar still above its own bull market support band.

We see Bitcoin below the bull market support band. It would be difficult for me to look at these conditions and say that this is the best case scenario for altcoins. And I’m definitely not saying this to make you feel bad, but I have to be honest and say, that’s the case.

Right now, while the Bitcoin bull market is below the support band, altcoins are very fragile, potentially due to all this economic uncertainty, as well as the NASDAQ and the stock market. S&P has been selling lately.”

Cowen continued his analysis by explaining his views on what the ideal situation is for altcoins regarding BTC.

“Altcoins do best when Bitcoin rises above the bull market support band, like in 2020 (May and September) or early or late 2021.”

The chart guru concluded his analysis by discussing whether there will be an alt season in the coming months. Cowen mentions that many altcoins have not risen with Bitcoin’s last $10,000 rally.

“If Bitcoin drops another 10% or 20%, then altcoin valuations against the US dollar will likely retrace previous lows when Bitcoin was at $33,000. The reason this is important is because if you want to allocate capital to the cryptocurrency, you should consider the potential scenario where Bitcoin falls below the bull market support band. If it does, it’s unlikely we’ll see a subseason right away.”

Cowen thinks that if BTC experiences the best-case scenario and breaks through the bull market support band, there will be ample time to buy altcoins as the markets will not be as fragile.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.