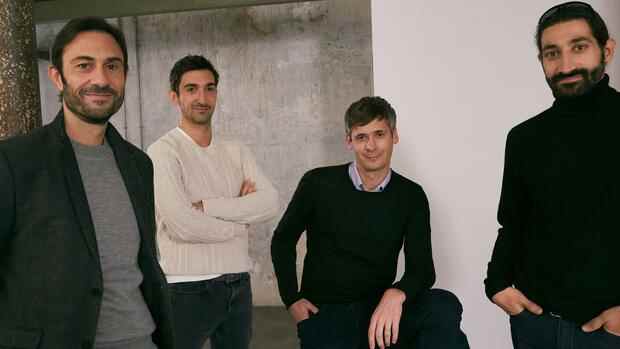

The founders of Ankorstore want to digitize retail purchasing.

Dusseldorf The French wholesale platform Ankorstore has secured further financing of 250 million euros. The start-up, which is already present in 23 countries, intends to use the money to expand further, to set up branches in Spain and Italy – but also to accelerate growth in business in Germany.

“We have more than sixfold the number of German dealers on our platform to around 20,000 in just one year,” says Germany boss Constantin Langholz-Baikousis in an interview with the Handelsblatt. Ankorstore offers retailers the opportunity to buy digitally from thousands of branded manufacturers in Europe with a minimum order value of just 100 euros.

“We will also use the fresh capital to further expand our team in Germany,” explains Langholz-Baikousis. “We need a local presence so that we can properly understand the market and the wishes of our customers.” Ankorstore already has branches in Berlin and Düsseldorf.

In the financing round, which is led by the investment firms Bond and Tiger Global, Ankorstore is valued at 1.75 billion euros and thus achieved what is known as unicorn status. Start-ups are called unicorns if their valuation is above a billion dollars.

Top jobs of the day

Find the best jobs now and

be notified by email.

Eurazeo and Coatue as well as the existing investors Index Ventures, Bain Capital Ventures, GFC, Alven and Aglae were also involved in the financing. “With its fast-growing, cross-border wholesale network, the company offers a first-class infrastructure for thousands of brands and independent businesses worldwide,” said Mood Rowghani, General Partner of Bond and soon to be a Director on the Board of Directors of Ankorstore. He calls Ankorstore the “operating system for the next generation of retail”.

Amazon also wants to earn money from companies’ purchases

“Our mission is to create a global wholesale business and thus strengthen independent retailers,” explains Nicolas Cohen, who founded Ankorstore a good two years ago together with Pierre-Louis Lacoste, Nicolas d’Audiffret and Mathieu Alengrin. The company now has 400 employees and offers around one million different products from around 15,000 brands on the platform.

Ankorstore is not the only company that wants to put business relationships between retailers and manufacturers on a digital basis. The Oderchamp company, founded by the Dutchman Joost Brugmans, has also been in existence since 2019. He is also building a platform that brings retailers and brand manufacturers together.

Investors at Orderchamp include henQ and the venture capitalist Prime Ventures, which has already invested in the e-commerce company Just Eat Takeaway (Lieferando).

With its Amazon Business division, Amazon is also targeting the business of purchasing companies. The industry leader is more focused on the procurement of large corporations than on the purchase of goods from small retailers. The entire digital procurement market in Germany is estimated at 250 billion euros.

The corona crisis has given digital shopping platforms another significant boost. “We have a large number of stationary retailers among our partners,” reports Ankorstore manager Langholz-Bakousis. “The possibility of ordering small quantities of goods with little effort makes it easier for you to plan your inventory in these difficult times.”

Long payment terms ensure traders liquidity

During the crisis, many stationary retailers discovered online trading as a second mainstay, which was able to at least partially compensate for the loss of sales in times of lockdown. They can use digital platforms to expand their product range without great risk and adapt it to changing demand.

An important argument for platforms like Orderchamp and Ankorstore is the long payment terms of up to 60 days that they allow. “Thanks to the payment terms, dealers ideally sell the goods faster than they have to pay for themselves,” says Langholz-Bakousis. This gives retailers the urgently needed liquidity in the corona crisis and beyond.

Investors have also been paying close attention to this. “As we expected when we made our first investment, Ankorstore has been instrumental in reopening independent and retail stores across Europe over the past few months,” said John Curtius, Partner at Tiger Global. “The strong growth combined with a courageous vision and an experienced team is very promising for the future.”

More: These new platforms are helping small retailers in the corona crisis