Northvolt’s first factory in Sweden.

Dusseldorf In the tranquil heath, about an hour and a half from Hamburg, power storage for German electric cars will soon be built. The Swedish battery manufacturer Northvolt wants to build its next gigafactory in the small town in northern Germany.

With a planned capacity of 60 gigawatt hours, it is significantly smaller than Tesla’s gigafactory in Brandenburg. But for the Scandinavian start-up it is only the second factory of this size outside of their home country. The Gigafactory in Skellefteå in northern Sweden went into operation at the end of last year. A recycling plant is to be built parallel to the battery factory in Heide.

“It was clear to us that the focus should be on Germany because we have a large number of customers here, high demand and engineering talent,” explains Northvolt CEO Peter Carlsson in an interview with the Handelsblatt. In Heide there is also a perfect connection to the North German and Danish offshore wind farms and the Nordlink power connection to Norway. Carlsson is not bothered by the fact that most of the major automobile manufacturers have their factories in the south of the country. The company already has purchase agreements with Volkswagen, BMW and Volvo.

A potential new customer could now also be Mercedes. After all, the Swabian car company also has a plant in Hamburg. “The planned factory in Heide is already well utilized with our German customers. But we also want to create additional capacities for new customers, and Mercedes has already announced that they are looking for other battery producers in addition to the partnership with ACC,” says Carlsson.

Top jobs of the day

Find the best jobs now and

be notified by email.

The demand for electric cars is increasing, but battery manufacturers are also currently struggling. Raw material prices are reaching new record highs worldwide. The rapidly rising prices for nickel, manganese, cobalt and lithium are also causing costs at Northvolt and other producers to skyrocket. There will therefore be no more falling battery prices, as was the case in the past ten years, at least in the short term.

“The war once again made raw material prices so expensive that we too had to raise our prices. But this is only a temporary phenomenon,” Carlsson says. In the long term, the former Tesla manager promises that prices will fall again. However, he cannot say how long the current phase will last.

Battery price increased by 29 percent

For an average nickel-cobalt-manganese (NCM) battery, the cost has increased by a total of 29 percent in just one year. This is shown by current calculations by the consulting firm Roland Berger, which are exclusively available to the Handelsblatt. In the case of the lithium iron phosphate batteries, which are hyped above all by Tesla, the costs have even risen by 41 percent. Raw materials account for almost 30 percent of battery costs.

“In the current situation, the increased raw material costs are also causing a significant increase in the price of electric car batteries,” explains car expert Wolfgang Bernhart from Roland Berger. The war between Russia and Ukraine is now further exacerbating the problem. Speculations about bottlenecks in deliveries from Russia are already having an effect: the nickel price on the London Metal Exchange (LME) rose above the $100,000 a ton mark for the first time and has thus more than doubled.

The price later fell back to around $48,200 a ton, but is still almost three times as high as a month ago. “Even before the war in Ukraine, raw material prices had risen massively,” says Bernhart. For example, with one of the most important raw materials for battery production: lithium. In the past three months alone, the “white gold” has risen to over US$ 67,550 per tonne of lithium hydroxide. A price increase of more than 100 percent.

>> Read here: Economist: “Ukraine crisis shock bigger than 1970s stagflation”

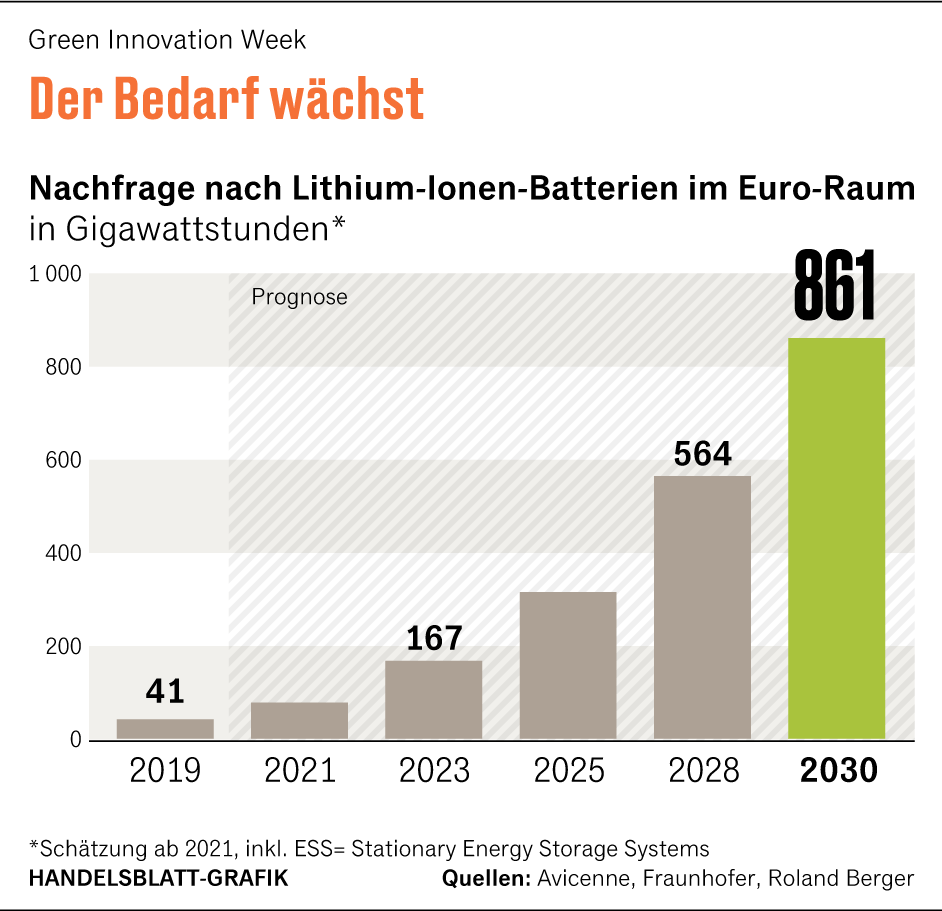

The high stock market prices also affect the prices for existing contracts via a so-called “price escalation clause”. Bernhart believes that this does not endanger the ramp-up of electromobility: “This will not affect the long-term trend towards e-mobility, but it could delay it in the short term.” Electric cars continue to lead the statistics for new registrations in February. Compared to the same month last year, they come to an increase of over 28 percent. And thus to a total market share of 11.3 percent.

Short-term cooling of the e-car boom

But Northvolt CEO Carlsson also expects the e-car boom to “cool down” in the short term. But you can see “that the demand is unbroken,” emphasizes the manager. That’s why the Swedes now want to invest around four billion euros in the new gigafactory in Germany.

Support also comes from the federal government. However, it is not yet possible to say exactly how high the amount will be. Tesla boss Elon Musk had received more than a billion euros from the federal government for his 100 gigawatt hour factory near Berlin. One way or another, Carlsson announced that “another round of financing for the construction of the factory in Heide will be made”.

In 2025, the first batteries should roll off the production line in Heide. Northvolt is thus pursuing a similarly ambitious plan as Tesla. The US car manufacturer completed its factory in Brandenburg in just two years.

Northvolt has raised $6 billion since its inception in 2016. Battery capacities totaling 170 gigawatt hours are now being built in Europe for this purpose. Northvolt only published plans for another joint battery factory in Gothenburg with the car manufacturer Volvo in February.

In Sweden, the company is also planning a 100 gigawatt hour factory for cathode material. However, the next battery production is likely to be in North America. According to Carlsson, the United States is currently being looked at.

More: Charging tariffs are increasing – is e-car electricity more expensive than fuel?