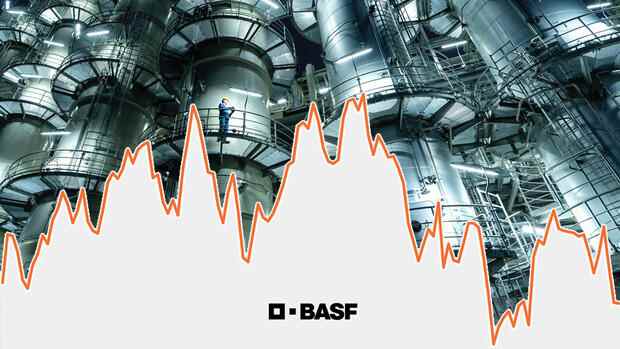

As far as prospects and stock market performance are concerned, some uncertainties and weaknesses are revealed at the Ludwigshafen chemical company.

(Photo: dpa [M])

Frankfurt The shareholders of the chemical group BASF have to deal with an unusually ambivalent constellation at the general meeting on Friday. As far as operational development is concerned, the chemical giant is currently in good shape. Company boss Martin Brudermüller can present annual accounts with a net profit of almost six billion euros and an operating result that has more than doubled to 7.8 billion euros, as well as a surprisingly good performance in the first quarter.

The BASF management also demonstrates confidence with the proposal of a further increase in the dividend to EUR 3.40 per share and a share buyback program worth EUR 3 billion.

As far as prospects and stock market performance are concerned, the Ludwigshafen chemical company reveals some uncertainties and weaknesses. Because it is becoming apparent that the turnaround is not sustainable and that earnings will come under pressure again in the second half of the year.

Read on now

Get access to this and every other article in the

Web and in our app free of charge for 4 weeks.

Continue

Read on now

Get access to this and every other article in the

Web and in our app free of charge for 4 weeks.

Continue