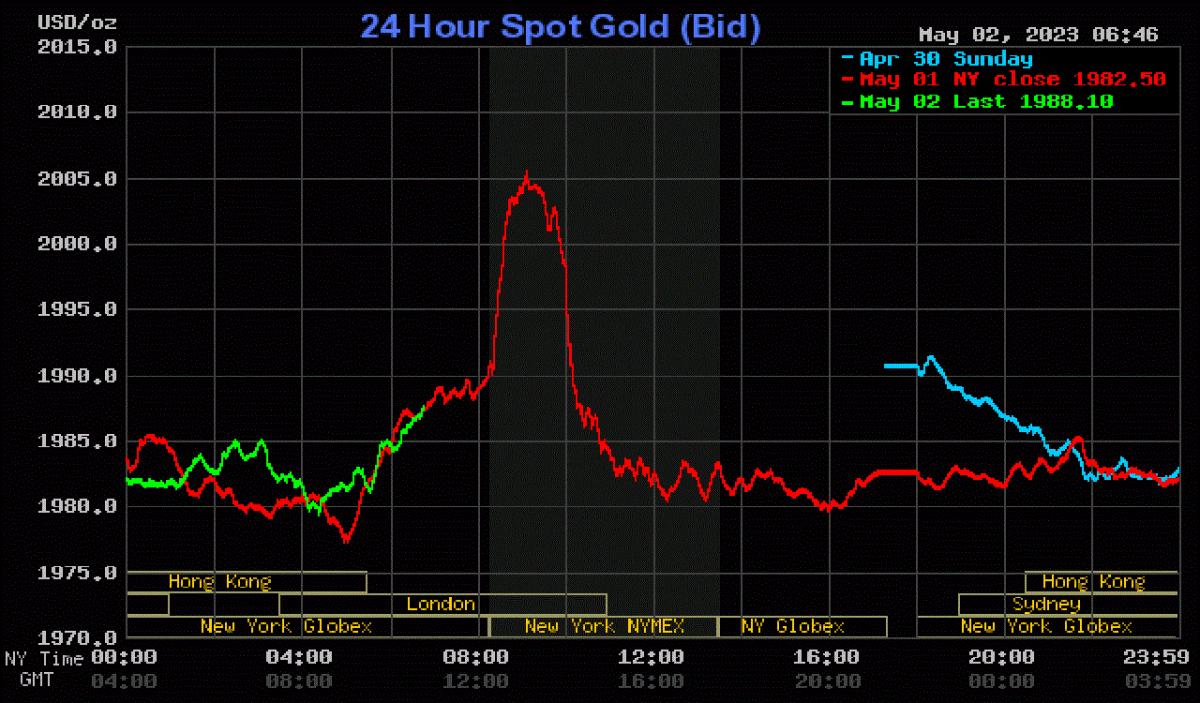

The third banking bankruptcy this year did not shock the markets. Now investors are focused on Wednesday’s Federal Reserve interest rate announcement. Gold prices only briefly hit over $2,000 on Monday.

First Republic Bank’s collapse is no big surprise

Three of the 30 largest US banks went bankrupt in less than two months. Yet the gold market barely moved in response to the First Republic’s collapse and news that JPMorgan had bought most of the bank’s assets. The government took over the First Republic this weekend. He also auctioned off the company’s assets. JPMorgan, PNC Financial Services, and Citizens Financial were asked to submit bids. Paul Ashworth, chief economist at Capital Economics North America, comments:

The collapse of First Republic Bank is no big surprise. It has mostly been on the edge of a cliff since it suffered $100 billion deposit withdrawals in March. But he was a timely reminder that the banking turmoil will continue to flare up periodically.

First Republic Bank was the country’s fourteenth-largest bank with close to $230 billion in assets, slightly larger than Silicon Valley Bank. In exchange for the purchase, JPMorgan will receive a $50 billion line of credit from the FDIC.

JPMorgan Chase CEO Jamie Dimon said on Monday he sees the takeover as the end of panic for the banking system. “This part of the crisis is over,” he said during a conference call on Monday. There are too many banks that are disabled in this way… There may be another smaller one. But that solves almost all of them,” he said.

The essence of this crisis is still not resolved!

cryptocoin.comAs you follow, markets expect the Fed to raise rates by another 25 bps on Wednesday. That’s why some analysts are watching what might happen next. Paul Ashworth comments:

Although the Fed’s emergency loans have not expanded further since the first crisis in March, it is noteworthy that the use of the Fed’s discount window remains extremely high. In addition, banks appear to be applying heavily to Federal Home Loan Banks.

The essence of this crisis is still not resolved. Savers are looking for higher returns amid rising interest rates. That’s why there is a deposit outflow. Ashworth warns:

Cash on hand is already running low. In this environment, the decline in deposits will increase the pressure to reduce credit, especially in small banks where the lack of general insurance is an additional problem. This pressure on bank lending will increase headwinds on GDP growth at a time when the economy is already slowing down.

It’s clear the Fed has broken something

Great Hill Capital Chairman Thomas Hayes says the First Republic’s failure points to a pattern and the consequences of the Fed raising rates too quickly. Based on this, Hayes makes the following statement:

In the case of the SVB alone, it was easy to blame the management. However, now that we see the pattern, it’s clear that the Fed has moved too far, too fast, and has broken something. We wouldn’t be surprised to see a ‘pause’ after this last hike. Markets are likely to take today’s news calmly, knowing that repeated bank failures must now push the Fed back and destabilize it going forward.

This could be a catalyst for gold prices!

On the other hand, it is important what Fed Chairman Jerome Powell thinks about the Fed’s banking sector. Therefore, any comment by Powell is likely to renew the momentum for gold prices. CompareBroker.io principal analyst Jameel Ahmad comments:

Gold prices, in particular, showed a gradual rise throughout most of 2023. Also, there are such alarming indications of more stress in the Banking sector. It is also possible that this could be a potential catalyst to add the necessary fuel to a rally that has run out of smoke in recent weeks.

In a note, Jameel Ahmad says another risk to consider is that he still needs to digest First Republic news as many global markets are closed for a public holiday on Monday, May 1. Ahmad said, “Confidence in the banking sector has now weakened even more. “This means investors should expect financial markets to stay on the defensive.”

A possible negative for gold prices!

OANDA senior market analyst Edward Moya says a possible downside for gold prices is that the Fed takes a more hawkish stance than expected. In this context, the analyst makes the following statement:

Inflationary pressures have increased recently. Given this situation, it is possible that the Fed will avoid signaling that it is ready to hold rates steady after raising rates once again. The Fed will likely choose to remain vigilant. Here is something that the market is not ready to price.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.