sandbox‘s native token managed to gain some demand last month. However, SAND has been bullish on lower timeframes since the last week of June as buyers started a recovery in the coin, which dropped to $0.7. Since then, both the $0.96 and $1.27 resistance levels have been successfully supported. So, can this rise continue or has demand decreased?

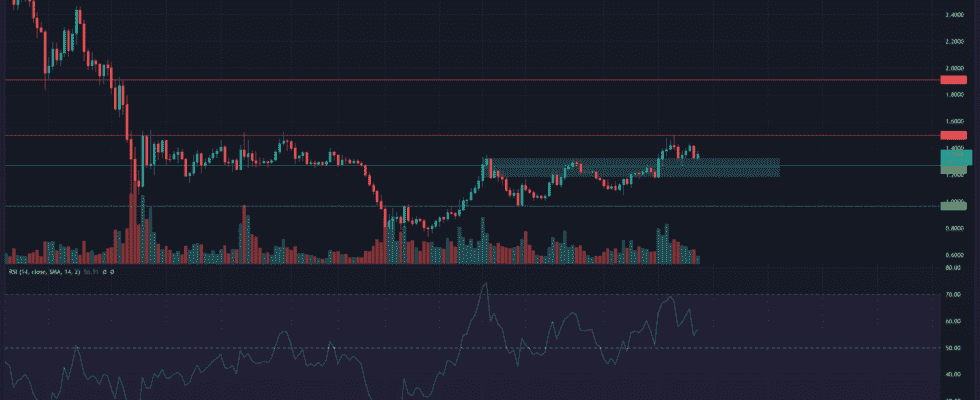

SAND – 12 Hour Chart

SAND held the support level at $1.27 in May and set it as an important level for the bulls. After that, the price fell below this level in June, but a few weeks before July, SAND managed to rise above the same level.

Koinfinans.com As we reported, the zone, which was at the level of $ 1.2 from late June, continues to highlight the downward trend that has since turned into a demand zone. On the higher time frame, the Relative Strength Index (RSI) has also been above the neutral 50 for the past three weeks and remains hopeful.

Considering all these data together, it seems possible to conclude that the momentum has been in favor of the bulls over the past month and a half. In terms of price action too, the price has set a series of lower and higher highs since mid-June.

SAND- 4 Hour Chart

Taking a closer look at the four-hour time frame, we can see two upward waves for SAND from mid-June. A rally pulled the SAND back from $0.8 to $1.3 and then to $0.95. Another rise from $0.95 to $1.49.

Based on the second move, a series of Fibonacci retracement levels have been drawn. The 38.2% retracement level settled at $1,288 and combined with the cyan demand zone and the $1.27 support level from May.

The 38.2% retracement level stood out as one of the always respected regions for SAND. However, smaller peaks have also been seen in the price over the past few days. In the shorter time chart, this created a decrease in buying pressure.

However, on the four-hour time frame, the bulls can be considered dominant as long as the $1.27-1.25 area is defended.

While the RSI has been above neutral 50 over the past ten days, the Equilibrium Volume (OBV) continued to trade in favor of the bulls, with a massive increase to the upside a few days ago. Although the RSI is in neutral territory at the time of writing, the momentum continues to rise.

OBV also showed significant purchase volume over the past few days. However, the Chaikin Money Flow (CMF) presented a rather ambiguous outlook. The CMF fell sharply below the -0.05 mark to show the heavy flow of capital from the market.

As a result, the price action once again highlighted that the $1.27 support level is critical. The positive progress of the Bitcoin price action may also create a positive result in the SAND price.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.