Blockchain analytics firm glassnodeAccording to , investors called “market tourists” are fleeing Bitcoin (BTC) and only long-term investors remain in the market and continue to trade.

Analysts, who released the “weekly on-chain” report on July 4, stated that Bitcoin left behind one of the worst performing months in 11 years with a 37.9% loss. The activity in the Bitcoin network, on the other hand, was at the same level as the bear market was at its worst in 2018 and 2019.

“bitcoin network is approaching a situation where almost all speculative assets and market tourists are completely cleared of assets.”

However, he noted significant levels of accumulation, despite the almost complete cleanup of “tourists”, noting that they also found that “prawns” holding less than 1 BTC and whales holding 1,000 to 5,000 BTC had “significantly increased” balances.

Especially shrimps, available bitcoin They find their prices attractive and save about 60,500 BTC per month. Glassnode stated that this is the “most aggressive rate in history”, equivalent to 0.32% of the monthly BTC supply.

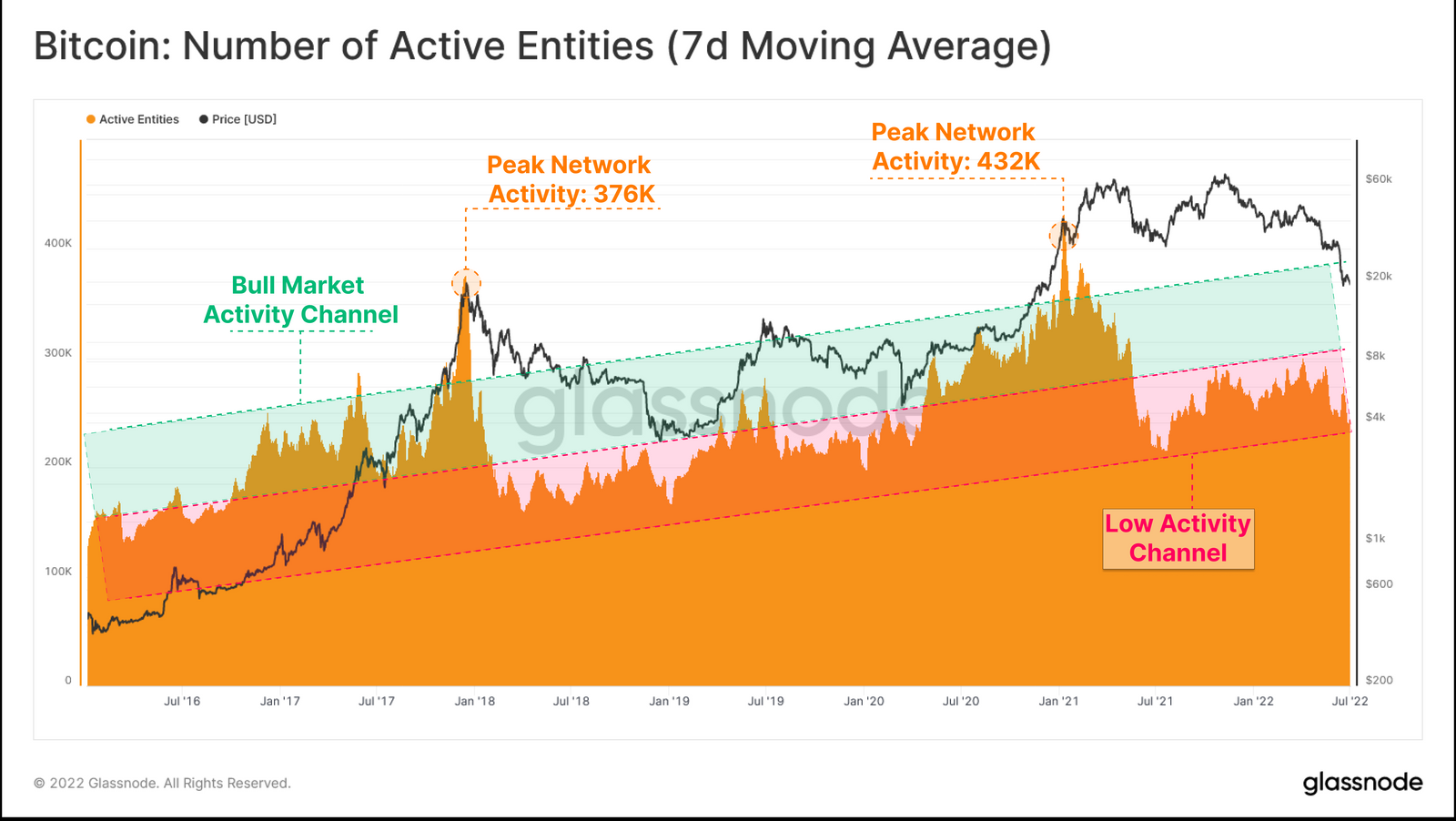

Glassnode, which also detects the liquidation amount of investors called tourists, stated that both active addresses and assets have seen a downtrend since November 2021, which means that both new and existing investors have not interacted with the network.

Koinfinans.com As we have reported, the activity of addresses is around 870,000 these days, from 1 million addresses per day in November 2021. The “active assets” obtained by mixing multiple addresses belonging to individuals and institutions are around 244,000 per day. Analysts commenting on these levels noted that it is around the lower end of the “low activity” channel typical of bear markets.

“Since active assets often tend sideways, long-term investor retention is more pronounced on this metric, which is indicative of a stable underlying user load,” analysts added.

The growth of new assets also slumped to 2018 to 2019 bear market lows, with the Bitcoin user base reaching 7,000 net new assets daily.

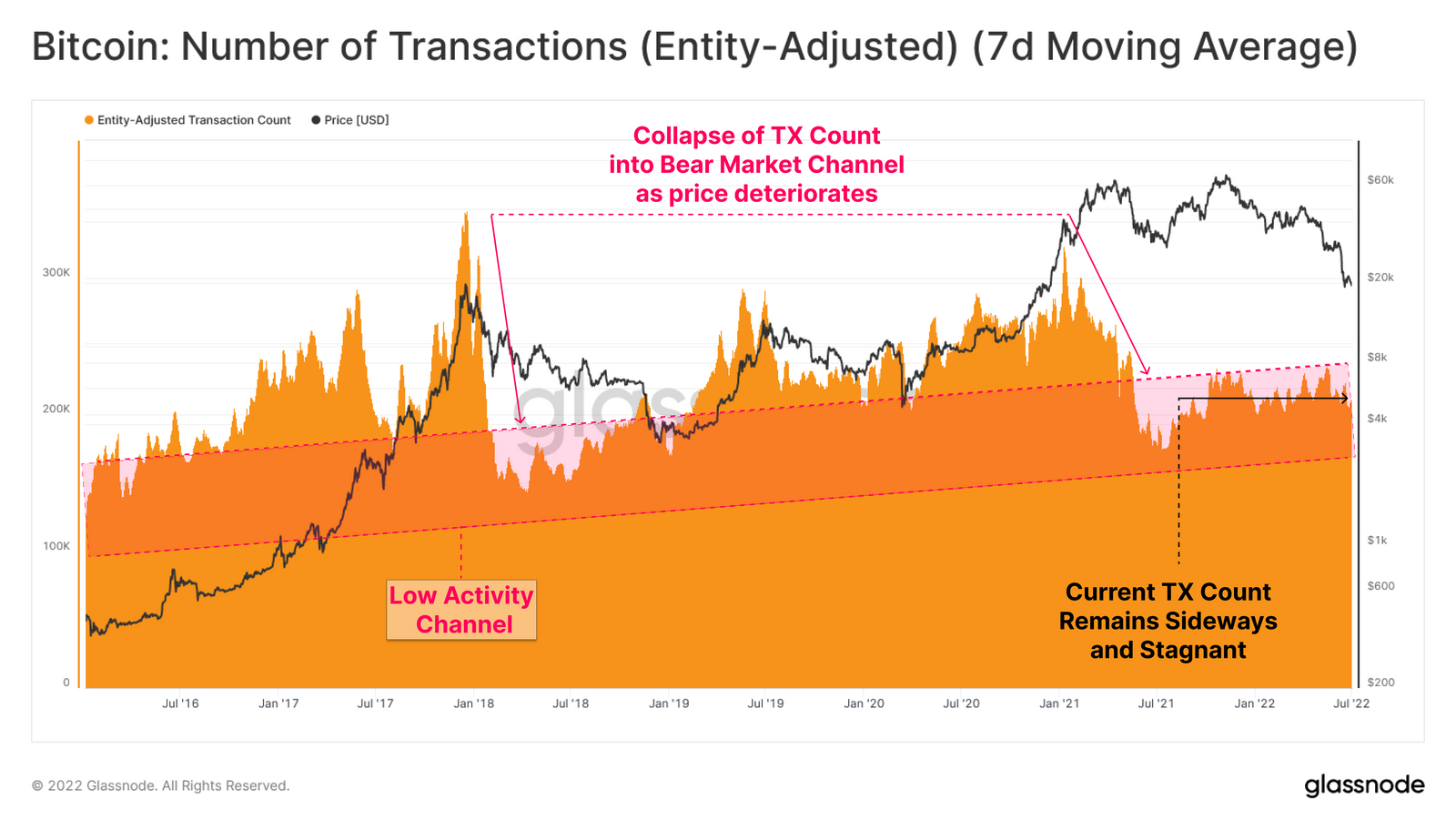

The number of transactions also remains “stable and flat,” indicating a lack of new demand, but also means that new investors are holding on to market conditions.

Glassnode has also found that the number of addresses with a non-zero balance, holding at least some Bitcoin, continues to hit all-time highs, currently at over 42.3 million.

past bear markets, bitcoin price when he fell he saw a wallet cleaning. Still, while this metric suggests otherwise, Glassnode says it shows an “increasing level of stability among the average Bitcoin participant.”

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.