Leading cryptocurrency Bitcoin And altcoins After the tremendous rise, the new week started with a decline.

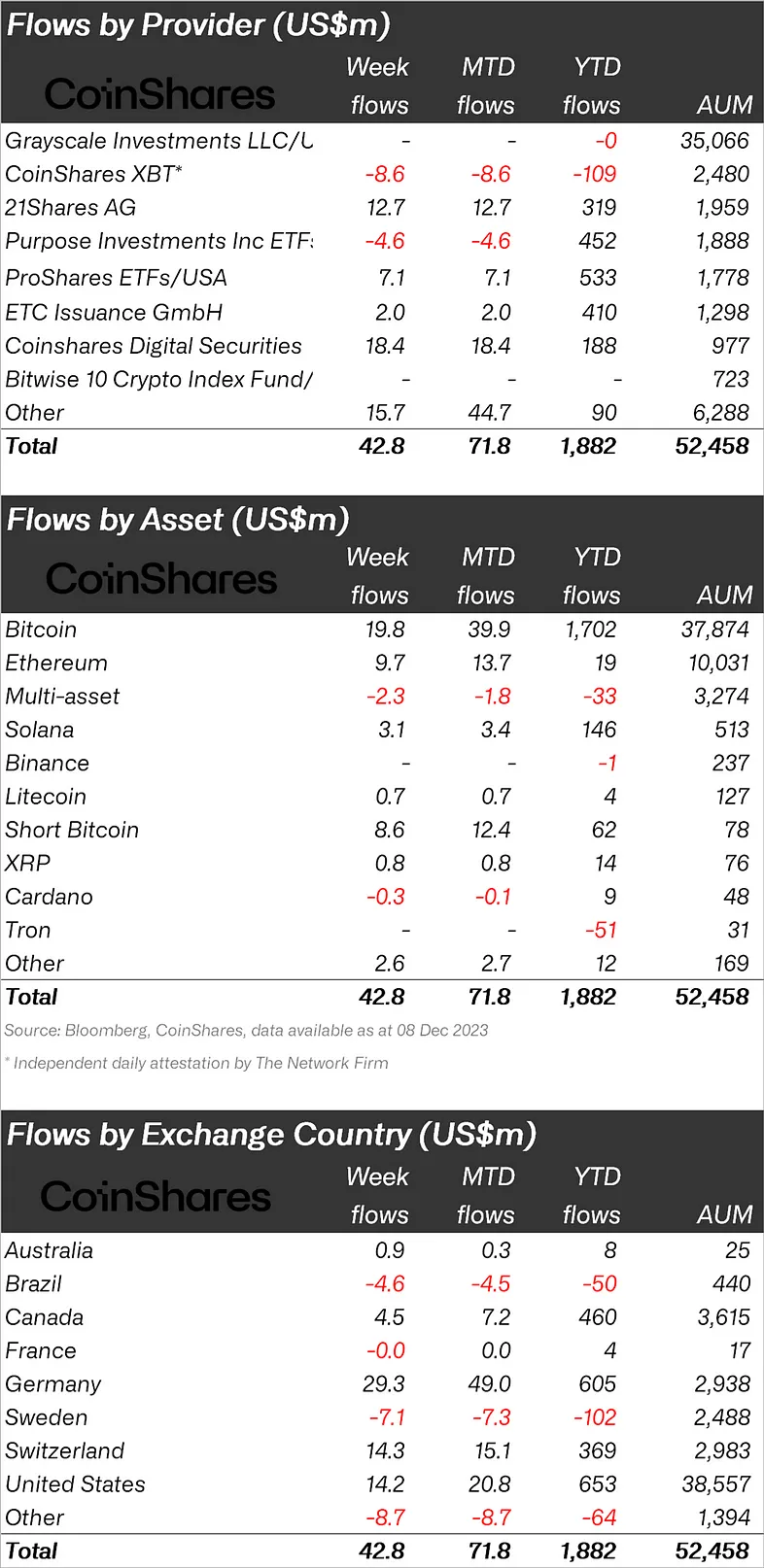

BTC While the decline in and altcoins makes investors nervous CoinShares published its weekly cryptocurrency report and said there was an inflow of $43 million last week.

“Cryptocurrency investment products saw total inflows of $43 million for the 11th consecutive week, but there was a significant decrease from previous weeks.

“Recent price appreciation has also led to significant inflows into short positions as some investors see the downward potential of prices.”

When looking at crypto funds individually, the majority of fund inflows ‘Bitcoin’It was also seen that there was.

BTC is the largest altcoin with an inflow of $19.8 million last week in Ethereum (ETH) An inflow of $9.7 million was seen.

Inflows in the Bitcoin Short fund, which is indexed to the decline of BTC, also increased and it was seen that there was an inflow of 8.6 million dollars.

When we look at other altcoins Solana (LEFT) 3.1 million dollars, XRP 0.8 million dollars, Litecoin (LTC) While experiencing an inflow of 0.7 million dollars Cardano (ADA) It had an outflow of 0.3 million dollars.

“In a remarkable turnaround this year, Ethereum saw total inflows of $10 million in its sixth week. Just 7 weeks ago, Ethereum saw $125 million in year-to-date outflows. However, ETH recovered and reached a total of $19 million.

Solana saw $3 million in inflows and remains a favorite in the altcoin space.”

When looking at regional fund inflows and outflows, it was seen that Germany ranked first with an inflow of 29.3 million dollars.

After Germany, Switzerland ranked second with 14.3 million dollars; The USA ranked third with 14.2 million dollars, and Canada ranked fourth with 4.5 million dollars.

Against these inflows, Brazil experienced an outflow of 4.6 million dollars.

*This is not investment advice.

For exclusive news, analysis and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android And iOS Start live price monitoring now by downloading our applications!