Ethereum It’s been a rough two years for (ETH), losing nearly 65% of its value since the 2021 all-time high. Some holders may be feeling it harder these days, with ‘signs of capitulation’ for the ETH price between six-month lows, analysts say.

However, after capitulation there is usually a price recovery. At least that’s what most experts would agree on market cycle theories.

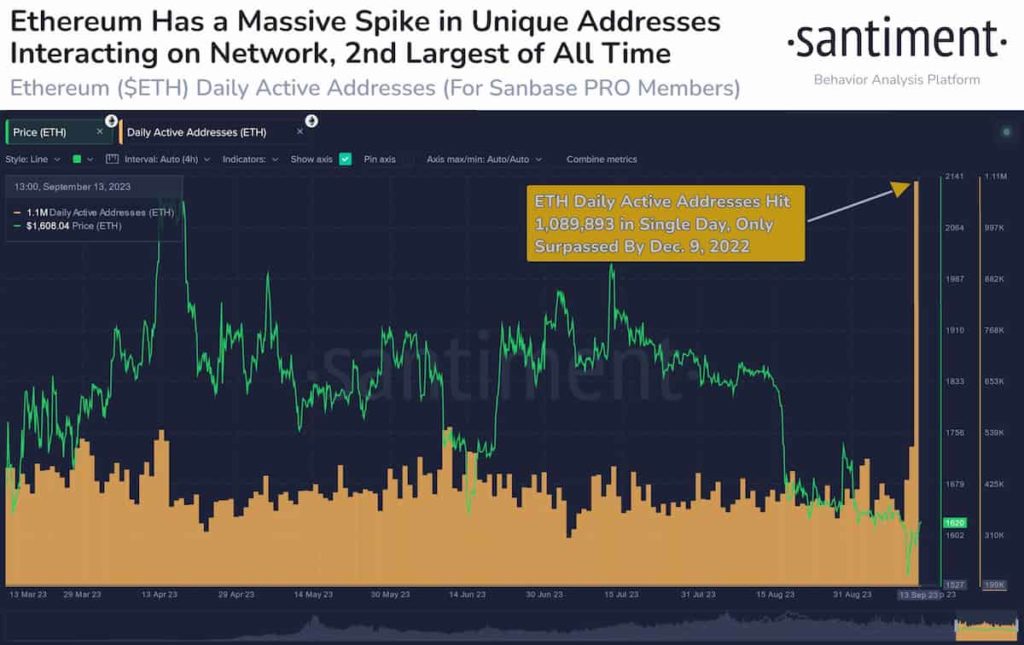

In this context, another major capitulation signal that Santiment’s Sanbase PRO analysts call a “historical anomaly” observed on the ETH Network on September 14 they reported.

As reported, ETH reached over 1 million Daily Active Addresses (DAA) in a single day. This is the second highest value of all time for this metric in the 8-year history of the network.

Capitulation Signal on ETH’s Daily Active Addresses

Analysts at Santiment believe that this “historical anomaly” can be seen as a major “capitulation signal needed for price recovery.” This supports the thesis that the ETH price may see a recovery in the near future. Because many owners had to realize losses that could be the end of a cycle.

DAA measures the number of unique addresses activated in a single day. Calculated by summing transactions sent and received from these unique addresses, DAA is a more reliable measure of market sentiment than overall transaction activity and can be inflated by multiple sendings from a few addresses.

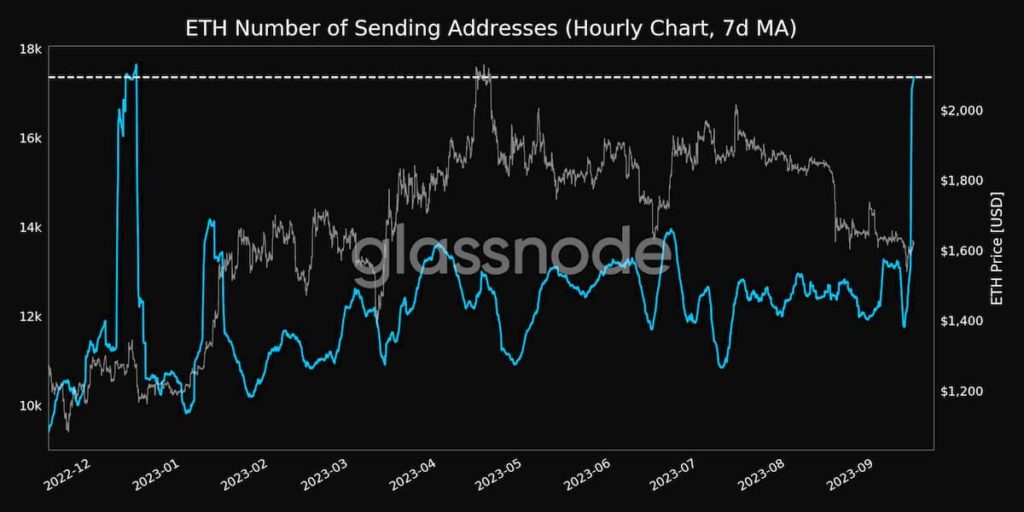

Glassnode in particular detected an increase in this public data. Because the number of sending addresses reached the highest level in the last 8 months with 17,364 this morning.

Ethereum Price Analysis

Meanwhile altcoinAt the time of writing, it is trading at $1,620 with a daily gain of 1.35%. It shows a consolidation behavior after the major decline that brought its prices below $1,550 per token on September 12.

With this, crypto- The general atmosphere in the market is still bearish. Therefore, further price movement for the second-largest cryptocurrency by market cap will depend on news and developments related to the macro and microeconomics as well as the Ethereum ecosystem.