Presenter of InvestAnswers channel, spot Bitcoin He thinks approval of his ETF would trigger massive inflows from Wall Street giants.

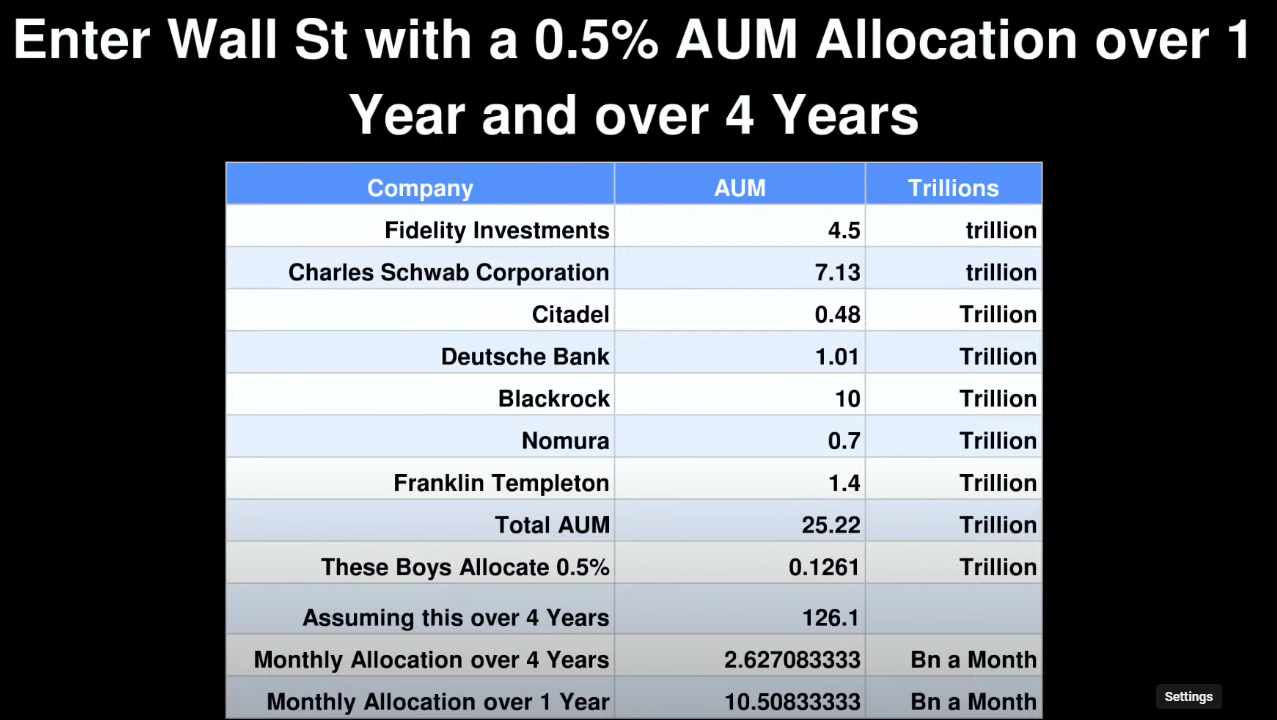

The analyst pointed out that companies such as leading US investment giants Fidelity Investments, Charles Schwab, Citadel, Deutsche Bank, BlackRock, Nomura and Franklin Templeton collectively have assets under management (AUM) of $ 25.22 trillion.

According to the analyst, if major Wall Street firms allocate just half a percent of their AUM for Bitcoin ETFs in the first year after the April 2024 BTC halving, the flagship crypto asset could rise by nearly 3,219% from current levels in less than half a decade.

…This is assuming 0.5% of assets under management will go up during the first year from April 2024. If this only happens for the first year, demand will drive Bitcoin price up until April 2028.

And again, assuming a 0.5% allocation in the first year, another 0.5% in the second year, and so on, this would take us to $920,000 per Bitcoin in April 2028.

NEWS CONTINUES BELOW