Quantitative analyst Plan B bitcoin He said the rally was not a bull trap, as many investors feared.

Posting on his Twitter account with 1.8 million followers, Plan B suggested that what was a bull trap, depending on many indicators, was actually the beginning of the bull cycle.

“To be frank, I don’t think the recent spike in Bitcoin is a bull trap. It’s the early start of a bull cycle.”

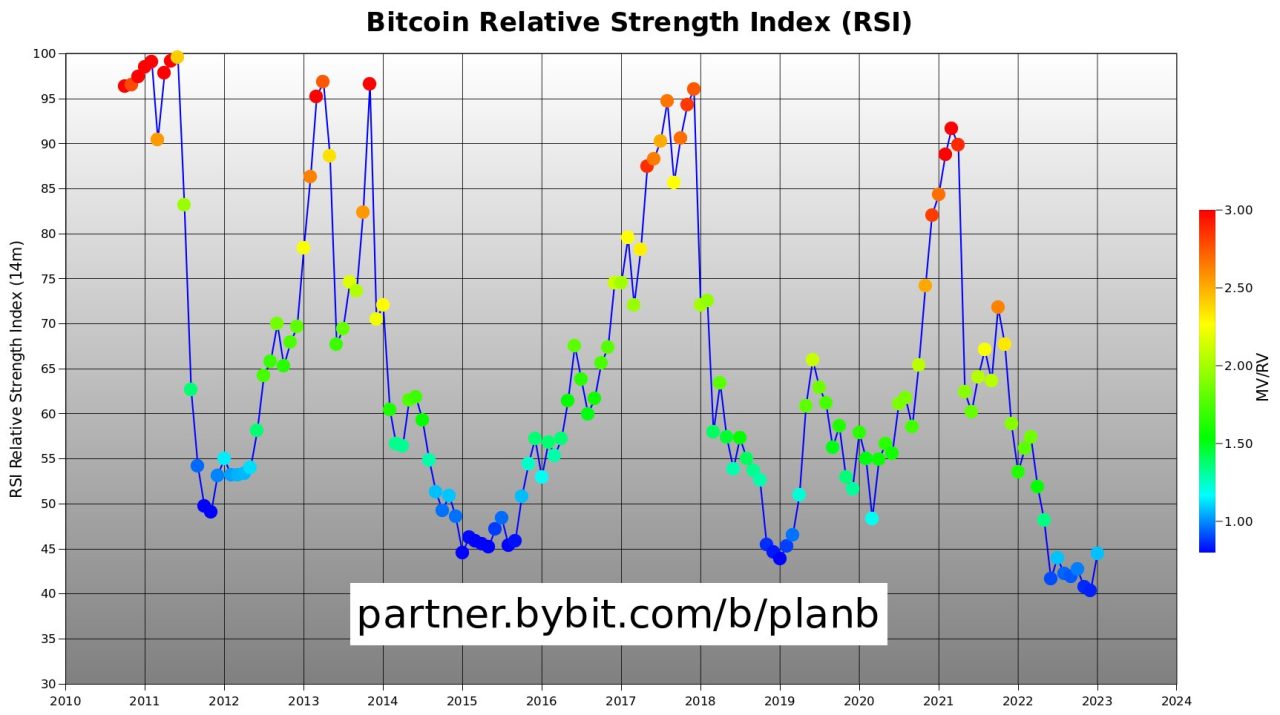

Plan Bstated that the relative strength index (RSI) is moving despite the low levels seen in the 2015 and 2019 periods.

Koinfinans.com As we have reported, the analyst, who is not satisfied with this prediction, thinks that the bottom levels have already come. He once again stated that the Plan B bottom is at $15,500. The halving, which will take place in 2024, will narrow the supply and increase the price to the level of $ 32,000.

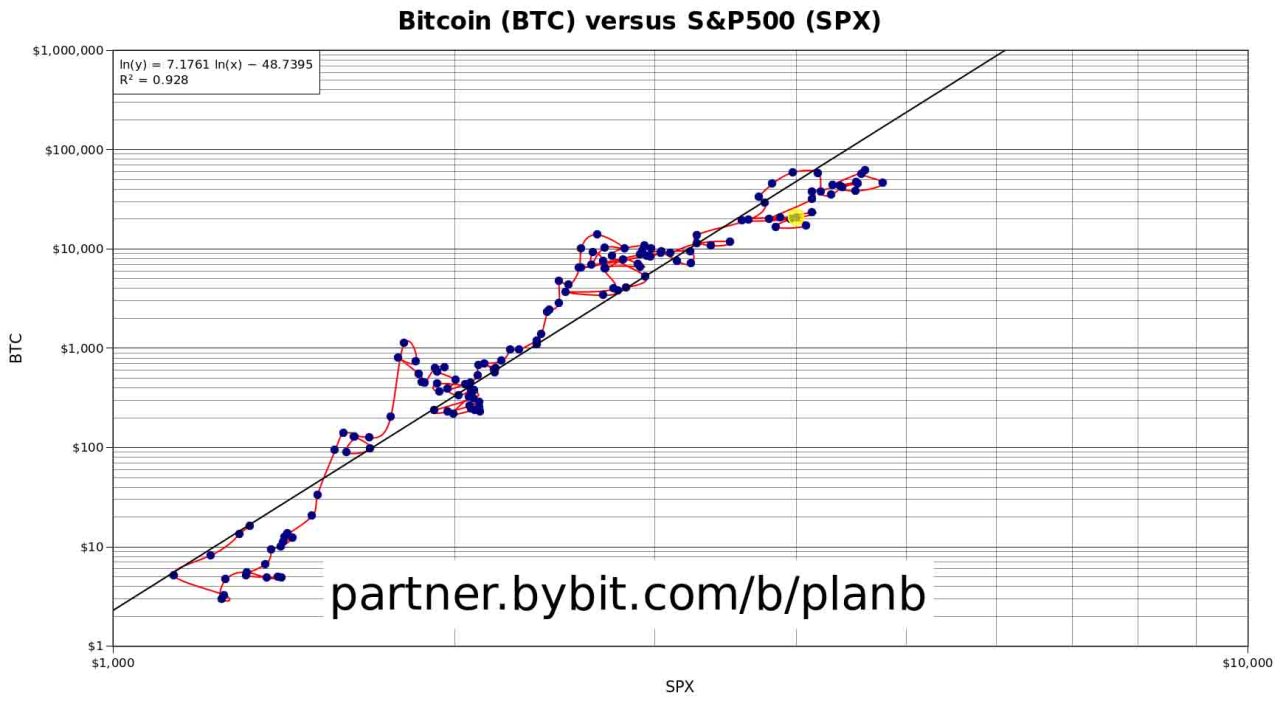

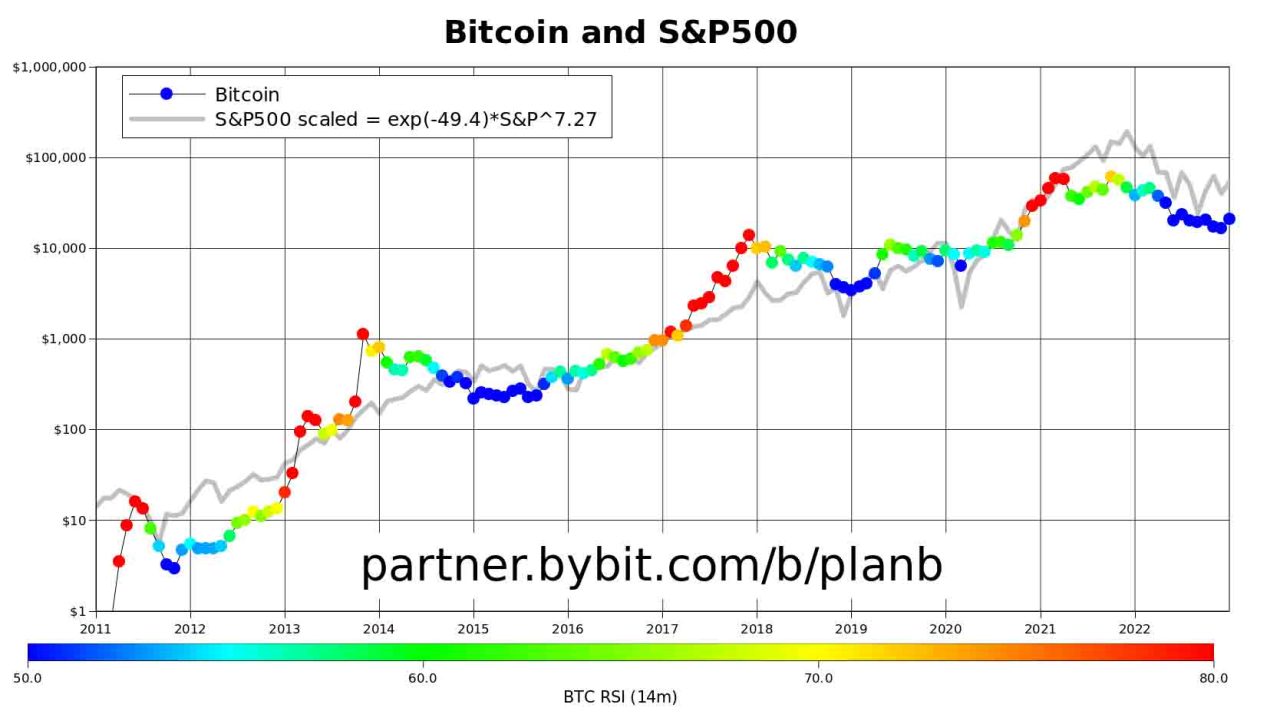

Plan B also S&P 500 He stated that the correlation between the index and Bitcoin shows that the crypto asset has more room to climb.

“BTC is trying to catch up with S&P (S&P shows BTC price to be $54,000).”

“Bitcoin has had a correlation with S&P and other assets from the very beginning. The difference helped it have more of an impact on BTC when S&P rose.”