Analyst Lucas Outumuro is trying to answer an important question on his medium page today. According to the analyst, Bitcoin BTC is outperforming despite (or because of) macro woes. Let’s look at the details.

Bitcoin and others

This week, we’re shifting gears from a macro perspective as bonds continue their historic sell-off while Bitcoin holds steady. We discuss how BTC could benefit from increased financial instability in 2023. Bitcoin network fees dropped by 30% this week. Because ordinary logins and general transactions have decreased significantly. Fees on Ethereum have reached their lowest level in the year, driven by low volatility and a general lack of activity on the mainnet.

On the other hand, both Bitcoin and Ethereum recorded net inflows of approximately $100 million to centralized exchanges this week. Some of these inflows may be due to FTX sales. Because most of their addresses have become active recently. Additionally, the approach exited $150 million worth of SOL stakes.

Is bond crash boosting Bitcoin BTC?

Although the prices of long-term bonds and Bitcoin have been moving together for the last year and a half, they are no longer moving together. Let’s examine the dynamics at play. With the Fed raising interest rates sharply in 2022, the value of long-term bonds has declined as they provide much lower rates. High interest rates have also put pressure on Bitcoin and risky assets in general. Because a) short-term bonds have become an increasingly attractive alternative. Also b) the discount rate for income from assets increased proportionately.

Then, as the pace of rate hikes slowed and discussions began about a Fed pause in 2023, both Bitcoin and long-term bonds rallied. This trend changed last month. Bitcoin is rising while long-term treasury bonds are falling. It also leads to a correlation of -0.74 between the two. Accordingly, this points to the lowest value seen in more than a year. So why is Bitcoin outperforming bonds? And why does this matter to the average person in crypto? The answer is that the market appears to be re-evaluating Bitcoin’s value proposition amid global uncertainty.

From medium of exchange to store of value

The market’s approach to Bitcoin has changed significantly over the years. Initially, when many people viewed Bitcoin as peer-to-peer cash, the volume of transactions processed was an important metric to track Bitcoin’s progress towards becoming a medium of exchange. The ratio of Bitcoin’s market value to its traded value (the NVT ratio shown above) has subsequently become a popular metric to track. It also showed that Bitcoin BTC was relatively worthless during the 2015-2016 bear market, when the value of Bitcoin was low compared to the volume it transferred on-chain.

Bitcoin reached an all-time high in its NVT ratio in September. So is the market indicating that Bitcoin is significantly overvalued? This is most likely not the case. Instead, this trend suggests that Bitcoin is valued by investors not for its transactional utility but for something else. In 2023, we have seen the demand for Bitcoin increase as the cracks of the traditional financial system are revealed. In March, Silicon Valley Bank collapsed. Additionally, as the Fed intervened with its BTFP program, the price of Bitcoin rose over 20%. Now, the value of long-term treasury bonds has fallen to its lowest level since 2007. Bitcoin remains stable and reverses its previously strong correlation with bond prices. It may be too early to start calling for a bull market. But it’s clear that the broader market has changed its tone regarding Bitcoin.

Scarce and predictable supply

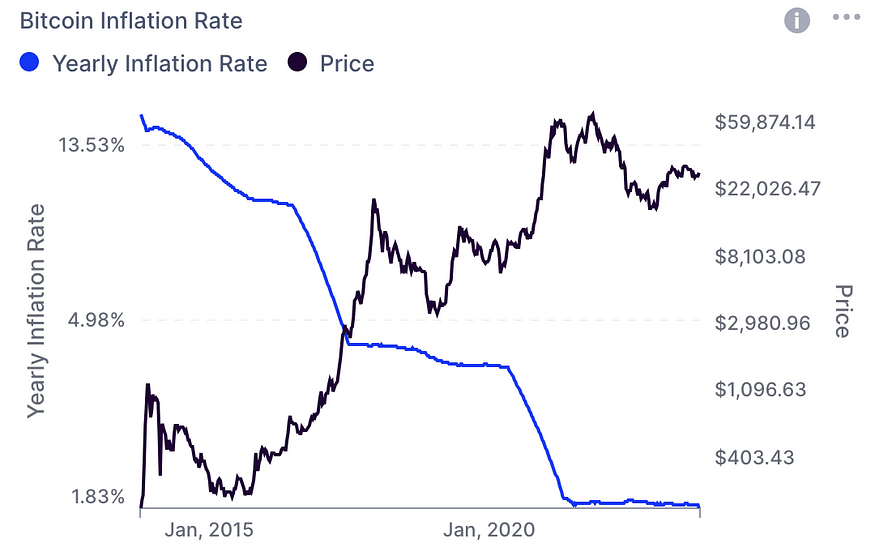

Bitcoin’s declining scheduled issuance is one of the key arguments that make it stand out as a store of value. Bitcoin BTC’s annual inflation rate is currently 1.7% and will drop to 0.85% in May 2024. We are in a period where the US debt has reached record levels of 33 trillion dollars. Additionally, as interest rates continue to rise, the risk of financial instability increases. Many macro experts, including Joseph Wang and Luke Gromen, have important things to say. Accordingly, they are looking at a point before the Federal Reserve steps in again with the latest iteration of quantitative easing. They argue that there is a greater chance of a “liquidity event” in which markets crash.

As with any potential crisis, it is difficult to predict when these crises will erupt. The recent bond crash shows signs of weakness in the traditional banking system. However, the extent of this is still unclear. At the same time, when we look at it as cryptokoin.com, it seems that the market has re-evaluated the correlation between bond prices and Bitcoin and sees more value in the crypto asset despite the rise in yields. Ultimately, this appears to strengthen Bitcoin’s value proposition in an unstable economic environment.

To be informed about the latest developments, follow us Twitter’in, Facebookin and InstagramFollow on . Telegram And YouTube Join our channel.