Geopolitical tensions in the Middle East triggered a sell-off in risk assets. With the increase in tension, the market, including the leading crypto Bitcoin, suffered serious blood loss. In this context, some cryptocurrencies have been oversold. Crypto analyst Vinicius Barbosa says two of these provide a potential buy signal.

CoinGlass’s data points to 2 cryptocurrencies!

cryptokoin.comAs you follow from , the market went through a bloodbath over the weekend. Although the tension between Iran and Israel seems to have calmed down for now, the market still continues to lose blood. With this blow, which came just days before Bitcoin’s halving event, which the market was eagerly awaiting, most cryptocurrencies were oversold. Therefore, these record losses also affected technical indicators.

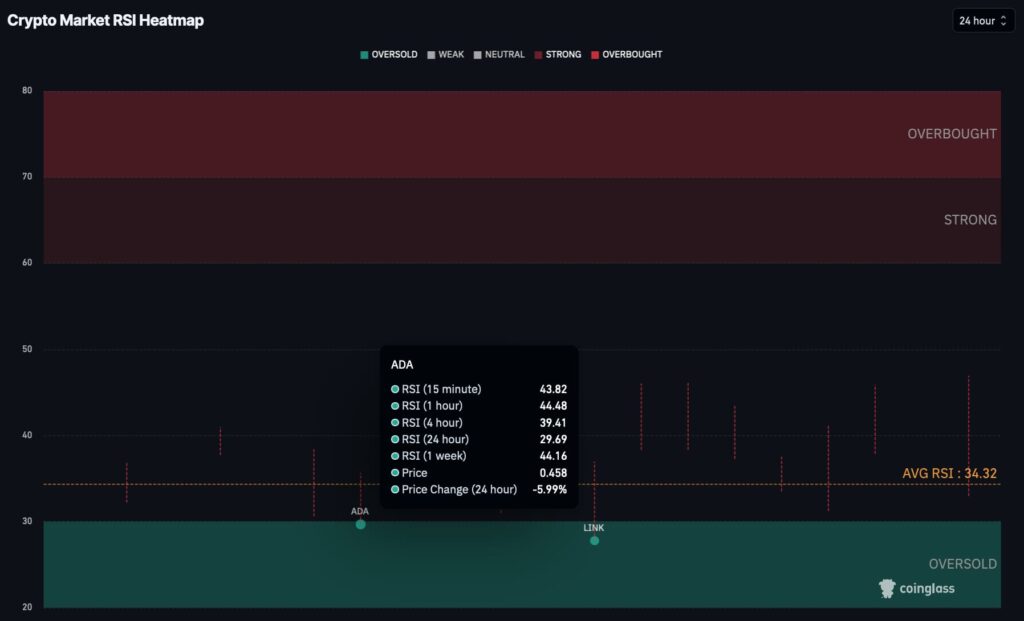

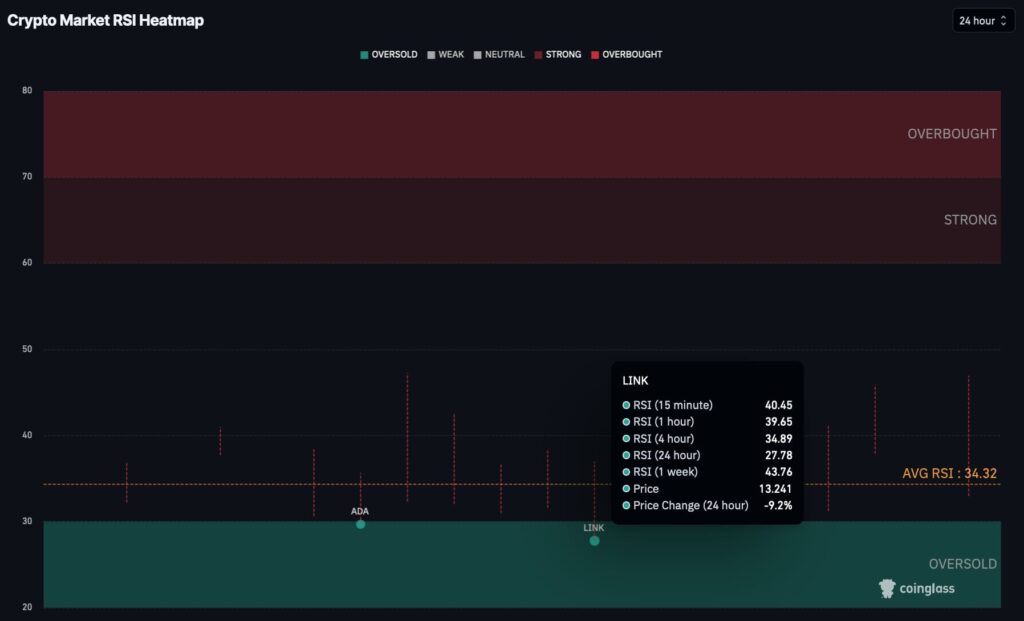

Notably, the daily Relative Strength Index of cryptocurrencies dropped to an average of 34.32 points on April 16. According to CoinGlass’s RSI average, two altcoins attract attention below this level. However, continued tension may invalidate this buy signal. This should also be kept in mind.

Ethereum rival Cardano (ADA) is in first place

Cardano (ADA) remains below the market average with an oversold daily RSI of 29.69. Additionally, ADA is currently trading at $0.45. ADA has lost 1% of its value in the last 24 hours. Moreover, it has lost more than 22% since April 12. Meanwhile, Cardano’s weekly Relative Strength Index remains neutral at 44.61. Thus, it points to medium-term consolidation. This suggests that ADA could be a potential buy at this point, as opposed to a short-term oversold situation.

Cryptocurrency trader Alan Santana’s technical analysis also confirms this buy signal. The analyst expects a hyped gain of over 1,300% from ADA for the next bull run. Meanwhile, even if ADA doesn’t reach this highly optimistic analysis, it still signals an impending price increase. Cardano recently lost its place in the top 10 by market cap to Toncoin (TON).

The next candidate to signal an overshoot: Chainlink (LINK)

Oracle Blockchain Chainlink (LINK) has a similar situation to Cardano on its daily RSI. However, LINK fell even lower at 27.78 on the 24-hour Relative Strength Index, after losing 9.2% during the period. At the time of writing, LINK was trading at $13.26. LINK is sending a potentially strong buy signal to long-term investors. Still, short-term performance is uncertain in an environment of escalating geopolitical tensions.

Chainlink has seen increasing demand since 2023 due to its off-chain data collection capabilities for decentralized finance (DeFi). This is a strong use case given the rise of real-world assets (RWAs) fueled by BlackRock’s tokenization interest.

The opinions and predictions in the article belong to the analysts and are definitely not investment advice. cryptokoin.com We strongly recommend that you do your own research before investing.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!