After the long election marathon, investors turned their eyes back to the markets. In particular, it is closely monitored whether the gap between foreign exchange and gold free market – CBRT rates will be closed.

After Recep Tayyip Erdoğan won the Presidential 2nd round, according to the CBRT data, the Dollar/TL rate exceeded the 20.00 TL limit. Gram Gold, on the other hand, is trading around 1255-1260 TL with an increase of 0.80%. Even though the gap between the Grand Bazaar and the Central Bank has largely closed, the Mint Gold Certificate traded on the Borsa Istanbul continues to be traded at a high premium.

Grand Bazaar exchange rates declined

With the election atmosphere left behind, the exchange rates in the Grand Bazaar, where the heart of money beats, decreased significantly. The USD/TL parity is priced at around 20.65, depreciating by 2.70% on the first business day of the week.

Access to physical gold has also become easier for investors who do not prefer foreign currency to protect their savings against inflation. Gram gold, which saw 1424 TL in the Grand Bazaar last week, is now finding buyers at 1350 TL.

The free market – CBRT exchange rate difference, which was up to 10% in the past days, decreased to 2% with the elimination of election uncertainty.

Gold certificate continues to be traded at premium

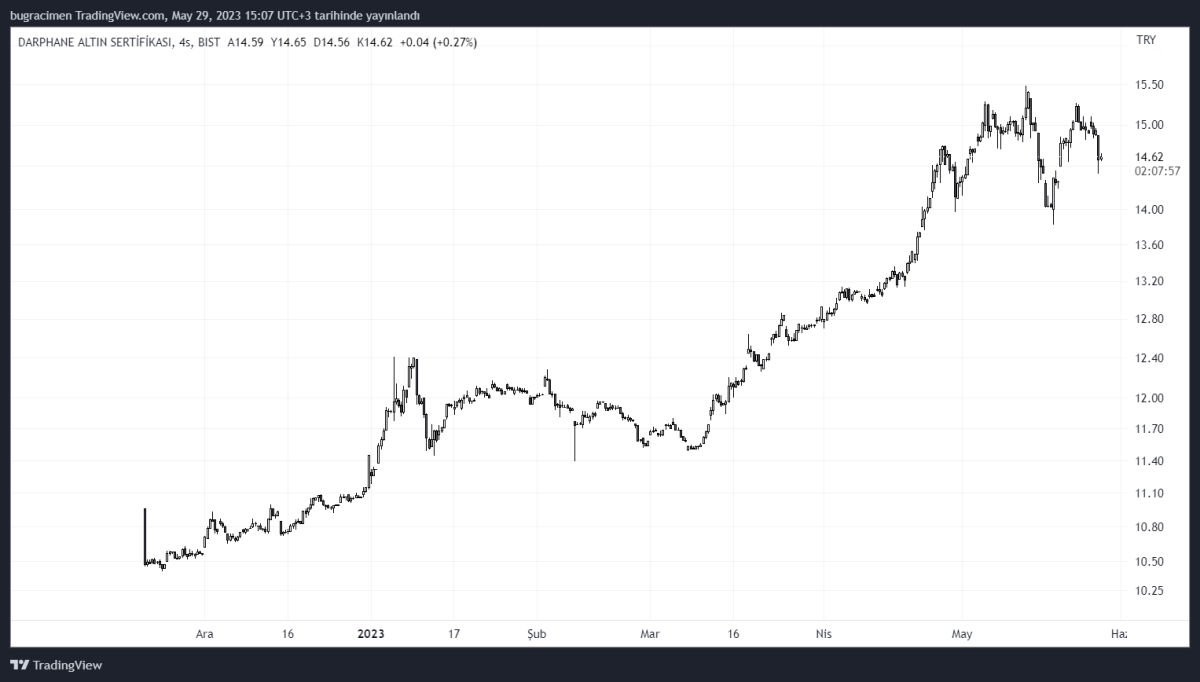

The gold certificate, which was launched by Mint to curb the demand for physical gold, continues to be traded at a premium. The certificate traded on Borsa Istanbul is currently at 14.63 TL.

Each certificate offered to the public by the Mint and Stamp Printing House, which is within the body of the Treasury and the Ministry, represents 0.01 grams of gold. Starting from here, when we make a simple calculation, 1 gram of gold of Mint is traded at 1463 TL.

When we compare the mint certificate with the CBRT gram gold rate, a difference of 200 TL emerges. Although it is unclear how long the current situation will last, the premium between the two pairs is currently around 16%.

Investors have the opportunity to convert their certificates into physical gold if they wish.

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. Therefore, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.