The recent fluctuations in the crypto market and especially the declines in altcoins have been the subject of widespread discussion among investors and analysts. Various predictions are made about when these fluctuations will end and which direction the market will go. Rekt Capital, one of the prominent names in this regard, presented a remarkable analysis about the future of the altcoin market.

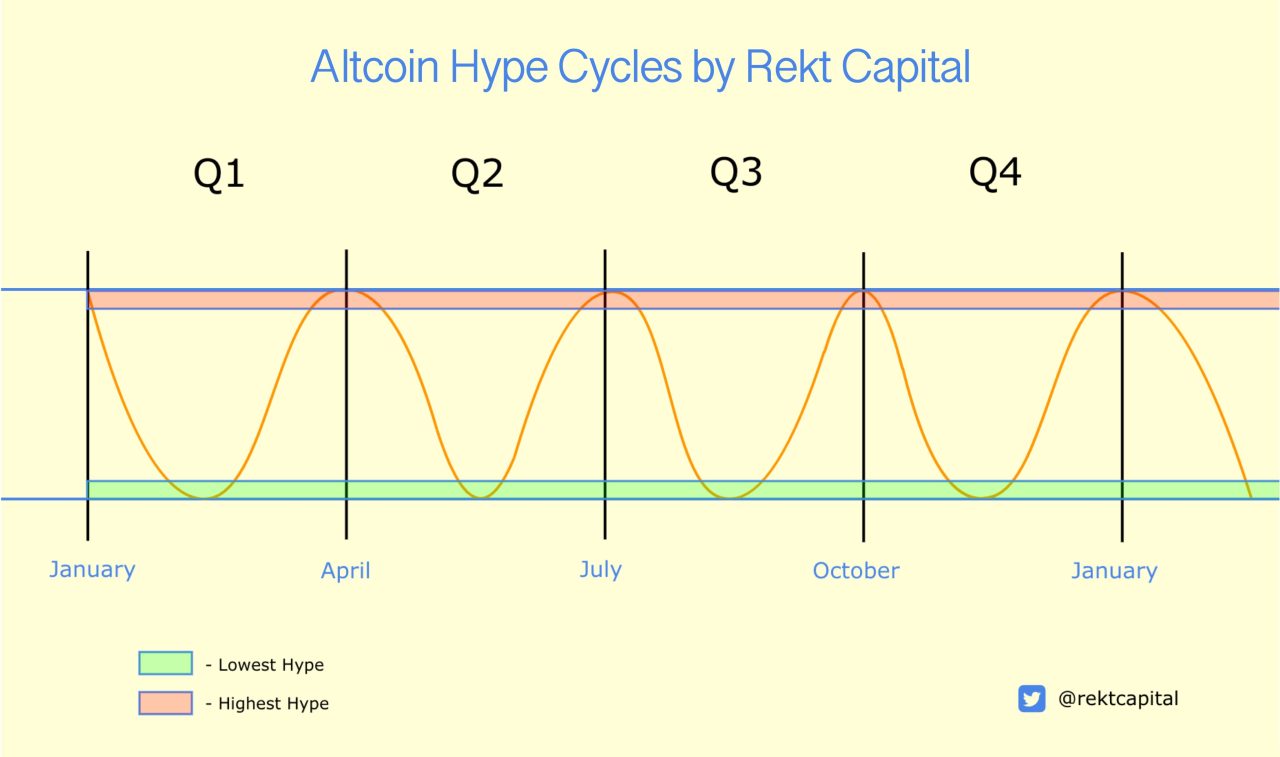

According to Rekt Capital’s analysis, altcoins move in certain cycles, and these cycles usually occur in three-month periods. Stating that the last cycle has recently reached its peak, the analyst states that altcoins are currently in a downward trend. However, an important point is that altcoins may hit bottom before entering a new cheating cycle in late May or early June.

Rekt Capital’s to your predictions According to the report, the movements of altcoins occur within a certain plan. Altcoins, which bottomed in February, faced selling pressure around the Bitcoin halving, and it is now predicted that they may hit bottom again in the early summer months.

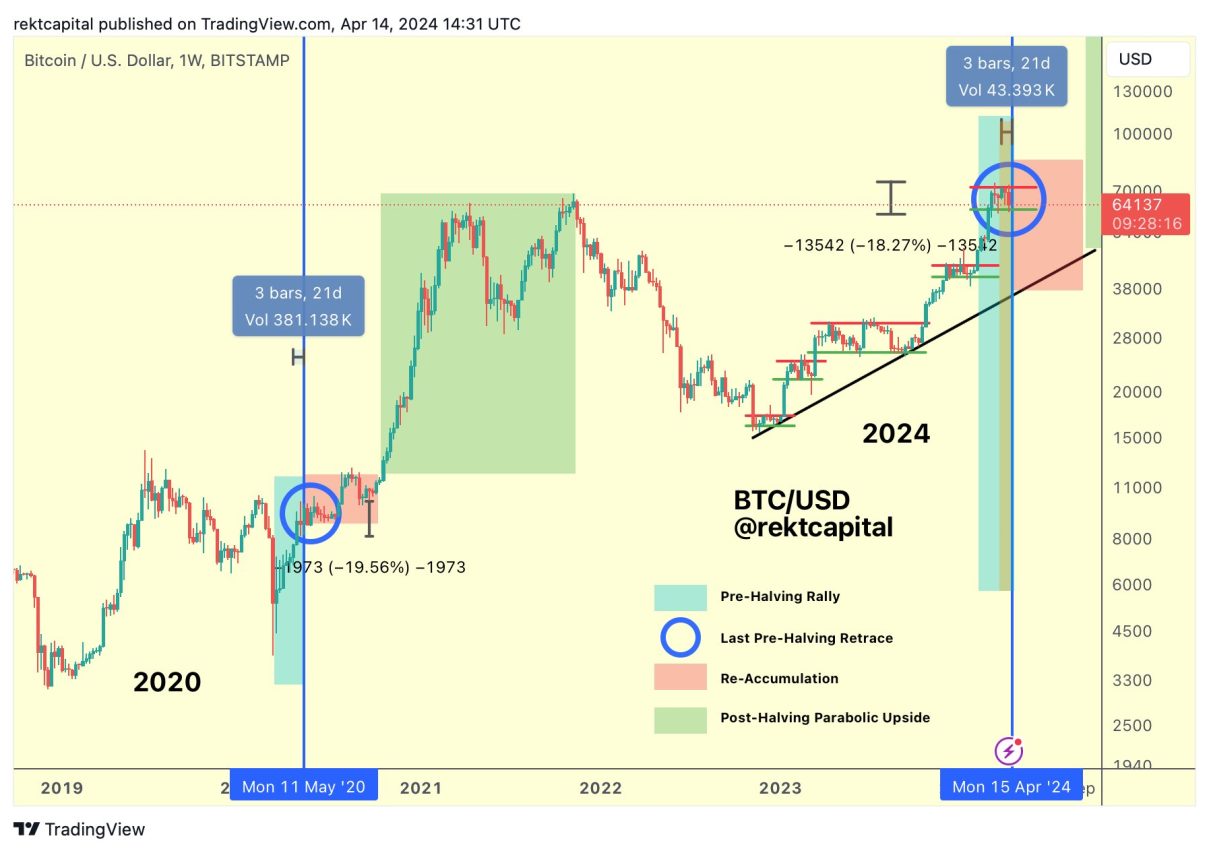

On the other hand, according to Rekt Capital’s assessment, Bitcoin is still in the bull market despite its recent correction. According to the analyst, Bitcoin’s price may experience a correction deep enough to raise doubts that the bull market is over, but it may then return to the uptrend.

“Bitcoin will go deep enough to convince you that the bull market is over. “Then it will continue its upward trend.”

Additionally, following the upcoming halving event, a short-term consolidation in the price of Bitcoin is expected as miners’ reward amount is halved. The analyst predicts that Bitcoin will stabilize and move between $60,000 and $70,000 in the next few weeks.

“Bitcoin is technically still in the transition period of its cycle between the pre-halving pullback phase (dark blue circle) and the reaccumulation phase (red). But this pullback is all about setting up the next phase: the reaccumulation phase (red). The recent relapse at $70,000 gave us a better idea of where the higher resistance of the reaccumulation range (red horizontal) is. Now it’s all about finding where the low of the reaccumulation range will be (green horizontal).

For now, the -18% pullback before the halving potentially points below this reaccumulation range. “If around $60,000 continues to be the bottom… BTC could consolidate between $60,000 and $70,000 in the coming weeks during the halving and beyond.”

At the time of writing, Bitcoin is trading at $66,007, up over 2% in the last 24 hours.

You can access current market movements here.