Following the SEC’s approval of the ProShares Bitcoin Strategy ETF, the United States’ first Bitcoin futures exchange-traded fund, the ProShares ETF, was launched on Tuesday and has faced high interest from investors ever since.

The launch of ProShares’ Bitcoin ETF has reaffirmed institutional investors’ confidence in the market.

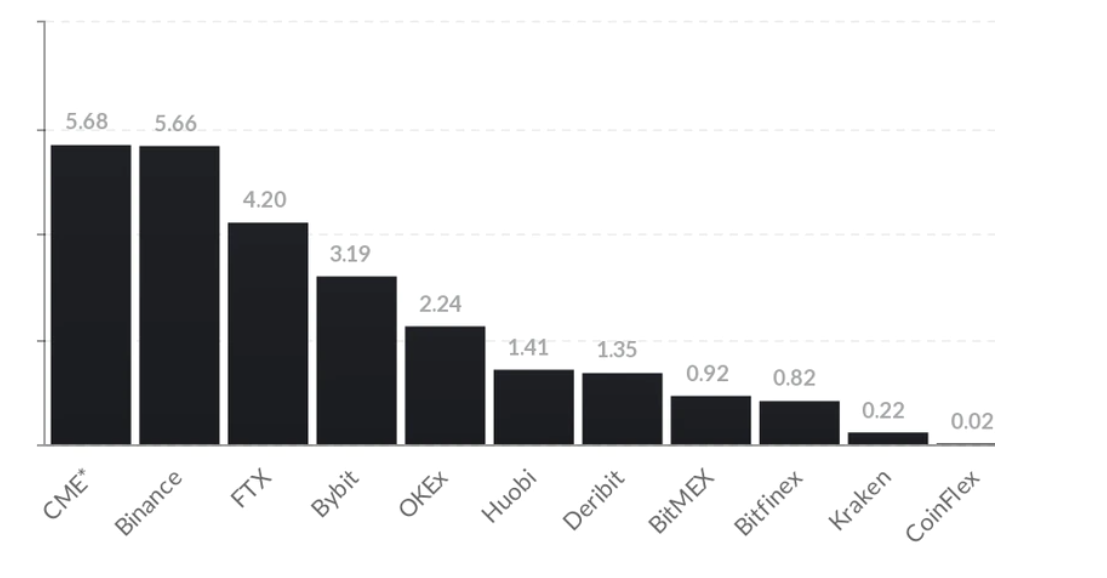

During all developments, Binance was replaced by the Chicago Mercantile Exchange (CME), which is heavily used by institutional investors.

More than $1.5 billion has flown into the market since the ProShares Bitcoin ETF was released, and investment in futures contracts on the CME has tripled as of this month.

Launched under the name BITO on the New York Stock Exchange, the ProShares ETF raised $1.2 billion in investments in the first three days.

CME accounts for $5.68 billion of the $25.7 billion total global futures volume, while Binance contributes $5.66 billion globally.

BITO currently has 1900 contracts for October and 2133 contracts for November. The CME allows institutional investors to enter 2000 futures contracts each. However, CME announced in a statement that starting in November, the position limit for monthly Bitcoin futures will be increased to 4,000 contracts.

It is thought that rival Bitcoin ETFs that will be released after the ProShares Bitcoin ETF can ease the pressure in the market.

Today, the second Bitcoin ETF is also listed on the Nasdaq.

It is stated that the fact that Bitcoin ETFs started to be traded on the US stock exchanges caused institutional investors to restore their confidence in the market, and the increase in the CME stock market was due to this confidence.

*Not Investment Advice.