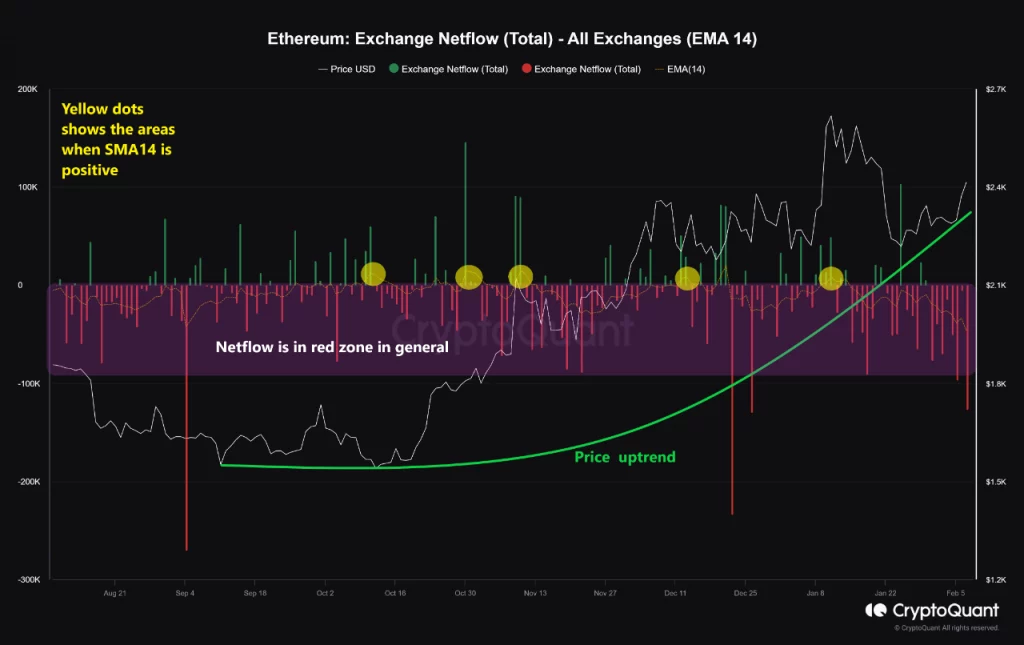

According to a recent report from crypto analytics platform CryptoQuant, Ethereum An intriguing relationship emerged between net flow data and price movement, providing valuable information for investors and enthusiasts alike.

Analysts have found that since August 2023, Ethereum price has tended to experience an upward trajectory following periods of net flow data accumulation in negative territory. This pattern means that there is a correlation between the net flow data and the subsequent movement of the ETH market cap.

In the details analyzed in the report, it tends to be the 14-day Exponential Moving Average, or EMA, which creates a consistent selling pressure when it enters the positive zone marked with yellow dots on the charts. This observation suggests that positive net flows could trigger a selling sentiment among investors, potentially cryptocurrencyThis means it can affect the price of .

As of current data, Ethereum’s net flow data continues to accumulate in the negative territory for the last 8 days. This accumulation of negative net flow data means a potential increase in buying activity as investors have historically seized opportunities during periods of negativity.

The correlation between negative net flow data and the subsequent upward price movement is a compelling signal for those monitoring Ethereum’s market dynamics. While past trends do not guarantee future results in the volatile world of cryptocurrencies, such patterns can serve as valuable indicators for traders and investors looking to make informed decisions.

In conclusion, based on the latest analysis of Ethereum net flow data, there is a suggestion that the price of the cryptocurrency may experience an upward move in the coming days. However, it is crucial that market participants remain cautious and consider a variety of factors, including external market conditions and broader trends, before making investment decisions.