In the cryptocurrency market, Bitcoin has fallen a bit. Analysts put forward their views at the stage where the price went down to the 30 thousand band. We include the opinions of 8 BTC analysts.

Bitcoin opinions of famous analysts

Our first analyst, Crypto Ed. Famous trader Crypto Ed draws attention to the importance of the $30,000 level. It is also awaiting a response from this range.

Our second analyst is Jelle. Famous trader Jelle is emphasizing the $28,000 level that has caught the attention of other market participants. Accordingly, he expresses his interest in “buying the bottom” for this level. Jelle also talks about a pullback for Bitcoin to surpass the $32,000 level. According to him, this is clearly a bullish divergence.

Our third analyst is Rekt Capital. Analyst Rekt Capital downplayed the intraday performance, stressing that there is no reason for panic.

Our fourth analyst, Crypto Tony, shares a similar sentiment. Accordingly, he points out that the $28,000 level is a suitable entry point.

On the other hand, our fifth analyst, Daan Crypto Trades, repeats his bullish stance. Accordingly, it highlights the solid bullish market structure. He also points out that a test of the $29,500 level is likely if the mid-range support is breached.

Bitcoin insights from analyst Willy Woo

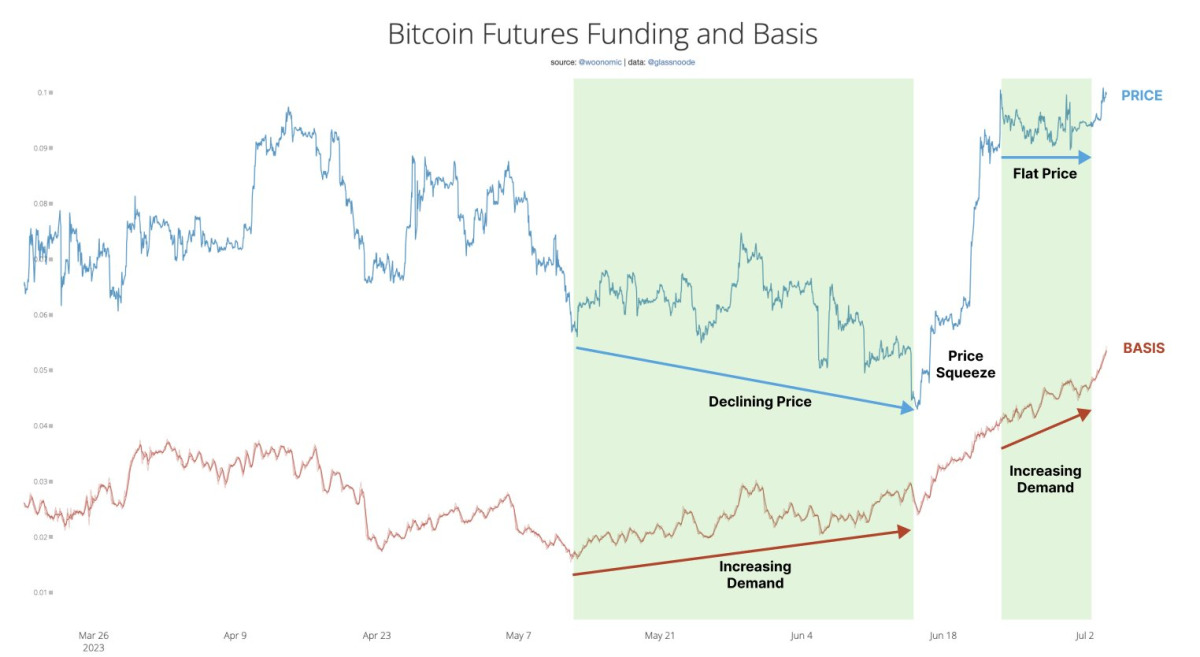

Our sixth analyst is the famous Willy Woo. Woo suggests that on-chain data indicates that Bitcoin (BTC) may be entering the early stages of a price squeeze. The analyst highlights a short squeeze situation in which traders who shorted the asset cut their losses due to an unexpected price spike, triggering further upward momentum. Woo emphasizes that the demand driving Bitcoin’s price action is primarily driven by calendar futures markets, which are popular with professionals and institutions. The analyst states that the continued increase in demand points to the early stages of another price squeeze.

Woo remains optimistic about potential price squeeze. On the other hand, he acknowledges that not all Bitcoin benchmarks are fully bullish. He warns of overbought calendar demand and the importance of monitoring the declining basis, which represents the cost of maintaining a long position. Sudden changes in base can affect bullish price action.

Bitcoin insights from crypto strategist Pentoshi

Pentoshi, a crypto strategist known for accurately predicting that the Bitcoin (BTC) bull market will end in 2021, is our seventh analyst. Pentoshi has issued a cautionary note regarding a potential market correction. Pentoshi maintains a positive outlook for Bitcoin to surpass the $32,000 level. On the other hand, it warns of a subsequent correction due to fear of missing out (FOMO) and excessive leverage. It also creates conditions for a fall.

Pentoshi advises investors considering entering the market around $32,000 to consider their targets. He also advises them to be wary of a possible larger fix. He underlines that long-term investments and increased leverage that entered the market late could contribute to a market correction.

Key support levels and Bitcoin’s momentum

According to Pentoshi’s chart analysis, key support levels for Bitcoin are around $29,100, $26,600 and $25,100. Previously, he correctly predicted a BTC retracement below $30,000 and indicated that the cryptocurrency is poised for an upward move after finding support around this level.

Pentoshi predicts that Bitcoin will reach an all-time high of $180,000 in 2026. It also predicts a price bottom of $69,000 in this market cycle. On the other hand, he humorously depicts the emotions of market participants during this time.

The approach of Markus Thielen, head of research and strategy at Matrixport

The eighth analysis comes from crypto services provider Matrixport. Matrixport predicts a significant rally for Bitcoin (BTC). It estimates the price increase will reach up to $125,000 by the end of 2024. This prediction is in line with Bitcoin’s historical pattern of gaining sharply following mining reward halvings. Matrixport’s analysis shows that a multi-month bull market typically occurs after a bear market, marked by Bitcoin reaching a 12-month high, is confirmed to be over.

The latest signal confirming the end of the bear market came as Bitcoin surpassed $31,000 to reach its highest price since June 2022. Similar signals have been observed in previous years, including August 2012, December 2015, May 2019 and August 2020. In addition, prices have increased in the following years.

Matrixport’s predictions

Markus Thielen, director of research and strategy at Matrixport, points to the potential for Bitcoin prices to increase by 123% in twelve months and +310% in eighteen months. On the other hand, it underlines the historical significance of this signal.

cryptocoin.com Looking at it as a whole, based on past signals triggered in 2015, 2019 and 2020, this projection will result in Bitcoin prices reaching $65,539 in twelve months and $125,731 in eighteen months. Thielen excludes the 2012 signal and the dramatic price spike that followed, describing it as an “epic, disproportionate” bull market.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow on. Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. Therefore, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.